Paypal debit card fees services

Since its inception in 1998, PayPal has been a pioneer in online payments, helping to revolutionize the way we pay for goods and services online. Today, PayPal is one of the most popular payment methods on the web, with over 200 million active users worldwide. While PayPal is a convenient and safe way to pay for online purchases, it's important to be aware of the fees associated with using the service. In this article, we'll outline the fees associated with using a PayPal debit card, as well as some tips on how to avoid them.

PayPal is a popular online payment system that allows users to pay for goods and services online. PayPal also offers a debit card that can be used to withdraw cash from ATM machines or to make purchases anywhere MasterCard is accepted. There are no fees for using the PayPal debit card to make purchases. However, there is a $1.50 fee for using the card to withdraw cash from an ATM machine.

PayPal's debit card fees are reasonable compared to other debit card providers. However, there are some potential downsides to using PayPal as your primary debit card provider. For example, if you lose your card or it is stolen, you may be responsible for the full balance on the card. Additionally, PayPal may place a hold on your account if you use your card for a large purchase or if you make a lot of small purchases within a short period of time.

Top services about Paypal debit card fees

I will lms website, elearning website, online course website, wordpress lms,membership

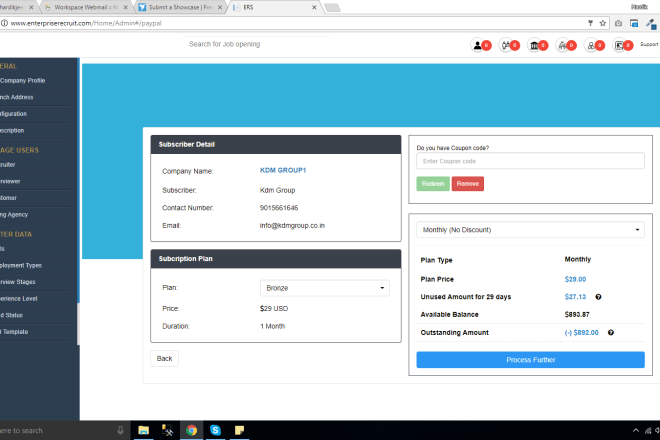

I will develop wordpress ecommerce website,subscription website with payments

I will do elearning website by learndash, membership website,

I will create a restaurant website with online food ordering

I will develop wordpress membership or subscription website with payment system

I will help you with wordpress membership or subscription website

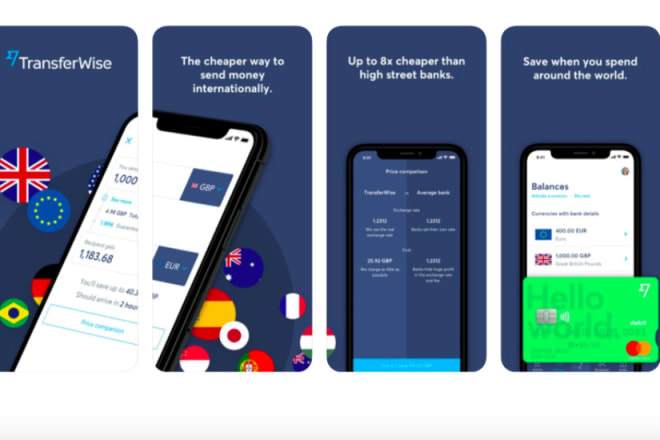

I will develop banking app like cash app paypal venmo or movo

I will do paypal integration and accept payments by credit debit card

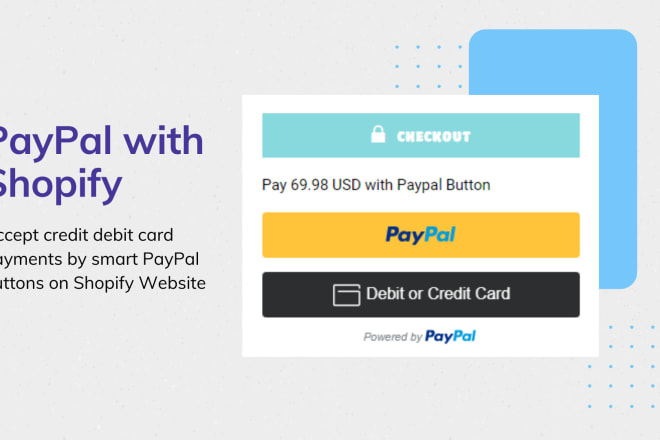

I will integrate shopify credit debit card paypal button

I will shopify integrate paypal credit debit card smart buttons

I will integrate paypal credit debit card payment smart buttons on wordpress website

I will add paypal credit debit card payment smart buttons on shopify website

I will do woocommerce and shopify paypal payment gateway integration

I will do paypal payment integration for any of your websit

I will integrate paypal credit debit payment gateway smart button on shopify wordpress

I will teach you how to lower credit card fees merchant service fees and point of sale