Paypal echeque charges services

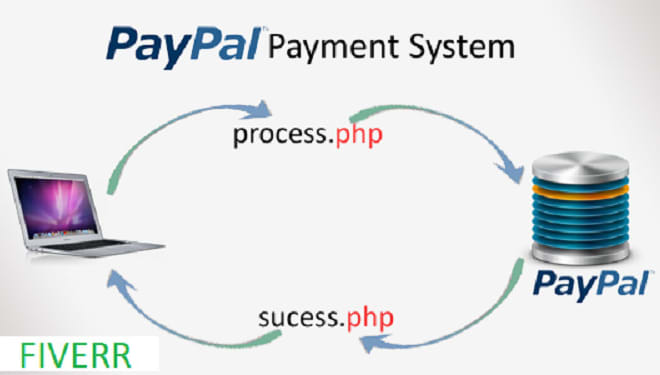

If you're using PayPal to send or receive money, you may be wondering about PayPal eCheque charges. PayPal eCheques are electronic checks that are processed through the PayPal system. When you send an eCheck, the money is withdrawn from your bank account and transferred to the recipient's PayPal account. When the recipient cashes the eCheck, the funds are transferred from their PayPal account to their bank account. There is no charge for sending or receiving an eCheck through PayPal. However, there are fees for other PayPal services, such as withdrawing money from your PayPal balance to your bank account, or sending money as a personal payment. If you're sending or receiving an eCheck, be sure to allow enough time for the funds to clear. It usually takes 3-5 business days for an eCheck to clear.

PayPal eCheque charges services is a way for businesses to send and receive payments using eCheques. This service is available to businesses in the US, UK, Canada, and Australia. There is a fee for using this service, but it is typically lower than the fees for other methods of payment.

In conclusion, PayPal eCheque charges are a great way to send money to friends and family members. With this service, you can send money to anyone with an email address. All you need is their email address and you can send them money. There are no fees associated with this service.

Top services about Paypal echeque charges

I will integrate Paypal, credit cards, echeque on your website

I will integrate paypal with your woocommerce

I will do paypal integration and solve paypal payment issues

I will implement PayPal payment method

I will do payment gateway integrations with paypal or stripe

I will add paypal smart buttons to your shopify store

I will integrate paypal in PHP asp csharp vb dot net

I will help and integrate paypal and stripe on your website

I will quickly integrate paypal payment gateway to your website