Paypal india fees services

As of July 2017, PayPal has over 200 million active, registered users in 193 markets, and operates in more than 200 countries. India is one of PayPal's key markets, and the company has been investing heavily in the country in recent years. PayPal India offers a variety of payment services for individuals and businesses, including online payments, mobile payments, and in-person payments. Fees for PayPal's services vary by country, but in India, the company charges a transaction fee of 2.9% + INR 30 for domestic transactions, and 4.4% + a fixed fee for international transactions. PayPal India also offers a number of value-added services, such as buyer protection and fraud prevention, that come with additional fees. For businesses, PayPal India offers merchant services, such as the ability to accept payments on website and mobile apps, and to process credit and debit card payments. Fees for merchant services are typically 2.9% + INR 30 per transaction. In recent years, PayPal has been investing heavily in India, with a focus on expanding its merchant services business. In 2016, the company launched a local operations center in Chennai and announced plans to invest $500 million in the country over the next five years. PayPal's heavy investment in India is part of the company's global strategy to expand its footprint in emerging markets. India is a key market for PayPal, and the company is betting big on the country's growth potential.

PayPal is a digital payment company that allows customers to make online payments. PayPal India offers a range of payment services, including online payments, mobile payments, and in-person payments. PayPal India charges fees for some of its services, but it also offers discounts and promotions for certain transactions.

After reading this article, it is clear that PayPal is a reliable and affordable way to send money internationally. The fees are low and the service is fast and efficient. Overall, PayPal is a great way to send money internationally.

Top services about Paypal india fees

I will import demo content of your wordpress theme

I will create a mobile responsive wordpress website

I will be your wordpress assistant

I will install wordpress on your domain using cpanel or ftp

I will be your buying agent in japan

How It Works!

1. Search the products you like on any Japanese websites. (Prefer famous platform like Amazon, Rakuten)

2. Message me, so that I can handle and be your assistance on your order product page until we both agree on.

3. Order a gig. Select the package.

4. Make a payment for your product to me through PayPal account (Note: You"ll also have to pay PayPal fees + 5% of your products fees, which is an exchange rate swap cost and handling fees)

5. I will make an order instead of you.

6. Once your items reach to my place, I will email you what which type of shipping you want me to send. At this point, I will repackaging, if needed to, and prepare for international shipping.

7. Make a payment again on shipping fees via PayPal. (Only PayPal fees need to be added)

8. Dispatch the product to your destination with tracking number provided

I will be your guide while your travel in north india

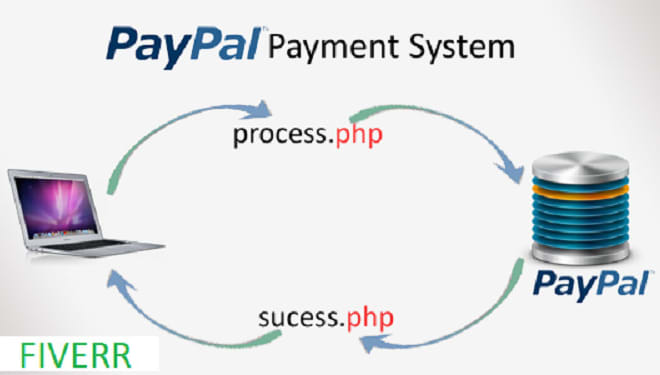

I will integrate paypal with your woocommerce

I will do paypal integration and solve paypal payment issues

I will help you pay less processing fees than paypal and stripe

I will implement PayPal payment method

I will add paypal smart buttons to your shopify store

I will tell you everything about India

I will integrate paypal in PHP asp csharp vb dot net