Paypal limits unverified services

As more and more businesses move online, PayPal has become a popular payment method. However, PayPal has been cracking down on unverified services, limiting what users can buy and sell. This has caused some businesses to suffer, as they are unable to receive payments through PayPal. In this article, we will explore the reasons behind PayPal's crackdown on unverified services, and how this is affecting businesses.

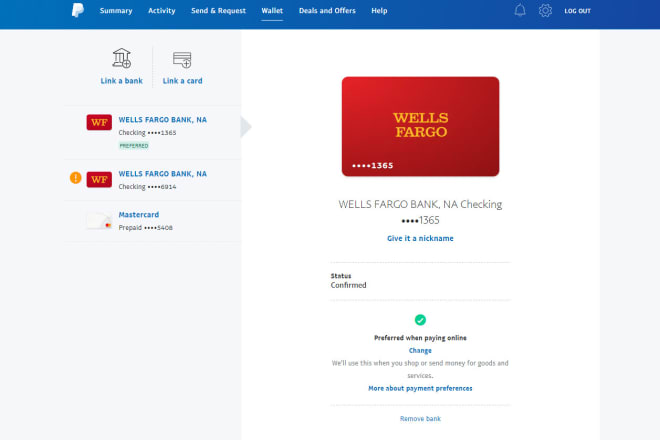

Paypal limits unverified services to $500 per transaction and $2,000 per month.

Paypal has recently limited the amount of money that can be sent through its unverified services in order to protect its users from fraud. This is a positive move by the company to ensure the safety of its customers, but it may also have a negative impact on small businesses that rely on these services to send money internationally.

Top services about Paypal limits unverified

I will give UK bank to paypal for lift limits

I will give u bank to lift your paypal limits

I will provide u bank to remove paypal limits and withdraw funds

I will provide USA bank to remove paypal send withdraw limits

I will integrate paypal with your woocommerce

I will do paypal integration and solve paypal payment issues

I will increase your selling limits on ebay

I will give US,UK bank to lift your paypal limits

I will implement PayPal payment method