Paypal my account profile services

In today's digital age, more and more businesses are accepting online payments through platforms such as PayPal. Whether you're a freelancer or small business owner, knowing how to set up and manage your PayPal account is essential to keeping your finances in order. In this article, we'll give you a step-by-step guide on how to create and manage your PayPal account profile, so you can make and receive payments with ease.

PayPal is a digital payment company that allows individuals and businesses to send and receive money online. PayPal offers a variety of services, including a personal account, a business account, and a premier account. Each account type has different features and benefits. With a PayPal personal account, users can send and receive money, make online purchases, and withdraw money from their PayPal balance to their bank account. Personal accounts are free to create and there are no monthly fees. A PayPal business account is designed for businesses that need to accept payments online. Business accounts have different features and benefits than personal accounts, including the ability to accept credit and debit card payments, send invoices, and track payments. There is a monthly fee for business accounts. A PayPal premier account is similar to a business account, but with additional features such as the ability to earn interest on your PayPal balance and get a debit card linked to your account. There is a monthly fee for premier accounts.

In conclusion, PayPal's my account profile services is a great way to keep track of your finances and make sure that you're always getting the most out of your money. With this service, you can see all of your transactions in one place, set up automatic payments, and more. If you're looking for a way to simplify your finances, PayPal's my account profile services is a great option.

Top services about Paypal my account profile

I will design subscription box website, redesign wordpress, membership website

I will create awesome qr code design for your logo, business data etc

I will do all clickfunnels, leadpages, instapage work

I will do elearning website by learndash, membership website,

I will dropship your product on my top rated ebay store

I will make you a forum website

I will let you be part of paypal

I will create new etsy account for you only paypal needed

I will lift paypal limit from your account and restore it to normal

I will provide paypal limited assistance if needed

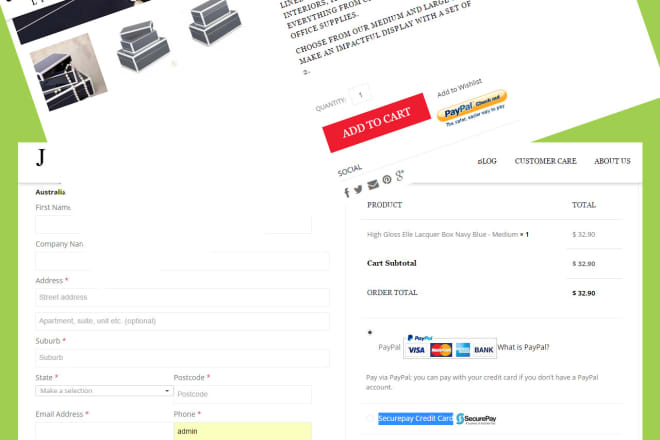

I will integrate paypal, credit debit card, woocommerce on wordpress website

I will create ebay seller account with active listings and paypal

I will quickly integrate paypal payment gateway to your website

I will skyrocket gofundme, indiegogo, kickstarter crowdfunding campaign promotion

I will integrate paypal, paypal express, securepay in wordpress