Paypal seller fee services

If you're a Paypal user, you're probably aware of the standard 2.9% + $0.30 fee that Paypal charges on all sales. But did you know that Paypal also offers seller fee services? With Paypal's seller fee services, you can get access to lower transaction fees, as well as other benefits like early access to funds and expanded dispute protection. If you're a small business owner who uses Paypal to process payments, these seller fee services can be a great way to save money on transaction fees. In this article, we'll take a look at the different seller fee services offered by Paypal, as well as the benefits and drawbacks of each.

Paypal is a payment processing company that allows businesses and individuals to send and receive money online. One of the company’s key services is its Seller Fee, which is a service that allows businesses to accept payments through Paypal without incurring any fees. The Seller Fee is a percentage of the total transaction amount, and is automatically deducted from the payment when it is processed.

After weighing the pros and cons, it seems that using PayPal to sell products or services comes with a number of advantages. The main benefit is that PayPal offers protection for both the buyer and the seller. Additionally, PayPal is a convenient way to send and receive payments, and it offers a variety of features that can be helpful for businesses, such as invoicing and tracking. There are also a few disadvantages to using PayPal, such as the fees associated with selling products or services, but on the whole, it seems that the benefits outweigh the drawbacks.

Top services about Paypal seller fee

I will do ecommerce bookkeeping, amazon, ebay, shopify, paypal

I will make multi Seller eCommerce store for you

I will build aliexpress and amazon dropshipping wordpress website

I will do dropshipping aliexpress to shopify

I will do bookkeeping for ecommerce amazon fba, ebay, shopify

I will do amazon to ebay dropshipping listings

I will create a responsive wordpress website

I will integrate paypal in android

I will create new etsy account for you only paypal needed

I will integrate paypal with your woocommerce

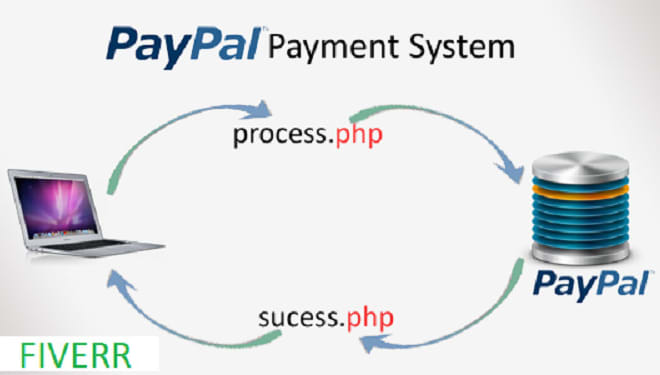

I will do paypal integration and solve paypal payment issues

I will create ebay seller account with active listings and paypal

I will implement PayPal payment method

I will add paypal smart buttons to your shopify store

I will integrate paypal in PHP asp csharp vb dot net

I will quickly integrate paypal payment gateway to your website