Paypal transfer fee to bank account services

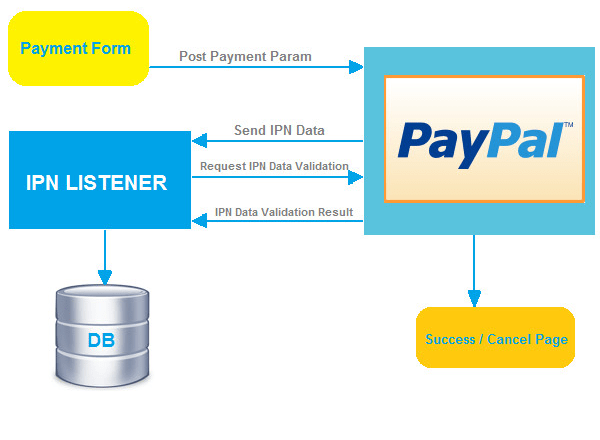

In recent years, the popularity of online banking has grown tremendously. Online banking allows customers to conduct transactions and manage their accounts without having to visit a physical bank branch. One of the most popular online banking services is PayPal. PayPal allows customers to send and receive money online with ease. However, PayPal also charges fees for certain transactions. For example, if you transfer money from your PayPal account to your bank account, PayPal will charge a fee. The fee varies depending on the amount of money you are transferring and the country you are transferring it to. In this article, we will discuss PayPal's transfer fee to bank account services. We will explain how the fee is calculated and how you can avoid it.

There are a few different types of PayPal transfer fee to bank account services. The most common type is the ACH transfer, which is free for all users. There are also wire transfer options which cost $5-$30, depending on the amount being transferred and the country the money is being sent to.

The PayPal transfer fee to bank account services is a reliable and affordable way to send money to friends and family. With a few simple clicks, you can send money to anyone with a bank account. The service is quick, easy to use, and most importantly, it's affordable.

Top services about Paypal transfer fee to bank account

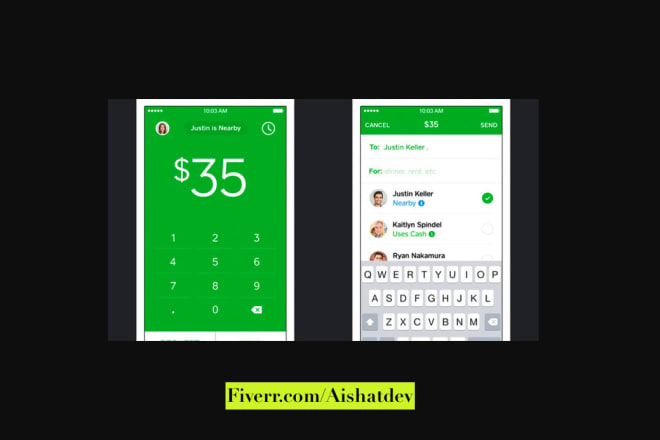

I will build cash app,bank app,loan app,payment app,online money transfer app

I will develop cash app, money transfer app, bank app, loan app

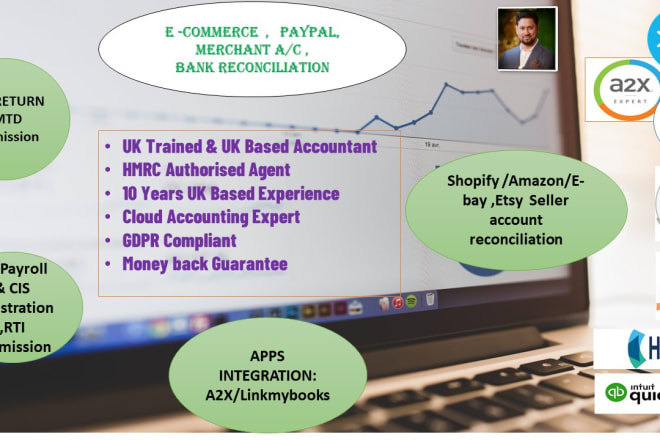

I will shopify amazon paypal and merchant account reconciliation

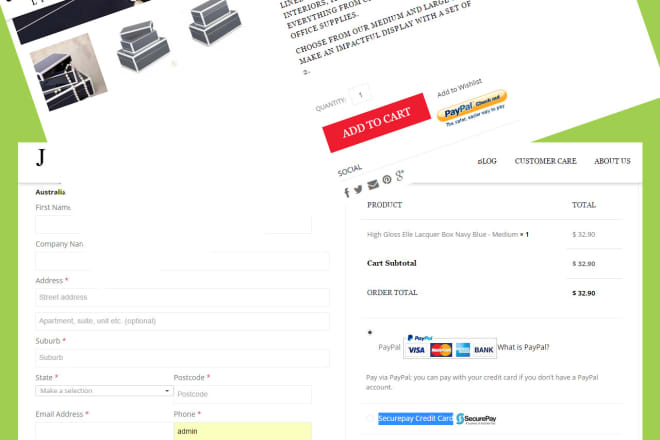

I will integrate paypal, paypal express, securepay in wordpress

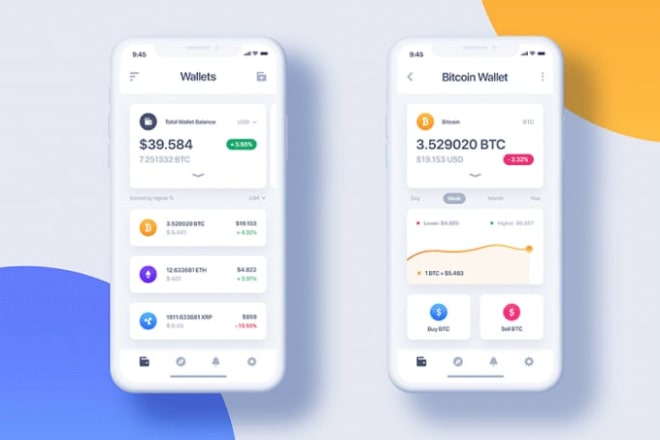

I will build cash app,bank app,loan app,payment app,money transfer app,wallet app

I will build cash app,bank app,loan app,payment app,online money transfer app

I will build cash app,bank app,loan app,payment app,online money transfer app

I will develop banking app like cash app paypal venmo or movo

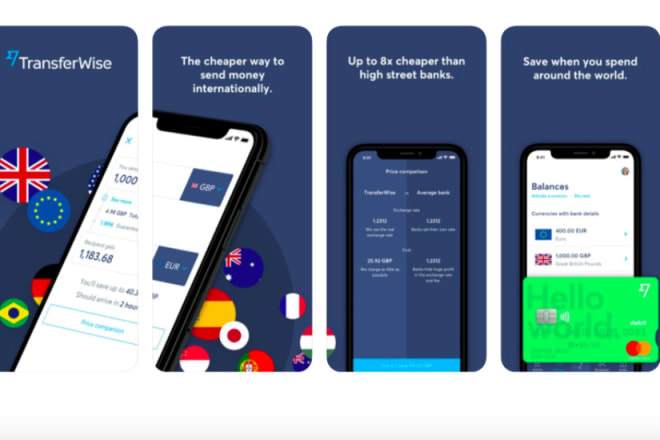

I will develop money transfer app, cash app, wallet app,bank app, payment app

I will develop a bank app,cash app,loan app like paypal, payooner

I will create cash app, money transfer app, bank app, loan app

I will develop cash app, bank, loan and money transfer app with web

I will develop cash app, worldwide transfer app, loan app, payment app, online money

I will do stripe or paypal integration as payment gateway