Paypal transfer to bank account services

In today's world, more and more people are using online banking and mobile banking to manage their finances. And with good reason - it's convenient, easy to use, and usually free. But what happens when you need to transfer money from your PayPal account to your bank account? Fortunately, there are a few different ways to do this. In this article, we'll go over how to transfer money from PayPal to your bank account using PayPal's built-in transfer service, as well as how to use a third-party service like TransferWise.

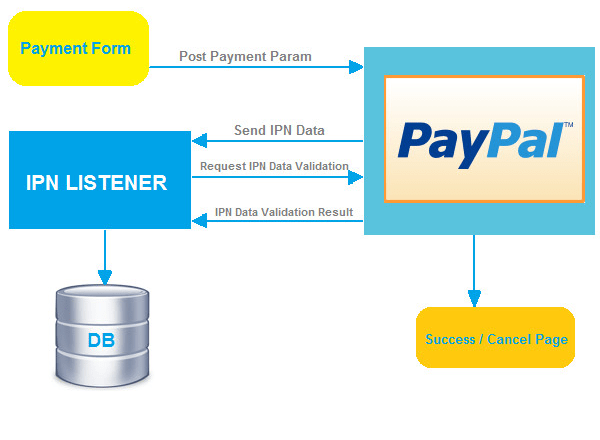

PayPal is a digital payment processor that allows users to send and receive money online. PayPal also offers a transfer to bank account service, which allows users to withdraw funds from their PayPal account and deposit them into a linked bank account. This service is typically used to withdraw money from PayPal balance when it is no longer needed, or to transfer funds from PayPal to a linked bank account when a user wants to use those funds for offline purchases.

Overall, using a PayPal transfer to bank account service can be a great way to manage your finances and make sure that you are able to transfer money between accounts without any issues. There are a few things to keep in mind when using these services, but as long as you are aware of the potential fees and charges, you should be able to use the service without any problems.

Top services about Paypal transfer to bank account

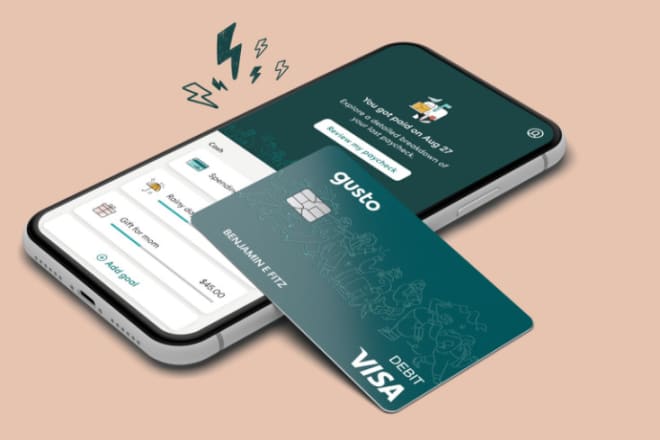

I will develop wallet app, cash app, loan app, payment app, online money transfer app

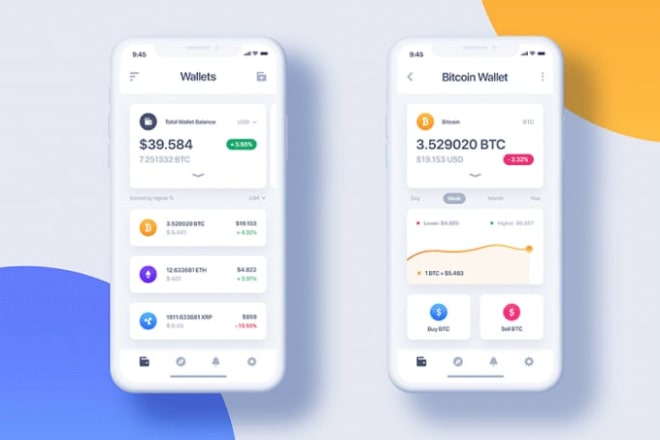

I will wallet app,crypto wallet app,exchange website,bitcoin wallet,crypto exchange

I will payment app, cash app, loan app, bank app, wallet app, money transfer app,paypal

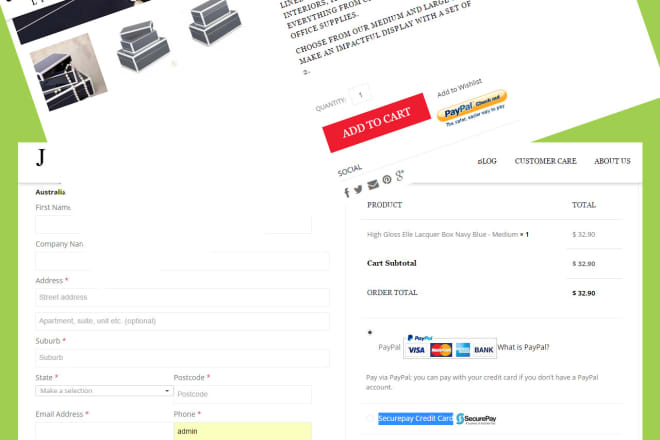

I will integrate paypal apple pay stripe amazon pay payment gateway

I will develop mobile app development, loan app, bank app, p2p payment app development

I will integrate paypal, paypal express, securepay in wordpress

I will build professional freelance marketplace website like fiverr

I will create freelance marketplace website from scratch

I will build cash app,bank app,loan app,payment app,money transfer app,wallet app

I will develop money transfer app, cash app, wallet app,bank app, payment app

I will develop a bank app,cash app,loan app like paypal, payooner

I will create cash app, money transfer app, bank app, loan app

I will develop cash app, money transfer app, bank app, loan app

I will develop cash app, bank, loan and money transfer app with web

I will develop cash app, worldwide transfer app, loan app, payment app, online money

I will do stripe or paypal integration as payment gateway