Paypal transfer to bank fee services

If you're like most people, you probably use PayPal to send and receive money online. Did you know that you can also use it to transfer money to your bank account? There are a few different ways to do this, and each has its own set of fees. In this article, we'll take a look at the different options and fees associated with each so that you can decide which is best for you.

There are a few different ways to transfer money from PayPal to your bank account. The most common way is to simply link your bank account to your PayPal account and then initiate the transfer from your PayPal balance to your bank account. This process typically takes a few days. Another way to transfer money from PayPal to your bank account is to use a PayPal transfer to bank fee service. This service allows you to transfer funds from your PayPal balance to your bank account immediately, for a small fee. This is a good option if you need to access your funds right away. Finally, you can also use a third-party service to transfer funds from PayPal to your bank account. These services typically charge a higher fee than PayPal, but they can be a good option if you need to transfer funds quickly and you don't have a PayPal balance to draw from.

Overall, using a service like Paypal to transfer money to your bank account can be helpful if you need to send money quickly. However, you should be aware of the fees associated with this service so that you can plan accordingly.

Top services about Paypal transfer to bank fee

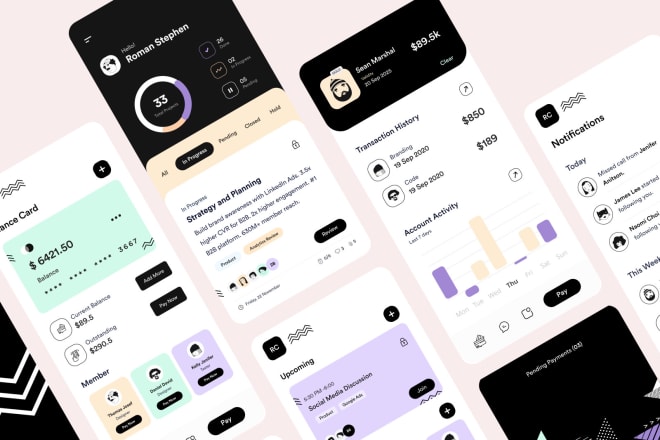

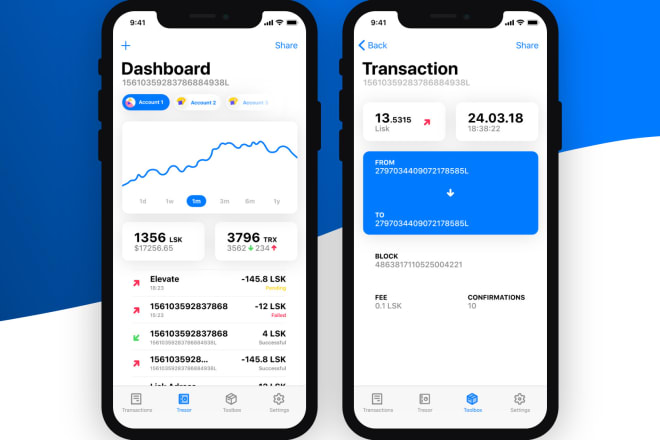

I will develop fast and secured banking app, wallet app, payment app and paypal

I will develop hotel payment wallet app for you

I will develop ewallet app like venmo

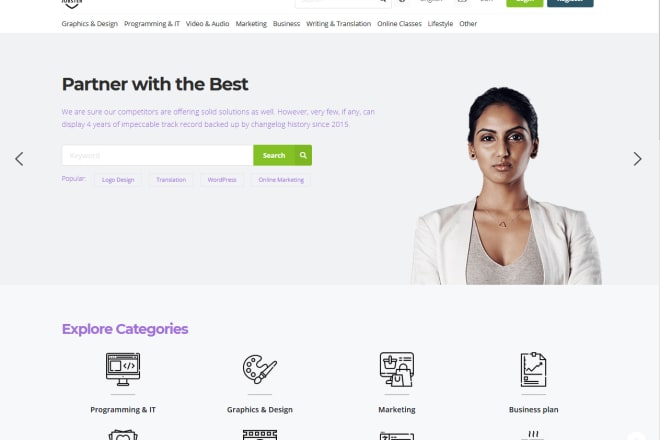

I will build freelance marketplace or freelance website like fiverr

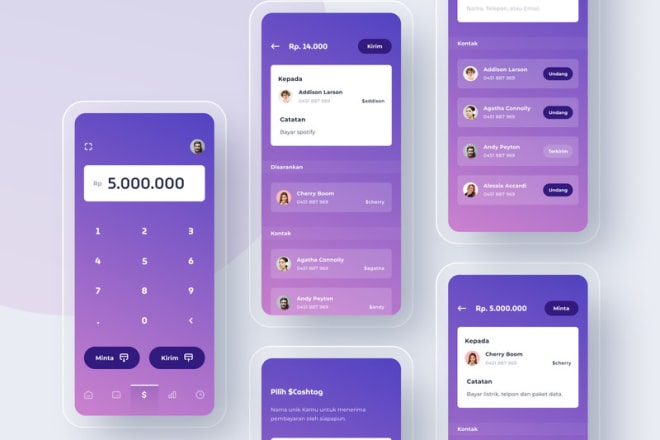

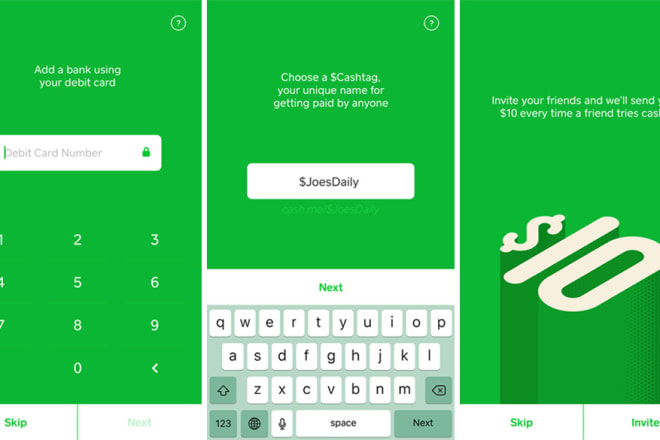

I will develop a premium cash app, money transfer app, bank app,payment app

I will develop cash app,money transfer app and banking app

I will develop cash app, bank app,loan app,payment gateway app

I will develop banking app like cash app paypal venmo or movo

I will develop cash app, bank, loan and money transfer app with web

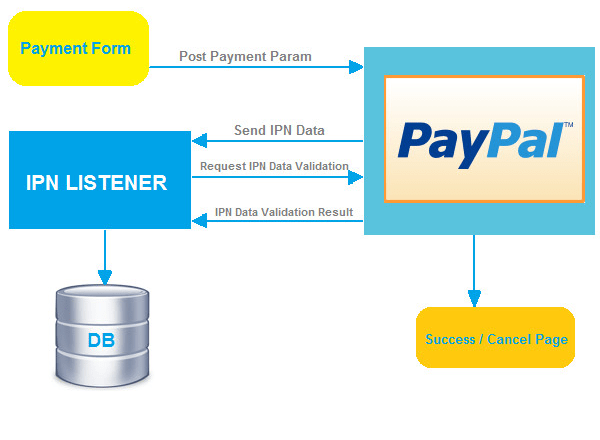

I will do stripe or paypal integration as payment gateway

I will do integrate paypal payment gateway for your website

I will create a cash app, wallet app, payment app, bank app, online transfer

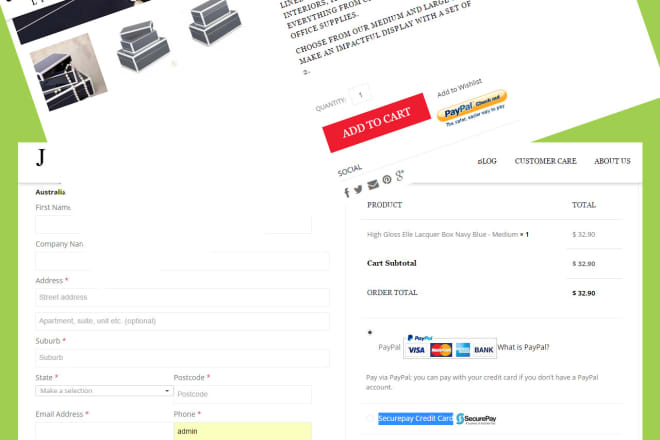

I will integrate paypal, paypal express, securepay in wordpress

I will integrate paypal or any payment gateway and fix issues

I will integrate any payment gateway in your website

I will integrate payment gateway, form, payment button

I will cash app, exchange wallet app, money transfer app, banking app