Paypal vcc services

In the world of online payments, there are few companies as well-known as PayPal. PayPal is a service that allows users to send and receive money online. PayPal also offers a number of other services, including the ability to use a virtual credit card, or VCC. A PayPal VCC is a virtual credit card that is linked to your PayPal account. You can use a PayPal VCC to make online purchases just like you would with a regular credit card. However, there are a few key differences between a PayPal VCC and a regular credit card. For one, a PayPal VCC is not a physical card. Instead, it is a virtual card that is generated by PayPal. This means that you do not need to have a physical credit card in order to use a PayPal VCC. Another key difference is that a PayPal VCC is not connected to a bank account. This means that you cannot use a PayPal VCC to withdraw cash from an ATM or to make purchases in a store. However, you can use a PayPal VCC to make online purchases. If you are looking for a way to make online purchases without a regular credit card, then a PayPal VCC may be a good option for you.

Paypal offers a virtual credit card service that allows users to make online purchases without having to provide their credit card information to the merchant. This service is provided by a third-party company called Payoneer.

In conclusion, PayPal VCC services are a great way to make online payments. They are convenient, safe, and easy to use. With PayPal VCC, you can make online purchases with confidence knowing that your personal and financial information is safe and secure.

Top services about Paypal vcc

I will help you get free trial for any website or software

I will send you ebay stealth guide 4 ebooks pdf

I will create an amazing wix site for your business

I will create ebay account for suspended sellers and provide ebay guideline to multiple

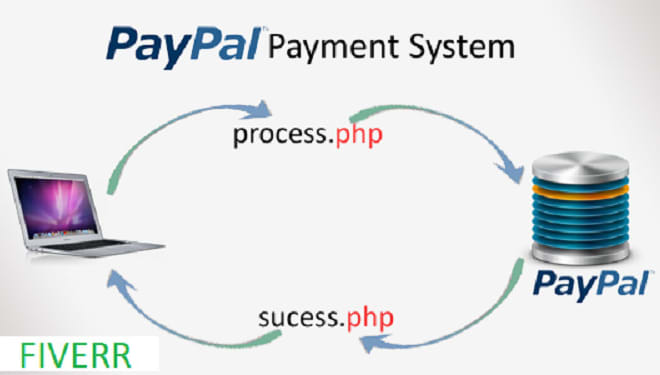

I will integrate paypal with your woocommerce

I will do paypal integration and solve paypal payment issues

I will implement PayPal payment method

I will add paypal smart buttons to your shopify store

I will integrate paypal in PHP asp csharp vb dot net

I will quickly integrate paypal payment gateway to your website

I will do stripe paypal payment method integrate and api expert

I will add unsupported paypal currency to woocomerce

I will paypal api work using php script

I shall implement paypal in your website in very short time.