Payroll system in excel services

As business owners, we often wear many hats. One minute we’re managing our inventory, and the next we’re taking care of our payroll. If you’re like most business owners, you’re always looking for ways to streamline your processes and make your life a little easier. Excel Services is a tool that can help you do just that. With Excel Services, you can manage your payroll using a simple spreadsheet. This can save you time and money, and help you keep track of your employee’s hours and compensation. If you’re ready to take your payroll management to the next level, read on to learn more about how Excel Services can help you streamline your process.

Payroll systems in Excel Services allow organizations to manage employee compensation and payments. By using Excel Services, businesses can automate payroll processes and reduce the need for manual data entry. Additionally, Excel Services can provide real-time reporting and analysis of payroll data.

Overall, using Excel Services to maintain your payroll system can be a great way to keep track of employee information and compensation. By using this method, you can avoid many of the common mistakes that can occur with paper-based systems. In addition, Excel Services can provide you with real-time updates on employee information, which can be invaluable when it comes to making payroll decisions.

Top services about Payroll system in excel

I will do bookkeeping with xero online

I will do automation using excel vba, excel macros

I will making you a payroll system in excel

I will do ocr bank statement PDF, jpeg, scan to editable word, excel within 24 hour

I will manage your bookkeeping using zoho books and tally

I will do bookkeeping and accounting on xero, quickbooks, myob, zoho, excel as well

I will be your excel vba macros and google sheet expert

I will do your excel spreadsheet and google sheet projects, vba, formula, functions

I will provide smart payroll management on excel with salary slip

I will create payroll sheet in ms excel

I will develop your HR and payroll management system for business

I will prepare payroll in ms excel

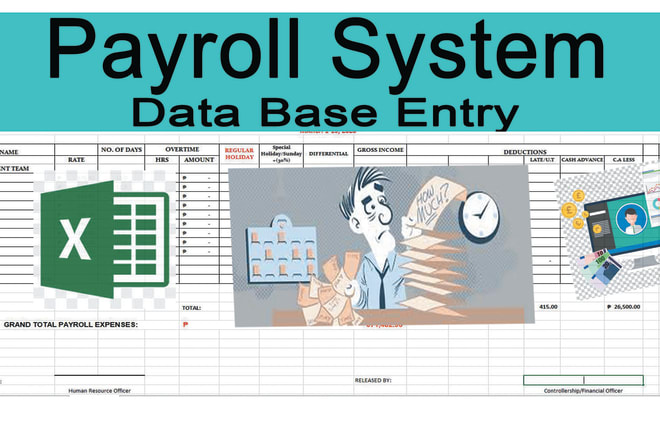

You will be able to see the headcount of total employee's Absenteeism, Leave, and rest day record etc on pay slip.It will calculate the amount of gross pay. Overtime, Deductions, Arrears and income tax detail net pay of each employee automatically.

You can also get printable pay slip of each employee.

✔️Crore areas of my proficiency are:✔️Employee Payroll

✔️Employee Payroll Manual Excel

✔️Calculate Monthly Payroll

✔️Calculate Weekly Payroll

✔️Overtime Calculation as per labor law

✔️Excel Salary

✔️Leaves, Absents and Weekly Off(Rest) record

✔️Salary Slips

✔️Payslip

✔️Salary Excel

✔️Tax System

We assure you that your worked be confidential.

I will provide UK payroll services for your company

I will manage payroll in excel using formulas, spreadsheets

I will calculate payroll, overtime, salary, wages in excel using formulas, spreadsheets

I will do your account and payroll works

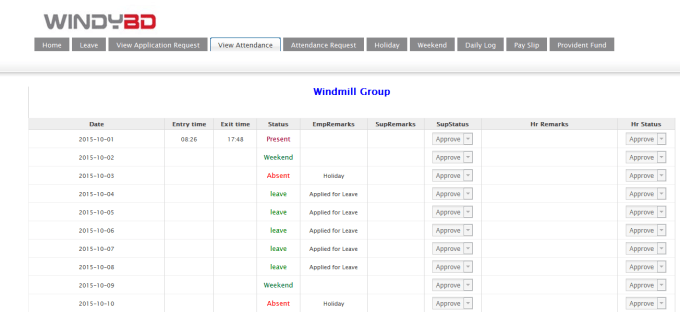

I'm Dil.A reliable and proficient person with over 8 years experience in doing monthly payroll.Also prepare monthly statutory returns for tax authorities and schedules for mgt.

I've done payroll for over 100 personnel in 2 days.I'm offering the following service & many more payroll requirements just to mention a few.

- Maintain payroll information by collecting,calculating& entering data into Tally/ Excel

- Update payroll records by entering changes in exemptions,insurance coverage,savings deductions & job title & department/division transfers

- Prepare reports by compiling summaries of earnings,taxes,deductions,leave,disability & nontaxable wages

- Determine payroll liabilities by calculating employee federal & state income & social security taxes & employer's social security,unemployment & workers compensation payments.

- Resolve payroll discrepancies by analyzing information.

- Maintain payroll operations by following policies & procedures,reporting needed changes.

-Maintain employee confidence & protect payroll operations confidentiality.

You need not dread this task, let us do it for you & you can consider it done.I’m sure you will get excellent work!!

Regards,

Dil