Penny stocks dvd services

Penny stocks are a type of stock that typically trade for less than $5 per share. They are considered to be a risky investment because they are often subject to manipulation and have a high degree of price volatility. Penny stocks are often traded on over-the-counter (OTC) markets, which are less regulated than major exchanges like the New York Stock Exchange (NYSE). This makes it easier for unscrupulous traders to manipulate penny stock prices. Penny stocks are not for everyone. They are best suited for investors who are willing to take on a higher degree of risk in exchange for the potential for high rewards. If you're thinking about investing in penny stocks, be sure to do your homework first. Research the company, its financials, and the market conditions before making any decisions.

Penny stocks are shares of small companies that trade at low prices. They are often volatile and risky, but can offer investors high returns. Many penny stock companies are scams, so it is important to research any company before investing. There are a number of services that offer penny stock trading, including online brokerages and trading platforms.

Penny stocks are a great way to make money in the stock market. They are a great investment for those who are willing to take the risk. However, there are a few things you should know before you invest in penny stocks. First, you need to know what you're doing. Second, you need to be prepared to lose money.

Top services about Penny stocks dvd

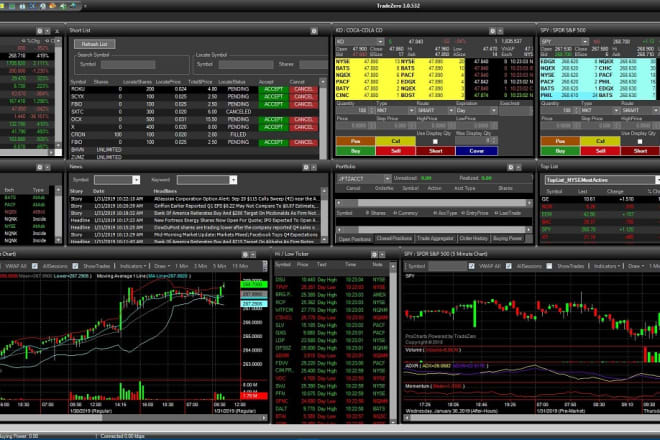

I will provide you with a detailed guide on how to day trade penny stocks

I will show you how to scalp penny stocks for day trading

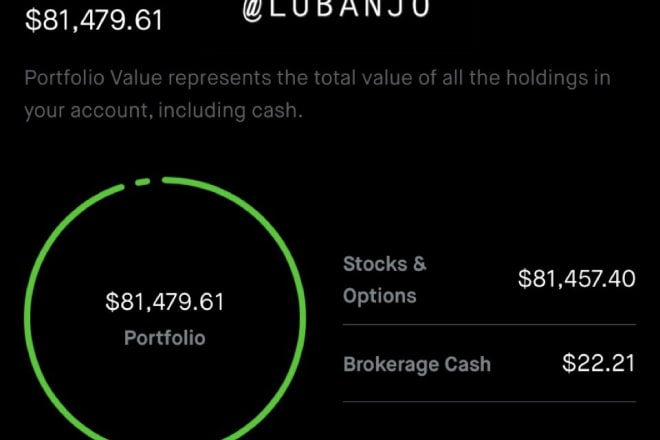

I will give 50 penny stocks to explode your investments

I will teach you why penny stocks, forex, technical analysis and day trading are scams

I will offer my full trading course in PDF and kindle

The course will cover the following:

- How to locate profitable trading setups on any stock, currency, commodity or index

- How to read charts using my technical analysis techniques

- When to get in and out of a trade

- How to maximize profits while limiting losses

- Creating a trading plan

And so much more...

Receive 4 extra courses for the standard gig. Trading Cryptocurrencies, Trading Penny Stocks, Trading Cannabis Stocks and Trading Forex.

For the premium gig you get all the courses plus I will use my 20 years experience and look at your choice of up to 5 stocks, currencies, cryptos or commodities for you. I will let you know if they are a buy, hold or a sell and the approach to take.

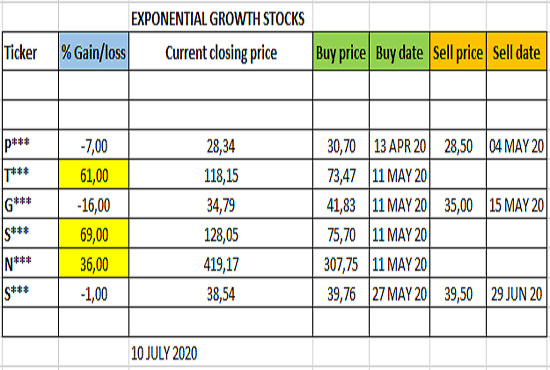

I will show you the exponential growth stocks to buy in US stock market

I will provide one excellent investment idea or advice or tip on US stocks

I will create an investing or trading guide for you to learn about stocks

I will offer my cannabis stocks trading ebook in pdf and kindle

In 2014 and 2016 I was able to profit massively flipping cannabis stocks using my trading techniques and strategies.

The legal and medicinal cannabis market is set to be a massive industry with estimates of being worth over $50 billion a year by 2025.

In a lot of ways with these stocks being very cheap, it is like buying APPLE or Microsoft stock back when they first became publicly traded. In other words the opportunity is great to get in early.

If you want to be ready for the next massive movement in cannabis stocks, you will need to know exactly what to look for when searching for a potentially profitable trade.

In this ebook I go through all the details in how to profit from cannabis stocks.

The 5 video full cannabis trading course will dig deeper into how I find and trade the best cannabis stocks.

The Premium gig, I use my 20 year expertise to give you the current status on all the major cannabis stocks. I look at each one and tell you if they are a buy or a sell.

* No reselling rights with this ebook.

I will pick up exponential growth stocks in US market

I look for stocks that can have an uptrend of 20 - 200% in 6 months.