Preparation of bank reconciliation statement services

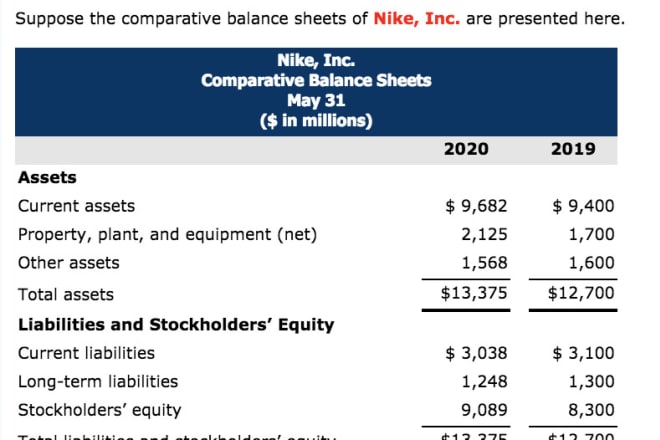

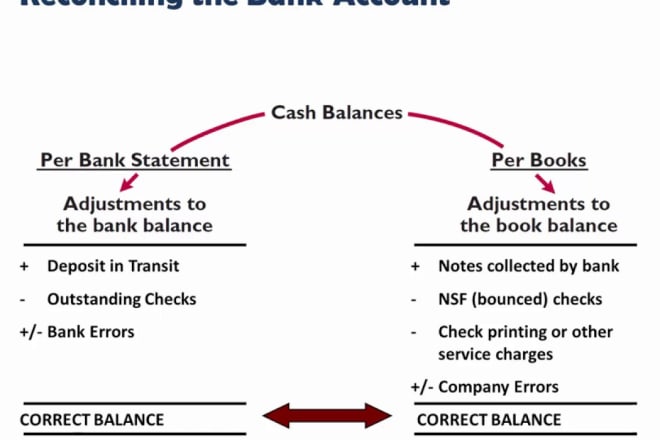

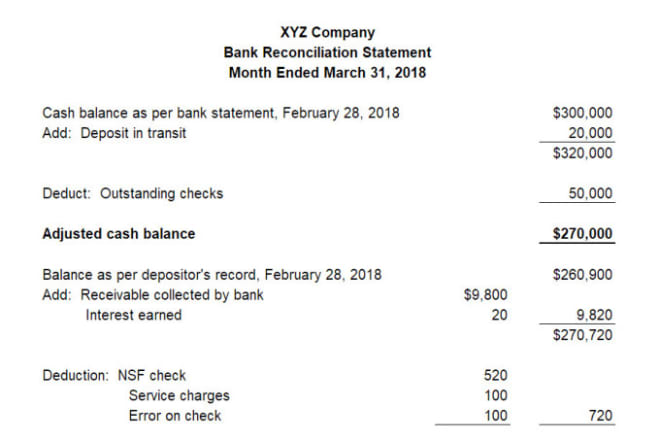

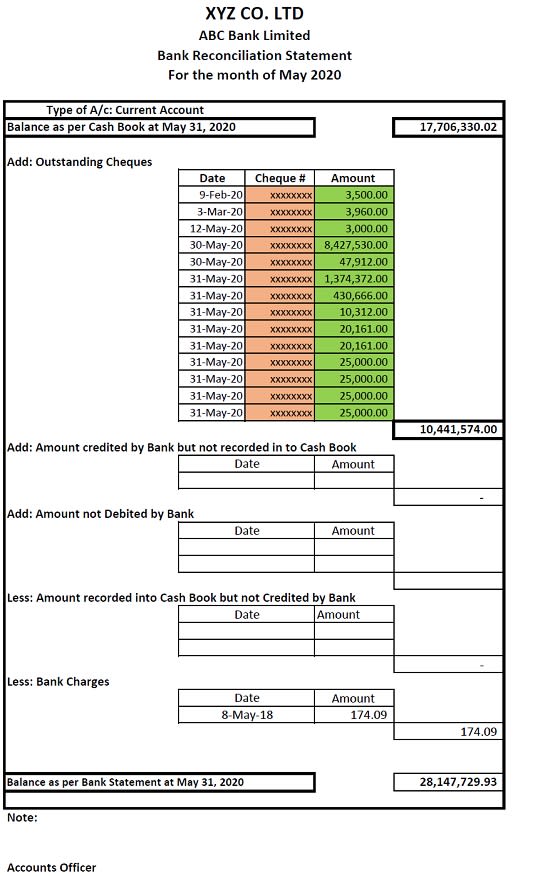

A bank reconciliation statement is a document that compares the bank's records of its transactions with the company's records. The purpose of the statement is to find any errors or discrepancies in the records and to correct them. The statement is usually prepared at the end of the month or quarter. There are two types of bank reconciliation statements: the Adjusted Balance and the Unadjusted Balance. The Adjusted Balance is the statement that is prepared after the errors have been corrected. The Unadjusted Balance is the statement that is prepared before the errors have been corrected. The Adjusted Balance is the most accurate statement of the company's financial position. It is the statement that is used to prepare the financial statements. The Unadjusted Balance is less accurate and is used for informational purposes only. The bank reconciliation statement is prepared by the company's accountant. The accountant compares the bank's records with the company's records and prepares the statement. The statement is then reviewed by the company's management. The bank reconciliation statement is an important part of the company's financial statements. It is used to find errors and discrepancies in the records and to correct them. The statement is also used to prepare the financial statements.

A bank reconciliation statement is a document that outlines all of the transactions that have occurred between a company and its bank over a specific period of time. This statement is used to reconcile the company's records with the bank's records.

Overall, preparation of bank reconciliation statement services can be quite beneficial for businesses. By ensuring that all transactions are accounted for and accurately reflected in financial statements, businesses can avoid potential problems down the road. Furthermore, regular bank reconciliations can help businesses identify and correct errors in their accounting records. As a result, businesses can maintain more accurate financial records and avoid costly mistakes.

Top services about Preparation of bank reconciliation statement

I will prepare financial statements and solution manuals

I will prepare bank reconciliation statement

I will prepare bank reconciliation statement and quickbooks for you

I will prepare bank reconciliation statement

I will prepare valid bank statement reconciliation

I will prepare bank reconciliation statement

I will prepare bank reconciliation statement

I will prepare bank reconciliation statement and bookkeeping

I will do bank statement or credit card reconciliation with quickbooks

I will do reconciliation from paystub, paypal, zelle, quickbooks bank statement

I will bank reconciliation of your bank and credit card statement

I will do bank reconciliation and credit card reconciliation

I will do bank reconciliation and credit card reconciliation

I will do accounts and bank reconciliation statement

I will prepare bank reconciliation on quickbooks online, excel

I am Muhammad Noman, working as Accounts Officer for more than three years and actively working as accounting freelancer for more than a year. I have done BBA (Finance) and currently pursuing ACCA, a globally recognized accounting qualification.

I have almost three years of experience of preparing bank reconciliation and other accounting reports. I offer accounting freelancing services of preparing bank reconciliation statement in excel, quickbooks online.

Along with service of bank reconciliation in quickbooks online/excel, I also offer following services.

- Setting up chart of accounts in quickbooks

- Setting up chart of accounts in excel and prepare a basic accounting system in excel

- Quickbooks online bookkeeping

- Financial accounting & bookkeeping services

- Financial statement preparation and analysis

- Accounting article writing

- Excel bookkeeping

- Excel accounting data entry and many more

Just put a message to me before placing order for satisfactory work.

Looking forward for your positive response and waiting for long term working relationship.

Thanks & Best Regards.

Muhammad Noman

I will reconcile bank and credit card statements