Prepare bank reconciliations services

In many cases, business owners are so busy running their business that they don’t have time to stay on top of their financials. This is where our bank reconciliation service comes in. We will work with you to ensure that your books are accurate and up-to-date, so you can focus on what you do best.

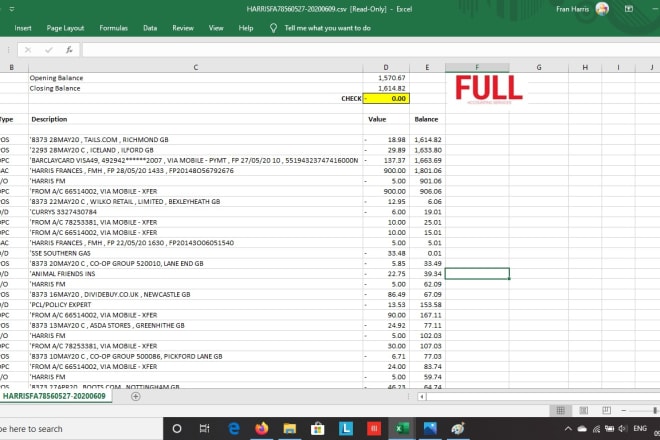

A bank reconciliation is the process of matching the balances in an entity's accounting records for a cash account to the corresponding information on the bank statement. This reconciliation process is used to identify differences between the two records, which can be caused by numerous factors such as bank fees, deposits that have not yet cleared, checks that have not yet been processed by the bank, etc. The goal of the reconciliation is to identify and correct any errors in the accounting records so that the cash balance reported on the balance sheet is accurate. There are a few steps that are typically followed in order to reconcile a bank account: 1. Obtain the bank statement for the account in question. 2. Compare the ending balance on the bank statement to the ending balance in the accounting records. 3. Identify any checks that have been written but not yet processed by the bank. These checks will need to be deducted from the accounting records balance. 4. Identify any deposits that have been made but not yet cleared by the bank. These deposits will need to be added to the accounting records balance. 5. Identify any bank fees that have been charged. These fees will need to be deducted from the accounting records balance. 6. Adjust the accounting records balance to match the bank statement balance. 7. Prepare a journal entry to record any reconciling items.

Overall, preparing bank reconciliations is a critical part of maintaining accurate financial records. By reconciling accounts on a regular basis, businesses can ensure that their books are in order and that they are not overspending. Additionally, preparing bank reconciliations can help businesses catch errors and fraud early on.

Top services about Prepare bank reconciliations

I will prepare bank reconciliation and credit card reconciliations

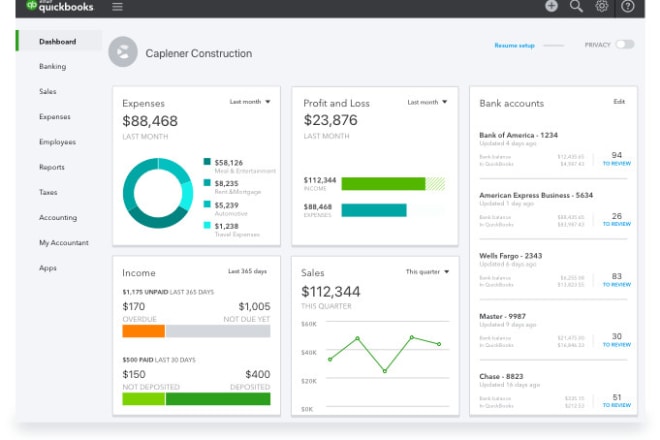

I will provide bookkeeping services and file your taxes with quickbooks

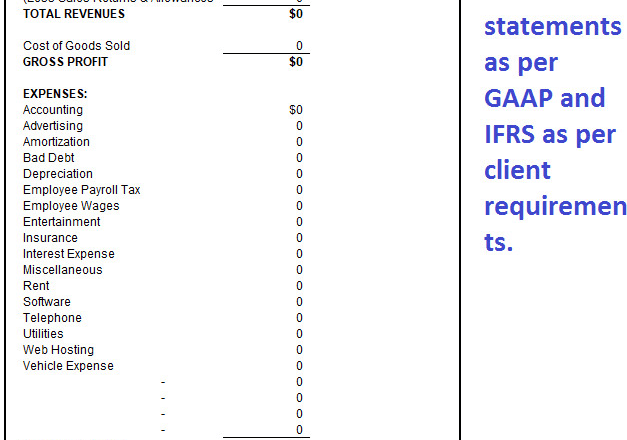

I will prepare financial statements and solution manuals

I will prepare bank reconciliation statement

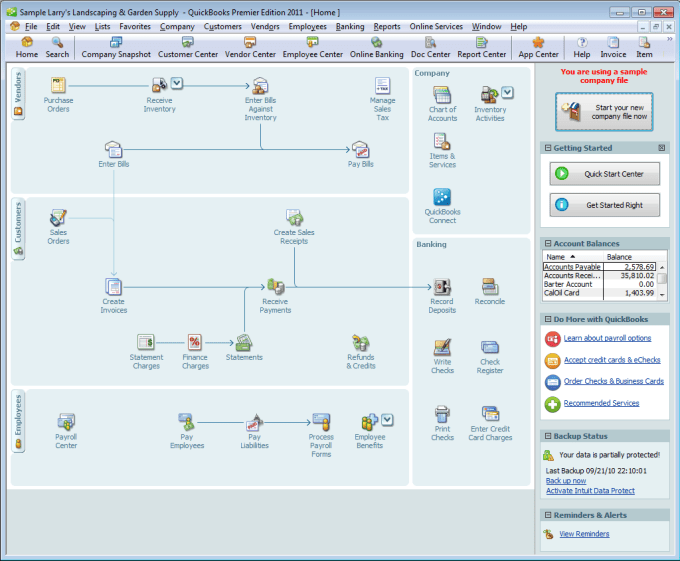

I will prepare bank reconciliation statement and quickbooks for you

I will prepare valid bank statement reconciliation

I will prepare bank reconciliation statement and bookkeeping

I will provide amazon accounting and book keeping with bank reconciliation

I will do bank reconciliations and bookkeeping

I will reconcile bank and credit card statements

I will perform bank and credit card reconciliations

I will do paypal stripe credit card bank reconciliations

I will do bookkeeping or chart of accounts in quickbooks

If you want to prepare well formatted financial report from Quickbook Output File. I will do it for you. I can create different kind of job under the same client.

I will be your quickbooks online CPA accountant