Price action system services

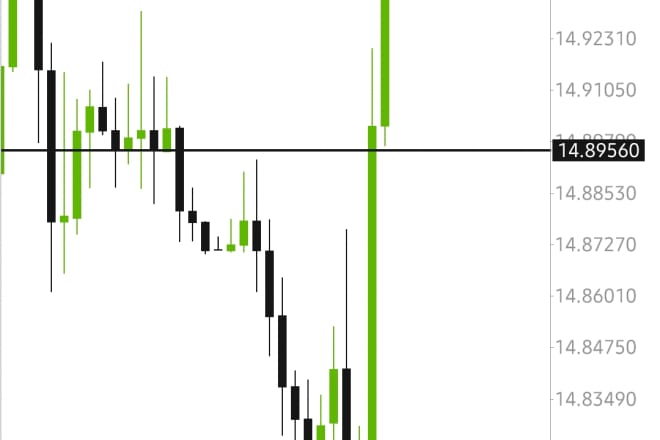

When it comes to investing in the stock market, there are a lot of different strategies that investors can use to try to make money. One popular strategy is known as price action trading. Price action trading is a type of technical analysis that looks at the price movements of a security instead of relying on indicators or other types of technical analysis. There are a lot of different ways to trade using price action, but one popular method is to trade based off of support and resistance levels. Support and resistance levels are areas where the price of a security has a tendency to pause or reverse. By identifying these levels, traders can try to predict where the price is going to move next. There are a lot of different ways to trade using price action, and there are a lot of different opinions on the best way to do it. In this article, we are going to take a look at a price action system that you can use to trade the markets.

There is no one-size-fits-all answer to this question, as the best price action system for a given trader or investor will vary depending on that individual's specific needs and goals. However, some key factors to consider when choosing a price action system include the system's ability to generate accurate and timely signals, its level of customization and flexibility, and the quality of customer service provided by the system's provider.

Although there are many different types of price action system services available, they all share one common goal: to help traders make more informed decisions. By providing accurate and up-to-date information, these services can give traders an edge in the market. Whether you are a beginner or a seasoned pro, using a price action system can help you achieve your trading goals.

Top services about Price action system

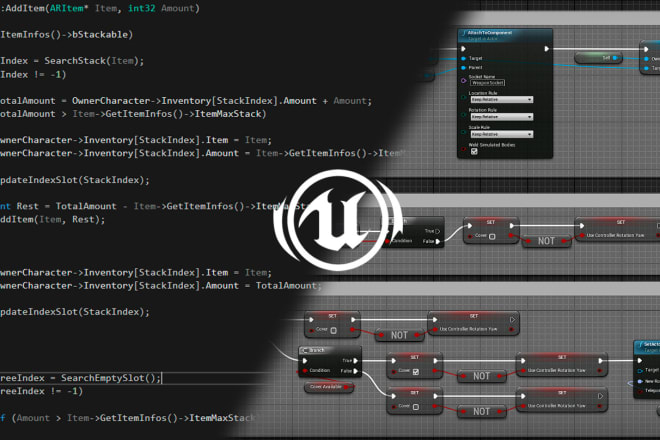

I will make or fix a system in blueprint or cpp in unreal engine 4

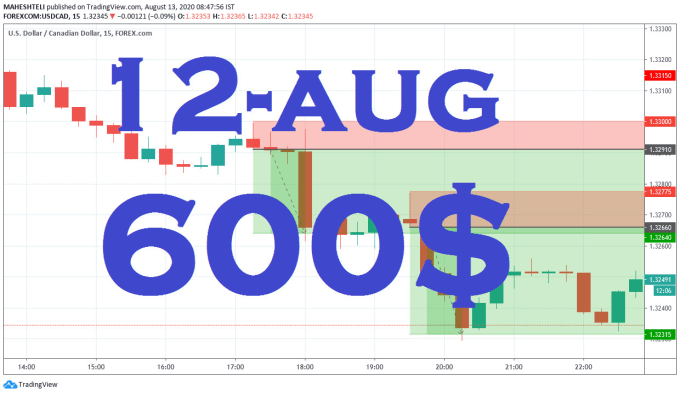

I will give you my profitable forex price action trading system

I will give you forex price action system with 90 percent accuracy

I will pass your ftmo challenge and make you funded trader

I will write meeting minutes from your video or audio meeting

I will revise your technology or engineering resume

I will create a discord bot in python and pass you the source codes

I will give you forex price action system with 90 percent accuracy

I will teach you price action trading strategy for forex and stocks

CUTTING EDGE TRADING SYSTEM -

RISK MANAGEMENT SKILLS -

DISCIPLINE TO FOLLOW TRADE PLAN -

EMOTIONAL INTELLIGENCE -

GOOD RECORD KEEPING -

Start this journey by learning cutting edge trading system. It is one of my best price action trading strategies.

QUICK MOMENTUM PRICE ACTION (QMPA) trading system

Works with any time-frame and

Works any financial instruments like stocks, forex, future, options etc.

If you will learn and implement it in your trading, intraday trading will become your profit generating asset. If you stick to it for at least 3 month, you will realize the potential of price action trading. It will raise you far above level of traders who are struggling for good trading system.

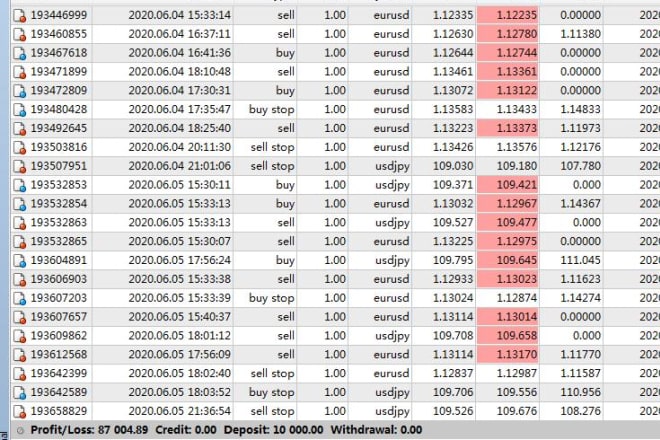

I will send you my 8 times profit forex expert advisor to earn real money

I will offer you the best successful forex trading system with key lessons

I will write code in deluge script to automate your process in zoho

I will teach you how to successfully read and trade price action

I will give you a highly profitable forex price action strategy

I will create amazing action comic pages

i will draw your fantasy action story in your mind to a fierce action comic for your personal purpose or public commercial.