Ratio analysis interpretation services

Ratio analysis interpretation services is a process used by businesses to evaluate financial statement data. This type of analysis can be used to help identify trends, compare companies, and make investment decisions.

There are a number of businesses that offer ratio analysis interpretation services. These businesses take financial data and analyze it to help their clients make better decisions. This can include everything from analyzing a company's financial statements to determining which stocks to buy or sell.

From the data collected through ratio analysis, it can be interpreted that the company is overall stable and has good potential for growth. The company has a good current ratio and a healthy level of debt, which suggests that it is able to pay its current liabilities and has room to take on more debt if necessary. The company's profitability and return on investment are both strong, indicating that it is efficient in its operations and is able to generate a good return for shareholders. The company's liquidity is also good, with a strong cash position and little need for short-term borrowing. Overall, the company is in a good financial position and seems to be performing well.

Top services about Ratio analysis interpretation

I will do a ratio analysis of financial statement and write a report

I will do financial position analysis and ratio analysis

I will teach f3 financial accounting fa fia fd acca

I will perform financial analysis and interpretation

I will do financial analysis, ratio analysis with interpretation

I will do financial analysis and ratio analysis of any company

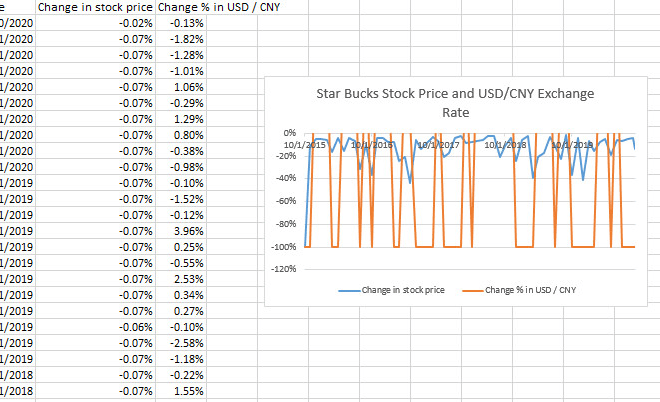

I will perform stock returns analysis on excel

I will do ratio analysis and interpretation

I will do ratio analysis and accounting numerical solution

I will prepare ratio analysis of your financial statements

I will do investment appraisal and financial analysis

Investment Appraisals using:

- Pay Back Period

- Accounting Rate of Return

- Internal Rate of Return (IRR)

- Annualized IRR

- Net Present Value (NPV)

Financial Ratios such as:

- Liquidity Ratio's: Current Ratio, Quick Ratio

- Leverage: Debt-Equity Ratio

- Profitability Ratio

- Working Capital Analysis:

- Receivable Turnover

- Inventory Turnover

- Payable Turnover

- Accounts Receivable Collection Period

- Asset Turnover Ratio

I will do financial analysis, feasibility, investment appraisal and ratio analysis

I will do spss data analysis and statistical report