Ratio analysis project services

There are many different ways to measure the financial performance of a company, but one of the most common and useful methods is ratio analysis. This technique can be used to evaluate various aspects of a company's business, including its profitability, efficiency, and solvency. Ratio analysis can be a helpful tool for project managers when trying to assess the financial health of their project's service providers. By understanding how to calculate and interpret key ratios, project managers can gain valuable insights into the financial stability of their service providers and make more informed decisions about which companies to do business with.

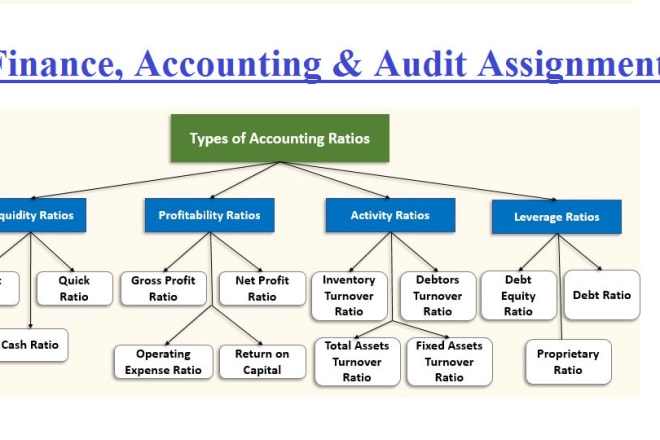

Ratio analysis is used to evaluate various aspects of a company’s financial performance and is a useful tool for both financial analysts and investors. The most common ratios used in ratio analysis are liquidity ratios, activity ratios, solvency ratios, and profitability ratios.

The ratio analysis project services is a great way to get your business on track. By using this service, you can get an accurate picture of your business's financial health and make necessary changes to ensure your business is successful. This service is an essential tool for any business, and I highly recommend it.

Top services about Ratio analysis project

I will do financial analysis, ratio analysis, project reports and accounting evaluation

I will do ratio analysis, financial accounting, project report

I will do ratio analysis, financial accounting, finance project report

I will provide financial analysis, project report, ratio analysis, accounting

I will provide financial analysis, project report,ratio analysis,accounting

I will do financial analysis, project report, ratio analysis, investment appraisal

I will provide financial analysis, project report,ratio analysis,accounting

I will do ratio analysis and accounting numerical solution

I will prepare ratio analysis of your financial statements

I will do investment appraisal and financial analysis

Investment Appraisals using:

- Pay Back Period

- Accounting Rate of Return

- Internal Rate of Return (IRR)

- Annualized IRR

- Net Present Value (NPV)

Financial Ratios such as:

- Liquidity Ratio's: Current Ratio, Quick Ratio

- Leverage: Debt-Equity Ratio

- Profitability Ratio

- Working Capital Analysis:

- Receivable Turnover

- Inventory Turnover

- Payable Turnover

- Accounts Receivable Collection Period

- Asset Turnover Ratio

I will do financial analysis, ratio analysis with interpretation

I will do financial analysis,ratio analysis and accounting

I will provide financial analysis, project report, ratio analysis

Will help you in:

- Horizontal and Vertical analysis of financial statements

- Financial Projections / Forecasting, Ratio Analysis

- Preparation of financial statements

- Project report and forecasting for fundraising

- DuPont analysis

- Discounted Cash Flow (DCF) Mode

- Liquidity ratios

- Profitability ratios

- Activity ratios

- Financial leverage ratios

WHY ME????????

I have more than 9 years’ experience in accounts and finance industry. I worked in financial content departments of multinational companies. I am ACCA and also did MBA-Finance.

I have also practical experience of Stock trading so can also help you in this field.

I will also love to help students in their studies.

Regards,

Zia