Robot forex services

In recent years, the use of robots for Forex trading has become increasingly popular. There are many advantages to using robots for Forex trading, including the ability to trade 24 hours a day, the ability to trade with a high degree of accuracy, and the ability to trade without emotion. However, there are also some disadvantages to using robots for Forex trading. One of the biggest disadvantages is that robots can only trade based on the rules that they are given, and they cannot think outside the box or make decisions based on experience or intuition. Another disadvantage of using robots for Forex trading is that they can be expensive. Some robots can cost thousands of dollars, and if you're not careful, you can easily blow your entire trading account on one bad trade. If you're thinking about using a robot for Forex trading, you need to do your homework and make sure that you understand both the advantages and disadvantages of using robots.

A robot forex service is a program that trades on your behalf in the foreign exchange market. It is designed to remove the emotional factors from your trading decisions, and can trade for you 24 hours a day, 5 days a week.

With the ever-growing popularity of forex trading, it's no surprise that more and more people are turning to robots to help them make money in the market. While there are a number of different robot forex services out there, they all essentially work in the same way: by using complex algorithms to analyze the market and make trades on behalf of their clients. While robot forex services can certainly help you make money in the market, it's important to remember that they are not perfect. Just like any other form of trading, there is always a risk of losses. However, by carefully choosing a reputable robot forex service and following their advice, you can minimize your risks and maximize your chances of success in the market.

Top services about Robot forex

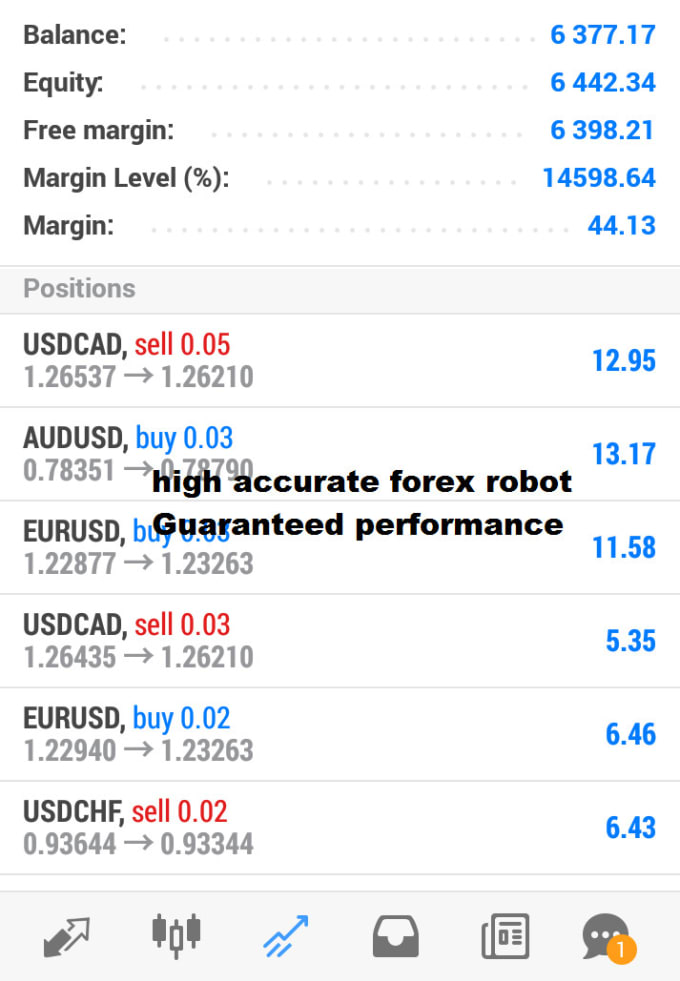

I will offer you my high profitable forex robot, trading bot, forex bot

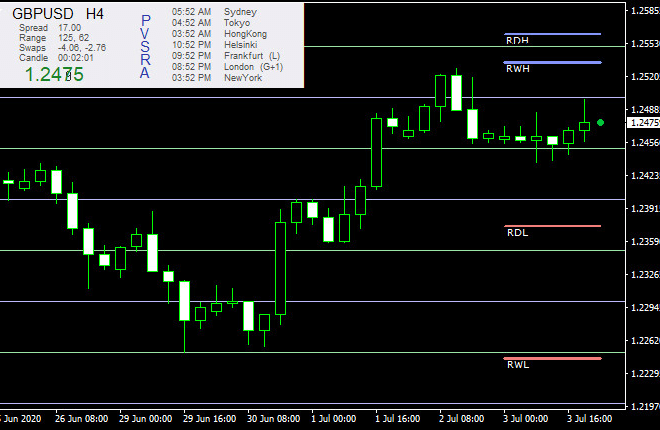

I will develop forex bot, tsr forex ea, forex trading bot,forex robot

I will give forex robot for auto trading

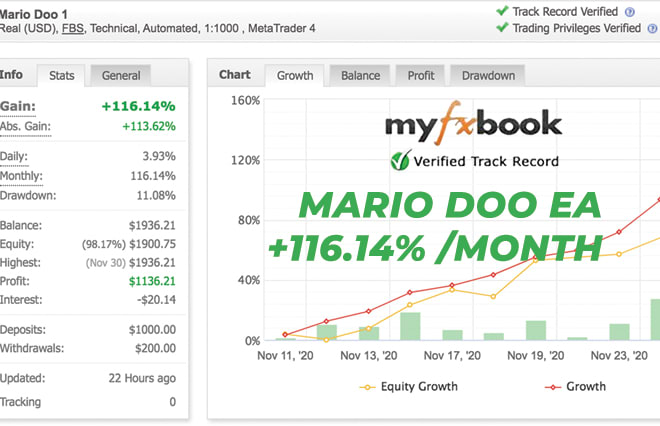

I will give mario doo ea best high profitable forex robot mt4 real

I will create forex robot ea or an indicator for mt4 mt5

I will code a metatrader 4 mt4 mt5 indicator or expert advisor forex robot ea

I will forex trading, forex ea robot, forex bot, forex ea, forex robot

I will code renko forex robot ea metatrader mt4 mt5

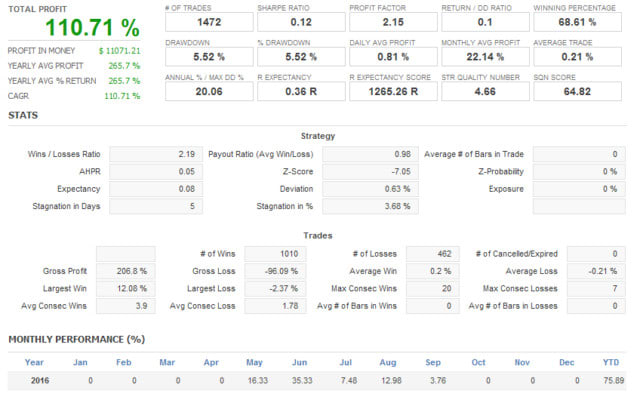

I will provide profitable forex trading bot,forex ea, robot, mt4 forex robot

I will give to you my profitable forex trading robot, forex ea robot

I will give you forex ea with highest accuracy,guaranteed profit

I will provide low risk forex ea robot, forex bot, forex ea, mt4 ea, mt4 robot

I will code expert advisor forex robot mt4 mt5

I will offer high profitable forex robot, forex bot, forex trading bot, trading bot

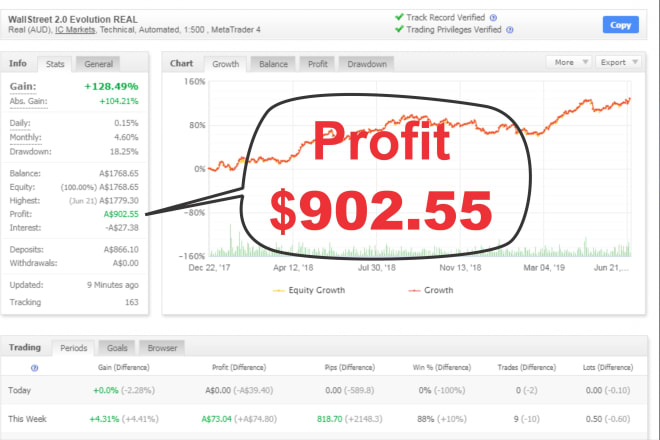

I will wallstreet forex robot evolution real money