Rpa bank reconciliation services

If you manage a bank, you know how important it is to keep track of all the transactions made by your customers. With so many different types of transactions happening every day, it can be difficult to keep everything organized. That's where RPA bank reconciliation services can help. RPA services can automate the process of reconciling your bank's transactions, making it easier and faster for you to manage your finances. With RPA, you can be sure that all of your transactions are accounted for, and that your books are always up-to-date. This can save you a lot of time and money in the long run. If you're looking for a way to streamline your bank's operations, RPA bank reconciliation services may be the answer. Contact a reputable RPA provider today to learn more about how they can help you.

RPA bank reconciliation services is a type of service that can be used to reconcile your bank account. This type of service can be used to help you keep track of your finances and make sure that your bank account is in good standing. This type of service can be used to help you reconcile your account if you have been a victim of fraud or if you have been overcharged by your bank.

Overall, RPA bank reconciliation services can provide your business with a number of advantages. These advantages include reducing the amount of time needed to reconcile your accounts, improving your data accuracy, and providing you with real-time insights into your financial situation. If you are looking for ways to improve your accounting and finance processes, RPA bank reconciliation services may be the right solution for you.

Top services about Rpa bank reconciliation

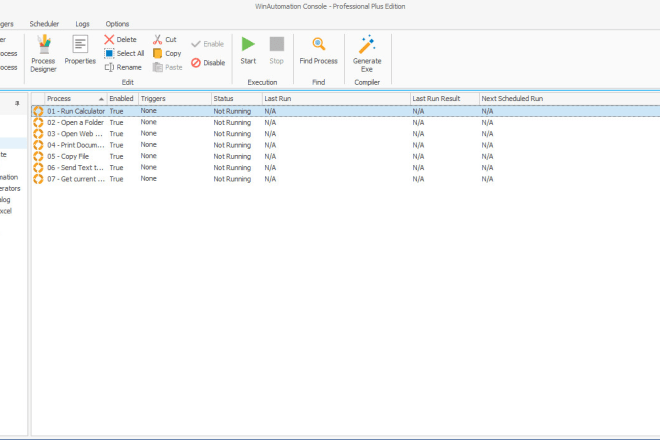

I will create any rpa process with power automate

I will prepare bank reconciliation statement and bookkeeping

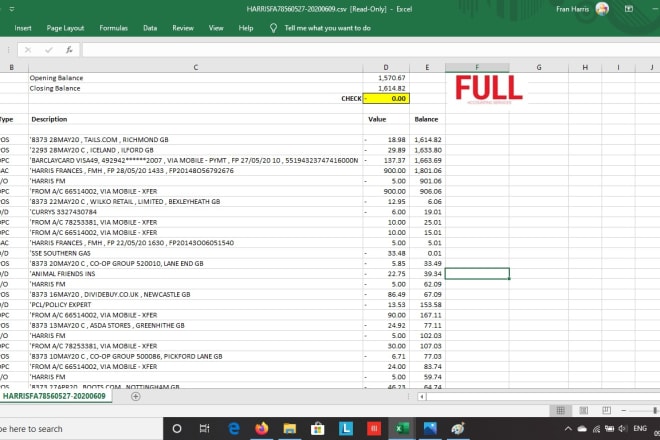

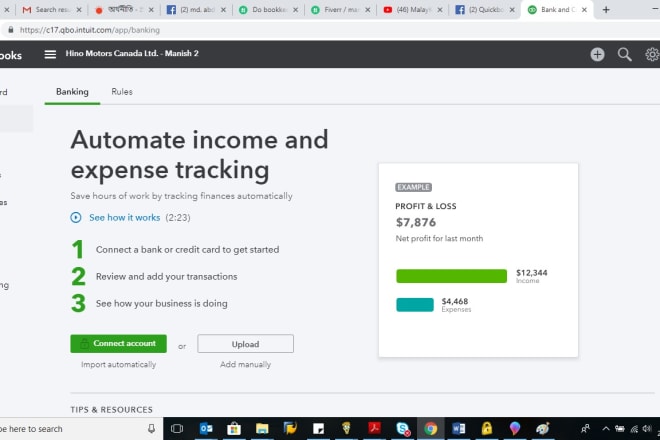

I will do bank statement or credit card reconciliation with quickbooks

I will reconcile bank and credit card statements

I will prepare bank reconciliation and credit card reconciliations

I will do bank reconciliation and credit card reconciliation

I will do reconciliation from paystub, paypal, zelle, quickbooks bank statement

I will do bank reconciliation and credit card reconciliation in quickbooks online

I will prepare bank reconciliation and credit card reconciliation

I will do bank reconciliation and credit card reconciliation