Service tax details

In this article, we will provide an overview of service tax in India. This will include a definition of service tax, who is required to pay service tax, and what services are subject to service tax. We will also provide some general information on the service tax rate and how service tax is calculated. Finally, we will briefly touch on some of the recent changes to service tax in India.

Service tax is a tax levied by the government on service providers in India. It is a form of indirect tax and is levied on the services provided by service providers. The service tax is levied on the gross value of the services provided and is paid by the service provider to the government. The service tax is not a new tax and has been in existence in India since 1994. The service tax is levied at a rate of 12% and is payable on a monthly basis. The service tax is not applicable on certain services such as educational services, health services, and religious services.

In conclusion, service tax is a tax levied by the government on the service provided by a company. The service tax is calculated based on the value of the service provided. The service tax is imposed on the service provider, and the customer is responsible for paying the tax.

Top services about Service tax details

I will do irish accounts for tax, company register, expert accountant in ireland

I will do schedule c,1099 form, 1040 tax form from w2, paystubs,slip

I will design paystub and checkstubs for employees and contractor

I will do financial consulting, accounting and tax services

I will prepare individual or business income tax return

I will review self prepared UK self assessment tax return sa100

I will do especially company details and key contacts

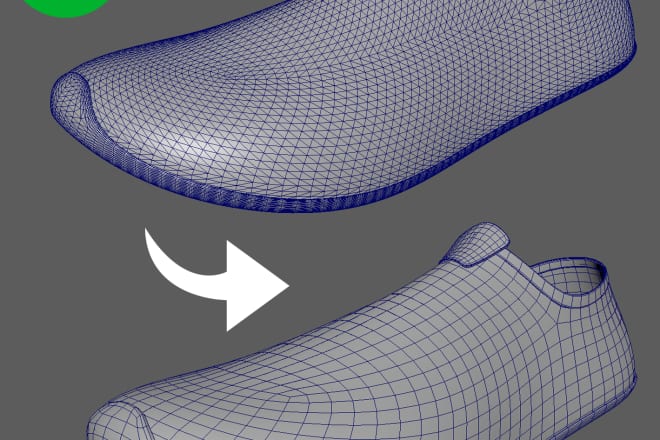

I will optimize your 3d model

I will modeling and sculpting printble 3d models

I will do wordpress migration service

I will transfer your wordpress site to another domain or hosting

# Want to change your domain name for website ?

Yes :) I am here about the service with more than 5 Year Experience about

Wordrpess Development .

I am a expert Wordpress Developer and Its very easy task for me .

I can deliver the service withing 24 Hrs without harming any files of your website.

Requirements

# Need Old Server Details

# Need New Server Details

Just place an order and send me details of both servers. I'll get started asap.

Please feel free to send a message here if you have any question, I'll get back to you asap.

Thanks

I will design amazing flyer for you

I will deliver High-resolution print ready.JPG and PDF files.

For the design, I need solid details (I can't find details from websites). I need a file with wording (which allows me to copy), images and LOGO.

Note: *I don`t do any logo design service with this gig.

I will scrape users from any telegram group, usernames, ids, first 200 users for free

I will create revit model with full details

I will playstation platinum trophy service