Service tax invoice

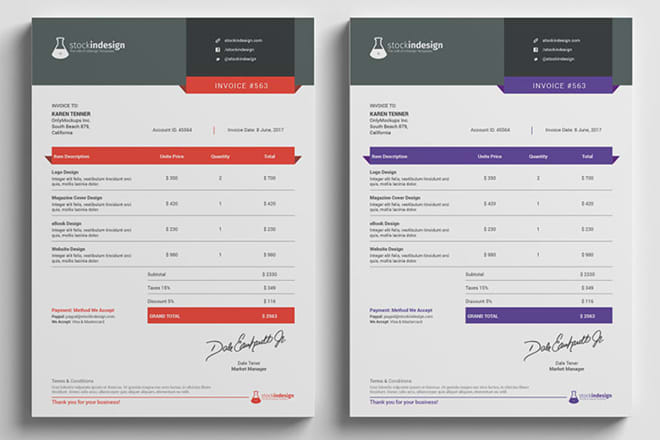

A service tax invoice is a bill issued by a company to its customers for the services rendered. The invoice typically contains the company's name and address, the customer's name and address, a description of the services rendered, the dates the services were rendered, the amount due, and the terms of payment. The service tax invoice may also include other information, such as the customer's account number, the invoice number, and a breakdown of the charges.

A service tax invoice is a document that is issued by a service provider to a customer for the services rendered. The invoice includes the name and address of the service provider, the name and address of the customer, the date of the service, a description of the services rendered, the amount charged for the services, and the service tax rate.

Service tax invoice services are an important part of any business. They help businesses keep track of their expenses and provide a way to bill customers for services rendered. Without service tax invoice services, businesses would have a difficult time keeping track of their finances and providing accurate invoices to their customers.

Top services about Service tax invoice

I will provide you tax,sba,eidl loan and ppp loan services

I will do accounting, bookkeeping, financial statements,tax and audit

I will do sales tax quickbooks calculation for your business

I will dynamic generate invoice or dynamic PDF and mail

I will record invoice and bills in quickbooks or xero

I will interactive pdf order form and invoice

I will design, and edit your receipt, invoice, and business card

I will design invoice for business

I will edit or design professional invoice templates

I will design amazing invoice for you

I will design invoice, letterhead template, and price list for you

I will do modern invoice, letterhead or envelope in 24hrs

I will develop car repair service center software with website