Startup capitalization table services

Whether you're a startup or an established business, you need to track your equity. Equity is what's left of your company after you subtract liabilities from assets. It's important to keep tabs on your equity because it's a key metric for attracting investors and measuring your company's value. One way to track your equity is to create a capitalization table, also known as a cap table. A cap table is a spreadsheet that lists all of the equity holders in your company and their percentage ownership. If you're a startup, you may not have all the information you need to create a cap table. That's where startup capitalization table services come in. These services help startups keep track of their equity by providing tools and resources to help them calculate and manage their equity data. Some startup capitalization table services also offer features like equity analysis and management, which can help you understand and optimize your equity position. Whether you're a startup or an established business, capitalization table services can help you manage your equity and make better decisions about your business.

A startup capitalization table is a document that lists the various types and amounts of equity financing a startup has raised. The table typically includes the names of the investors, the investment amount, the valuation of the company at the time of the investment, and the percentage of ownership each investor holds. The purpose of a startup capitalization table is to help founders and startup employees understand the company's equity structure and how it may change over time as the company raises additional rounds of financing. The table can also be used to negotiate equity agreements between founders, investors, and employees.

Overall, startup capitalization table services can be a great way for startups to stay organized and keep track of their equity. For founders, it can be a helpful tool to keep track of how much equity each person has in the company. For investors, it can be a useful way to keep track of their investment and see how the company is growing.

Top services about Startup capitalization table

I will write a professional business plan for startups in 12 hours

I will write complete business plan for startups

I will write a complete business proposal or business plan for startups

I will design winning startup and investor pitch deck

I will create business plan for startups and existing businesses

I will write your business plan

I will advise on startup pitch deck and fundraising

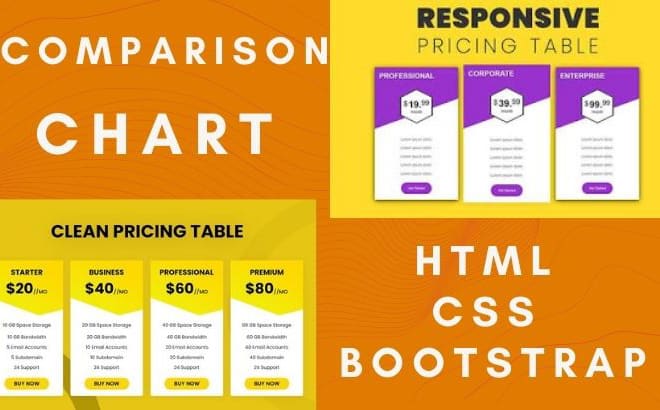

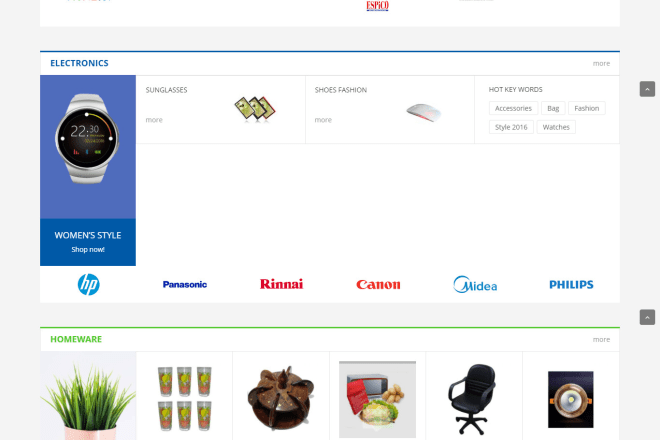

I will create table, pricing table,comparison table using html,css

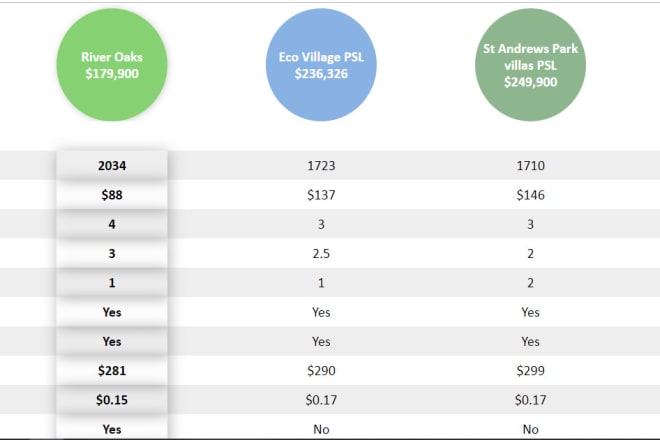

I will design wonderful PSD pricing table,comparison table, chart

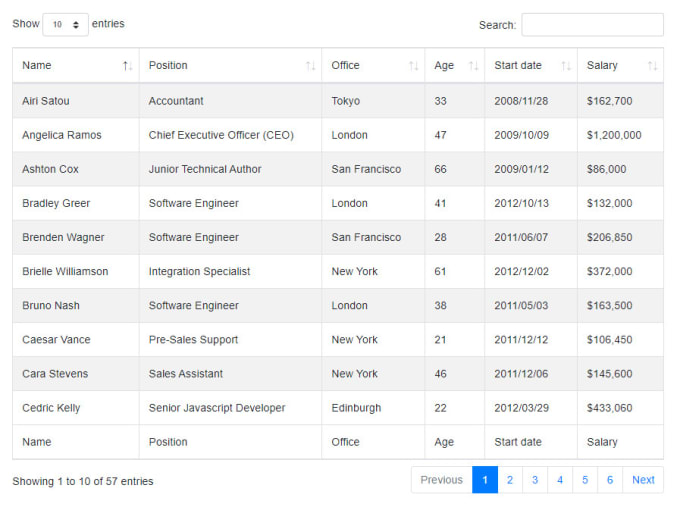

I will add or edit jquery datatables or js grid table

DataTables is a plug-in for the jQuery Javascript library. It is a highly flexible tool, based upon the foundations of progressive enhancement, and will add advanced interaction controls to any HTML table.

Benefits of DataTables & Js-Grid Table

- Adds Sorting functionality to the table

- Adds Search functionality to the table

- Adds Row Manage By Controlling Total Number Of Raws functionality to the table

- Adds Pagination functionality to the table

Below are the things that I can do for jQuery DataTables & Js-Grid Table:

- Convert your Table to DataTable OR Js-Grid Table

- Can modify the functions of the DataTable OR Js-Grid Table

- Modify the design of the DataTable OR Js-Grid Table

- Add TOTAL of any particular column to it's footer

- Add the custom number to sorting to the DataTable OR Js-Grid Table

DO NOT CONTACT ME FOR YOUR SCHOOL/COLLEGE ASSIGNMENTS.

Reason: The School/College Assignments are for Student's Practice which can help them to improve their knowledge about programming.

I will design professional pricing table or pricing list

I will do a minimalist logo design

Do You own a startup or a company? Does your startup have a logo? If not, You are in the Right Place!

We at Vectographic will do an in-depth research about your startup and create a Simple, Different and minimalist logo that would be appealing as well as story-telling.

Send us a Message to discuss before placing an order!

Check out our other gigs!

I will do price list, pricing table, comparison chart diagram using html,css,bootstrap

I will prepare a realistic business PLAN

I am working as a financial analyst in a reputed multinational bank and providing financial

consulting to more than 20 reputed companies. I have 8+ years of work experience in financial consulting, business plan preparation and project finance.

Qualities of a good business plan.

No one can deny the importance of a good business plan. Not only it helps you to understand your business in a more holistic manner, but it helps to you to present your business plan in front of business partners, investors and bankers.

2 reasons people need a business plan.

- Primary Purpose - Those need business plan for their own business

- Secondary Purpose - Those need business plan for assignment to submit in classroom

Business Plan mainly includes the following.

- Table of Contents

- Executive Summary

- General Company Description

- Products and Services

- Marketing Plan

- Operational Plan

- Management and Organization

- Personal Financial Statement

- Startup Expenses and Capitalization

- Detailed Financials

- Start-up Funding

- Projected 5 years Profit and Loss

- Projected 5 years Balance Sheet

- Projected 5 years Cash Flow

Before placing an order, please leave a message so that I can send you custom offer based on your specific requirement.

I will design your startup website in 99 dollars

I will design your next table runner or throw design

This gig covers the graphic design only of your next trade show or expo table runner or throw. If you are interested in our printed and physical display packages please contact us and we will provide you a custom fiverr estimate for the design, print and shipping of your next trade show display.

Sizes of table throws:

- 6'

- 8'

Types of table throw cover prints:

Print on the front panel only (Front Panel Dye Sublimation)

Print on the entire throw (Full Dye Sublimation)

Logo on the front panel only (Perma-logo)

Standard sizes of table runners:

- 24'

- 30"

- 36"

- 60"

Types of table throw cover prints:

All table runners are fully printed with dye sublimation and typically finished with hemming around all the edges. They drape over the table allowing your message to hang down the front of the table.