Supply and demand forex indicator services

In the world of foreign exchange (forex) trading, there is no shortage of supply and demand indicator services. But what are these indicators and do they really work? This article will attempt to answer these questions and more. Supply and demand forex indicators are services that claim to help traders identify potential areas of support and resistance in the market. These services typically use a combination of technical analysis and fundamental analysis to generate their signals. There is no shortage of opinions on whether or not these indicators actually work. Some traders swear by them, while others believe they are nothing more than a waste of time. The truth probably lies somewhere in between. Like any other tool, supply and demand indicators can be useful if used correctly. But ultimately, it is up to the trader to decide whether or not they are worth the time and effort.

Supply and demand forex indicator services are tools that help traders identify potential areas where the price of a currency may change. These services can be used to help traders make decisions about when to buy or sell a currency.

Overall, supply and demand forex indicator services provide a valuable tool for traders and investors alike. By analyzing the market and identifying potential areas of support and resistance, these services can help traders make more informed decisions about their trades. While there is no guarantee of success, using these services can give traders a better chance of success in the forex market.

Top services about Supply and demand forex indicator

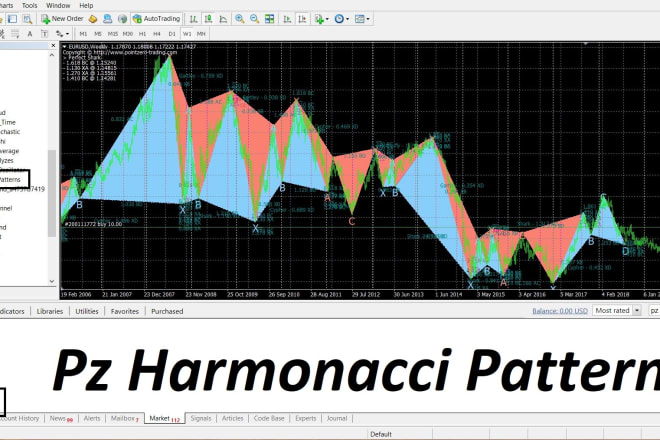

I will analysis of stocks, commodities, currencies and crypto

I will create a complete beginner friendly forex trading course for you

I will give you alternative ichi lines indicator for mt5 and mt4

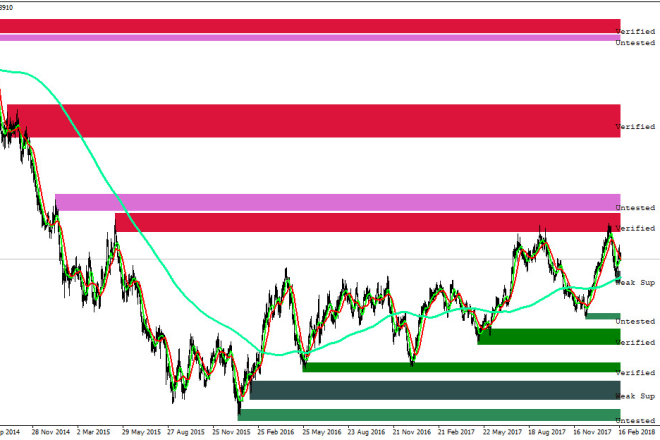

I will forex supply and demand template

I will provide you with perfect forex system and indicator

I will give best high profitable forex ea robot mt4 mt5 hedging

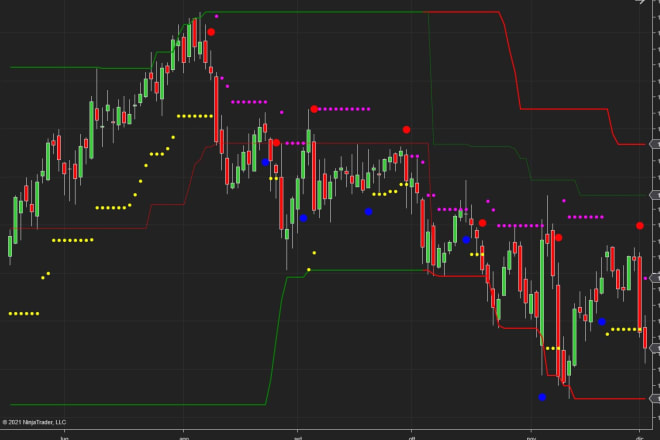

I will trading ninjatrader 8 indicator

I will give you the best forex trading template 2020

I will increase pips with profitable indicator

I will provide world top 3 supply and demand trading courses

I will increase pips with profitable indicator

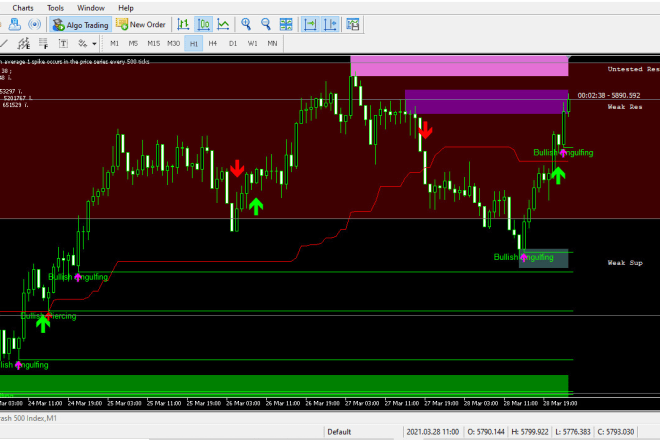

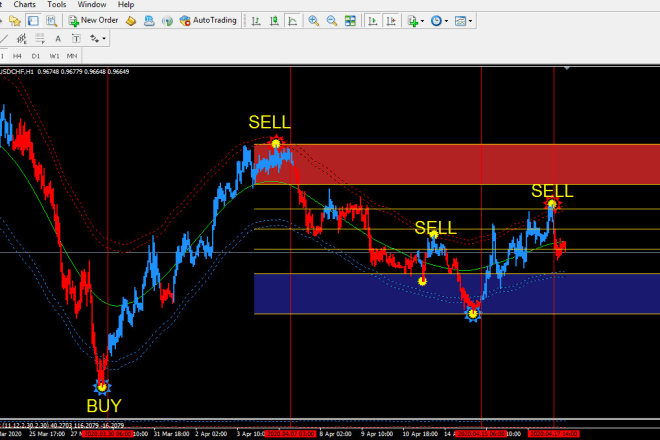

New forex traders can also win in the forex trading by my this FX win Profitable Strategy Template + Indicator, My system will tell you when and where you should trade. This is a highly profitable and simple to use forex strategy.

It comes with a Tutorial how to set up the indicators and template.

There is no need for prior knowledge in forex, markets or finances to use this strategy effectively. Anyone who can use a computer can use it. You can use this strategy on any type of Forex platform.

EXTRA

---------------------------

I will teach you institutional based supply and demand trading and a strategy

I will provide Forex Loss Cover Strategy Template and Indicators

If you have loosed money in Forex Trading and still losing trades then it is time to cover your all losses with my Great Strategy, It is a very simple, easy, accurate and high profitable method and it is easy to install on your MT4 (Meta Trader).

- Accuracy 75 to 90%

- Non Repainted Entry Signal

- First Arrow may repaint, but you must always wait until the 2nd arrows.

- Indicator will give you Alert when the 2nd Green or Red Arrow appears.

- Use divergence and new RSI indicator

- Red dot indicator can predict big movements.

- Multiple Time Frames Best Forex Strategy.

- Works on Meta Trader 4 or MT4

I will give a forex trading strategy and you will get financial freedom