Supply demand indicator mt4 services

In any economy, the interaction of supply and demand determines the price of goods and services. The same is true in the foreign exchange market. Currencies are traded in pairs, with each currency being traded against another. The supply and demand for each currency determines its value relative to the other currency in the pair. The supply and demand for a currency can be affected by a number of factors, including a country's economic stability, interest rates, inflation, and its political and economic relations with other countries. All of these factors play a role in determining the price of a currency. In the foreign exchange market, traders can use a supply and demand indicator to help them make trading decisions. A supply and demand indicator is a tool that uses historical data to identify areas of potential supply and demand in the market. By identifying these areas, traders can make better informed decisions about when to buy and sell currencies. There are a number of different supply and demand indicators available, and each has its own advantages and disadvantages. The supply and demand indicator is just one tool that traders can use to make better informed decisions about their trades. In order to be successful in the foreign exchange market, it is important to have a well-rounded approach that includes a variety of different tools and indicators.

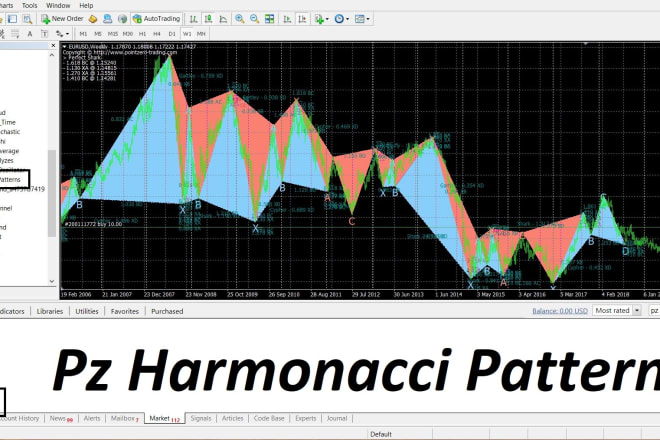

A supply and demand indicator is a technical indicator that is used to show the relationship between the amount of goods or services that are available and the amount that is desired by buyers. The indicator can be used to identify periods of excess supply or demand, which can be used to make trading decisions.

This article has covered the supply and demand indicator MT4 services that are available to traders. It is important to remember that these services are not perfect, and there will be times when the indicators produce false signals. However, if used correctly, the indicators can be a valuable tool in your trading arsenal.

Top services about Supply demand indicator mt4

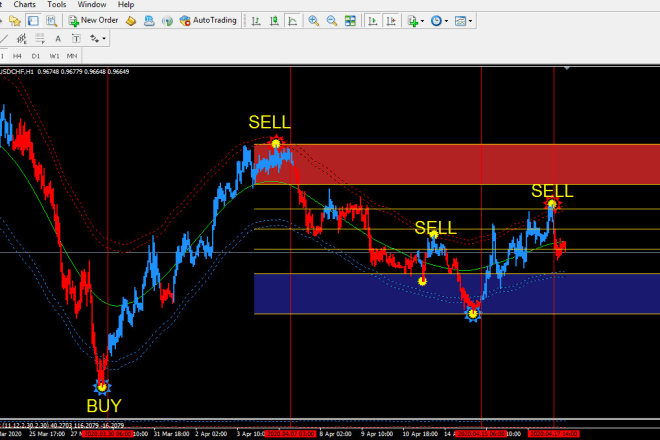

I will give you the best forex trading template 2020

I will give you pipup and support resistance indicators

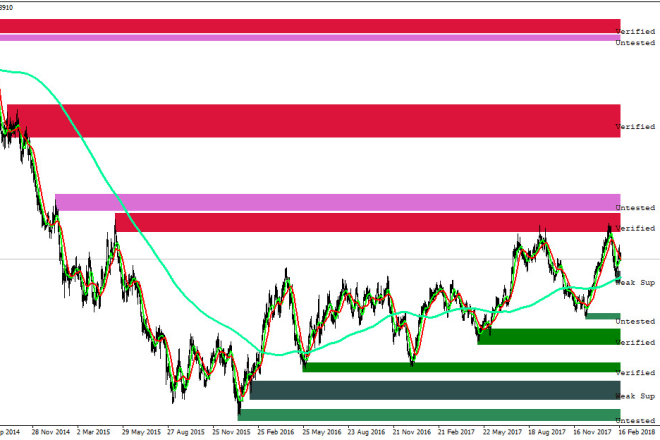

I will give golden supply and demand mt4 indicatr for forex

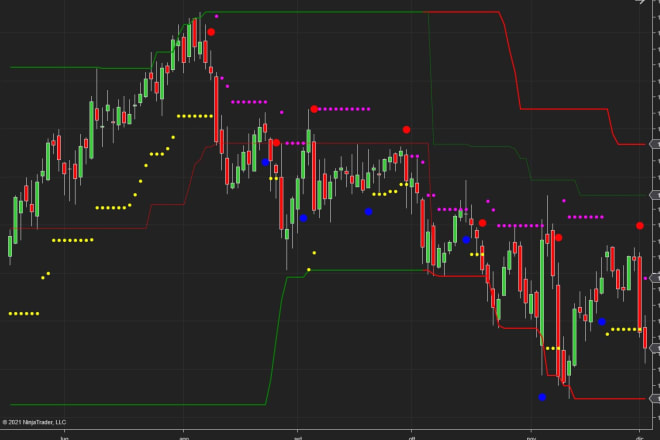

I will trading ninjatrader 8 indicator

I will teach you institutional based supply and demand trading and a strategy

I will provide you with perfect forex system and indicator

I will provide world top 3 supply and demand trading courses

I will virtually assist with all your supply chain related tasks

I will solve any supply chain question that you have

I can help you with:

- Build the supply chain strategy.

- Day to day supply chain decision making

- Give insights around supply chain solutions

- Any Supply chain Conceptual questions.

- Supply Chain assignments.

With my more of 15 years of professional working experience in supply chain in big companies, plus my Industrial Engineering background mixed with my Master degree in Business I can certainly help you solve any type of concerns. Supply Chain is complex and have many arms around. Let me simplify your life by giving you the most efficient and effective supply chain solution for your concern.

My specialities are focussed on resource/ material/ demand planning, procurement, inventory management, field services, crossed- functional collaboration, organizational structure, process definition, distribution, third parties management. vendor management,

You can ask me any questions in advance to make sure we are on the same page and i'll meet your needs.

Happy to help!

I will forex supply and demand template

I will custom indicator, mt4 indicator, tradingview indicator, pinescript, mql4

I will give you my best indicator and template for consistent profit