Tactical arbitrage 2018 services

If you're looking to make money in 2018, then you should definitely consider investing in tactical arbitrage. Tactical arbitrage is a type of investing that involves taking advantage of discrepancies in prices between different markets. By arbitrageur between these markets, you can earn a profit without taking on any risk. There are a number of different tactical arbitrage services available, and choosing the right one can be the key to success. In this article, we'll take a look at some of the best tactical arbitrage services out there and help you choose the right one for you.

Tactical arbitrage is the process of buying and selling goods or services in different markets in order to take advantage of price differences. It is a type of price arbitrage that is often used by traders and investors to make profits. Tactical arbitrage can be used in a variety of markets, including the stock market, the foreign exchange market, and the commodities market. In each of these markets, there are usually different prices for the same good or service at different times and in different places. By taking advantage of these price differences, traders and investors can make profits. There are a number of different tactical arbitrage strategies that can be used, and the best strategy for a particular trader or investor will depend on a number of factors, including the type of market, the time frame, and the amount of capital that is available. One of the most popular tactical arbitrage strategies is known as "pairs trading." This strategy involves finding two different assets that are traded in different markets and that have a high degree of correlation. Once the two assets have been identified, the trader or investor will then buy the asset that is undervalued in one market and sell the asset that is overvalued in the other market. Another popular strategy is known as "statistical arbitrage." This strategy is similar to pairs trading, but it involves finding three different assets that are traded in different markets and that have a high degree of correlation. Once the three assets have been identified, the trader or investor will then buy the asset that is undervalued in one market and sell the asset that is overvalued in the other two markets. Tactical arbitrage strategies can be used in a variety of different markets, and they can be used to trade a wide variety of assets. However, it is important to remember that these strategies can be risky, and that traders and investors should always conduct thorough research before entering into any trades.

There are many different types of arbitrage, but 2018 is shaping up to be a great year for tactical arbitrage. This type of arbitrage takes advantage of inefficiencies in the market to earn a profit. There are many different ways to do this, but the most common is to buy low and sell high. This year, there are many different opportunities for tactical arbitrage. With the current state of the economy, there are many different places to find inefficiencies. The best way to find these opportunities is to keep up with the news and be on the lookout for changes in the market. Tactical arbitrage is a great way to earn a profit, and 2018 is shaping up to be a great year for it. There are many different opportunities out there, so be on the lookout for them. With a little research, you can find a great opportunity and make a profit.

Top services about Tactical arbitrage 2018

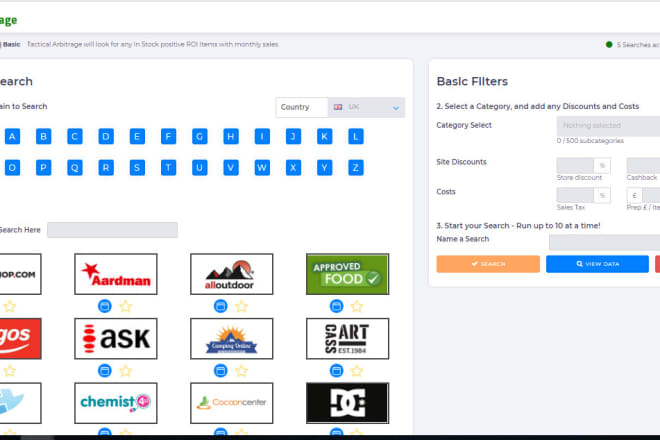

I will develop custom xpath for tactical arbitrage

I will create custom xpaths for tactical arbitrage

I will create custom xpath file for tactical arbitrage

I will create custom xpath for tactical arbitrage

I will do product sourcing for amazon online arbitrage

I will do product sourcing for amazon online arbitrage

I will be your virtual assistant for amazon online retail arbitrage

I will search products for online arbitrage

I will sell adsense arbitrage course build a professional arbitrage website