Tax preparation services

Tax preparation services can save you time and money when it comes to your taxes. They can help you find deductions and credits that you may not have known about, and they can also help you file your taxes electronically, which can save you even more time.

There are many tax preparation services available to help individuals and businesses with their taxes. These services can range from simple tax return filing to more complex services such as tax planning and advice. Some tax preparation services also offer audit protection and other financial services.

While there are many tax preparation services available, it's important to choose one that is reputable and has your best interests in mind. You can use online resources to research different tax preparation services and find one that is right for you. When it comes time to file your taxes, be sure to have all of your documentation in order and be prepared to answer any questions the tax preparer may have. With a little preparation, you can ensure that your taxes are filed correctly and on time.

Top services about Tax preparation services

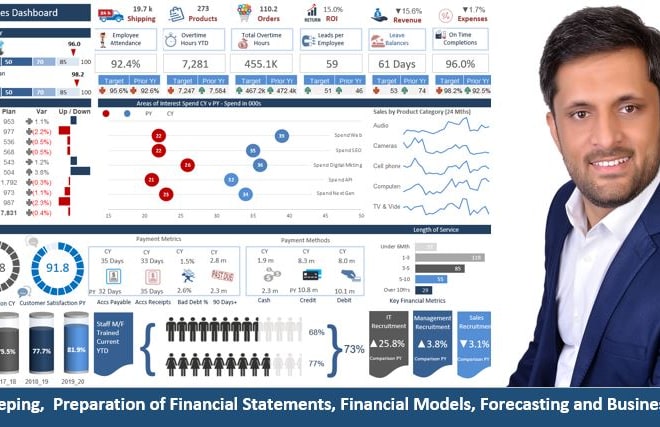

I will provide accountancy, bookkeeping, tax returns preparation services

I will prepare individual or business income tax return

I will prepare canadian corporate tax return t2

I will provide accounting and tax preparation services

I will provide tax preparation services

I will prepare USA income tax return and provide related services

I will tax preparation credit services

I will prepare financial analysis,forecasting and taxation

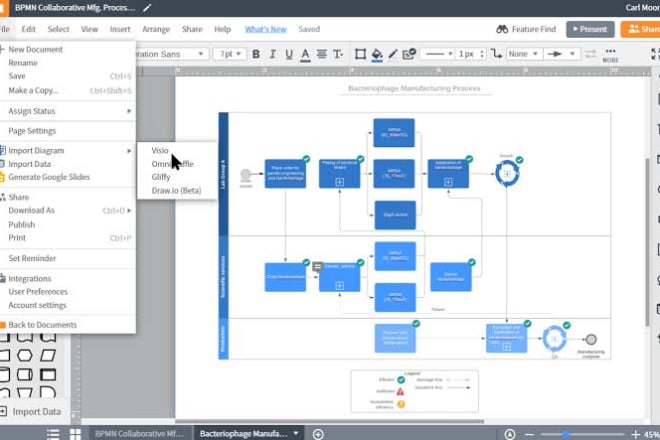

I will prepare flowcharts and diagrams on ms visio for you

I will provide you tax,sba,eidl loan and ppp loan services

I will do bookkeeping using quick book online and excel

I will do financial consulting, accounting and tax services

I will do amazon, shopify, ebay accounting by using a2x, quickbooks and xero

I will prepare unaudited report per singapore frs and bookkeeping

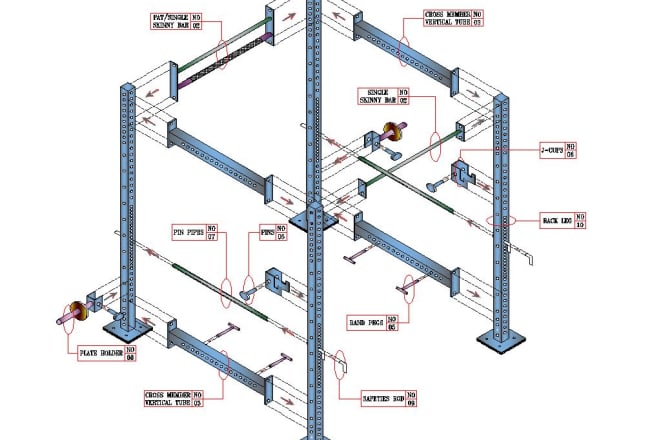

I will arch hvac plumbing shop drawings

I will get you hired with my 12 page interview preparation pack

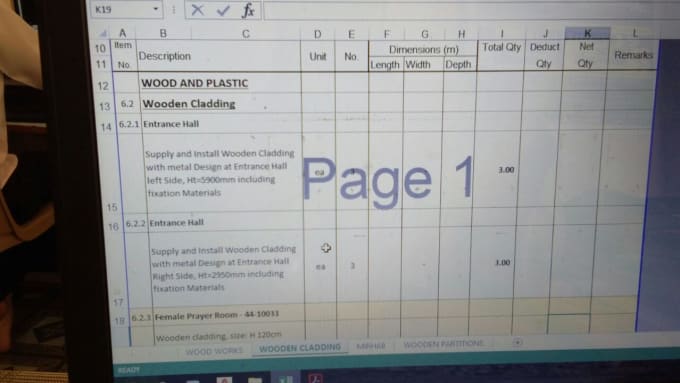

I will estimate building quantities draw architectural structural plans

· Preparation of Bill of Quantity (B.O.Q) as per CSI standard.

· Checking and certification of contractor’s bills.

· Taking off Architectural and Structural quantities as per drawings.

· Preparation of work order against approved budget.

· Preparation of purchase request and material recovery statement.

· Quantification and submission of monthly earned value report.

· Preparation of detailed Bills of Quantities and variations.

· Comparison of BOQs of contractors.

· Preparation of BBS.

Taking actual measurements at site as per work done by contractor.