Tradeline brochure services

A tradeline is a type of credit account that appears on your credit report. It includes information about the account, such as the date it was opened, the credit limit, the balance, and the payment history. A tradeline can be either positive or negative, depending on the account's payment history. A tradeline brochure is a document that outlines the terms and conditions of a tradeline account. It typically includes information about the account's credit limit, interest rate, and payment terms. A tradeline brochure can be an important tool for consumers who are considering opening a new credit account. The tradeline brochure services industry is made up of companies that provide tradeline brochures to consumers. These companies typically offer a variety of tradeline brochures, and they may also offer other credit-related services. If you're considering opening a new credit account, you may want to request a tradeline brochure from a company that provides them. This can give you a better understanding of the account and help you make an informed decision.

A tradeline is a credit account that is reported on a consumer's credit report. A tradeline can be a credit card, loan, line of credit, or any other type of account that is reported to the credit bureaus. Trade lines can be either positive or negative, depending on the account history. A tradeline brochure service is a company that provides information about tradelines to consumers. These services typically include a database of tradelines that consumers can search through, as well as tools and resources to help consumers understand and manage their credit.

Overall, we found that tradeline brochure services are a great way to boost your credit score. They are an affordable way to get started and can help you improve your credit history.

Top services about Tradeline brochure

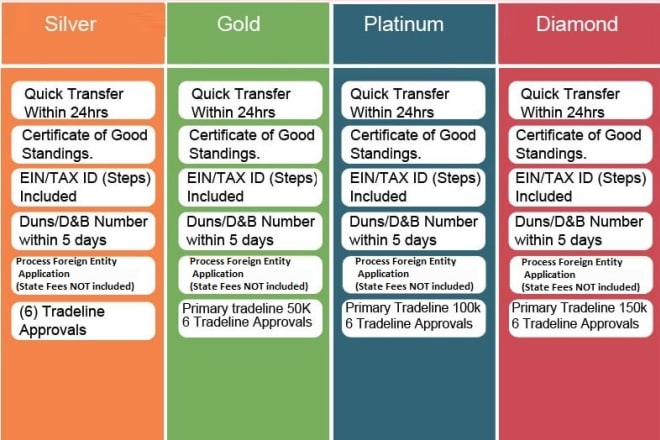

I will add a primary tradeline to your credit report

I will add a tradeline to improve your credit profile

I will shelf corp with 6 tier 1 tradeline approvals

I will design flyer, brochure, creative design services

I will provide brochure design service

I will do the unique flyer, trifold brochure, multipage brochure

I will create the unique Trifold brochure, Bifold Brochure, Multipage Brochure, Z fold brochure, flyer, poster for Your business. It is important to me to do a perfect product that helps Your company be successful.

I will do an amazing brochure design

Here's what you get in your Brochure:

★ Pixel Perfect and Print Ready Brochure Design★ High DPI and all source files are provided for your Brochure★ Unique design for both printing and digital platforms.

Take a look at our GIG Packages to find your best match for your Brochure Design.

A source file and all print ready files are rendered once the brochure design is finalised by you.

What kind of brochures we do:

Corporate Brochure, Entertainment Brochure, Product Brochure, Trifold Brochure, Bifold Brochure. We do it all!

NOTE:

Read FAQs to learn what we will require from you.

Have any question? Don't hesitate to contact us.

★★ Professional DESIGNS ★★

★★ TOP QUALITY WORK ★★

★★ 100% Satisfaction ★★

I will design flyer, brochure, postcard, leaflet design

- My self:

- I will create an attractive Brochure, E-brochure Bifold brochure, trifold brochure for your event, activity, occasion, product, business or promotion.

- My Survises:

I will design a professional brochure

I will design your unique Flyer | Poster | Post Card | Bifold Brochure | Trifold Brochure | Z-Fold Brochure | Booklet | Catalog | Brochure | Company Profile.

IN MY SERVICES