Traders dynamic index metatrader indicator services

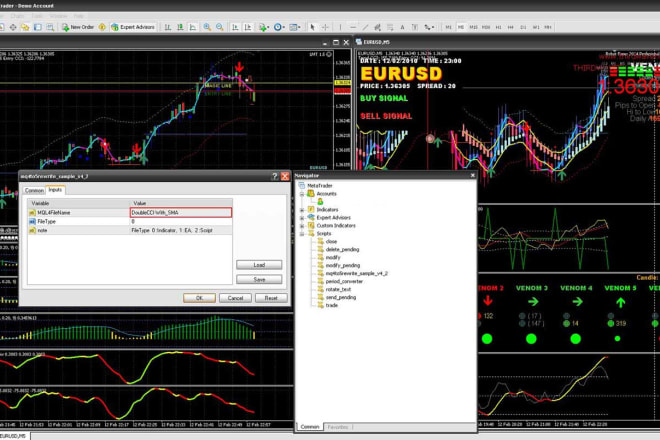

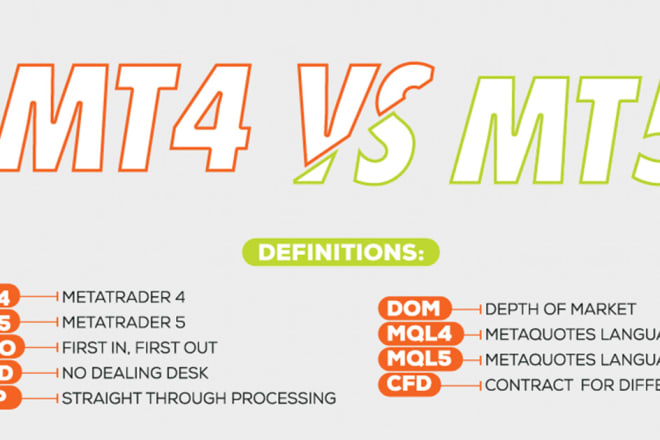

In recent years, the popularity of online trading has grown exponentially. With this increase in popularity has come a corresponding increase in the number of tools and services available to traders. One such service is the Traders Dynamic Index (TDI) Metatrader indicator. The TDI is a technical indicator that is designed to help traders identify market trends and make better trading decisions. The indicator is composed of three main components: the TDI indicator itself, the Traders Dynamic Index Signal Line, and the Traders Dynamic Index Histogram. The TDI indicator is calculated using a combination of price, volume, and momentum. The Traders Dynamic Index Signal Line is a moving average of the TDI indicator. The Histogram is used to identify when the TDI indicator is overbought or oversold. The TDI indicator is available for free on the Metatrader platform. There are also a number of paid services that provide the indicator as well.

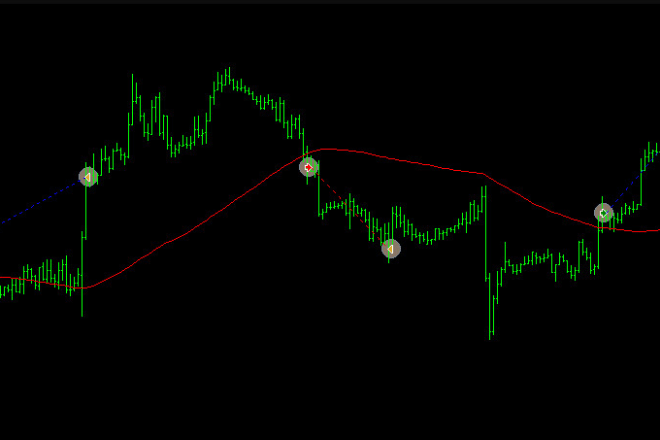

A trader's dynamic index (TDI) is a technical indicator that is used to help traders identify potential reversals in the market. The TDI is based on the Relative Strength Index (RSI) and the Moving Average Convergence Divergence (MACD) indicators.

Based on the information presented in the article, it appears that the Trader's Dynamic Index (TDI) Metatrader indicator is a reliable and useful tool for traders. It provides them with an easy way to monitor market conditions and make informed decisions about when to enter and exit trades. The TDI is also affordable and easy to use, making it a great choice for both beginner and experienced traders.

Top services about Traders dynamic index metatrader indicator

I will code errorless mql4 and mql5 indicators for metatrader mt4 mt5

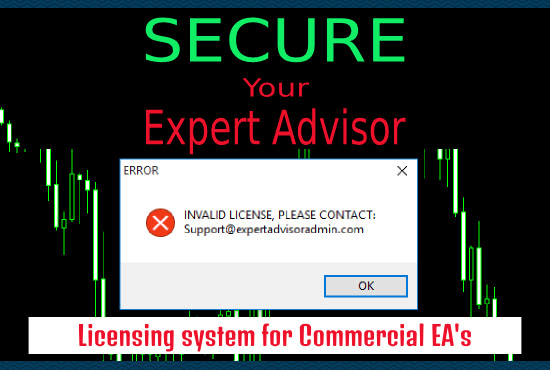

I will add or code licensing system to protect your mt4 indicator or ea

I will do mt4 mt5 indicator or expert advisor forex robot ea

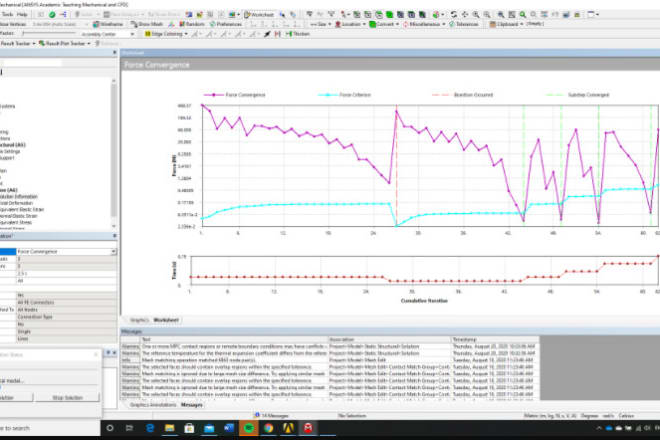

I will code mt4 mt5 custom indicator and ea trading bot mql

I will code a metatrader 4 mt4 mt5 indicator or expert advisor forex robot ea

I will code mt4 mt5 indicator or expert advisor forex robot ea

I will code mt4 forex trading bot expert advisor or indicator mql4

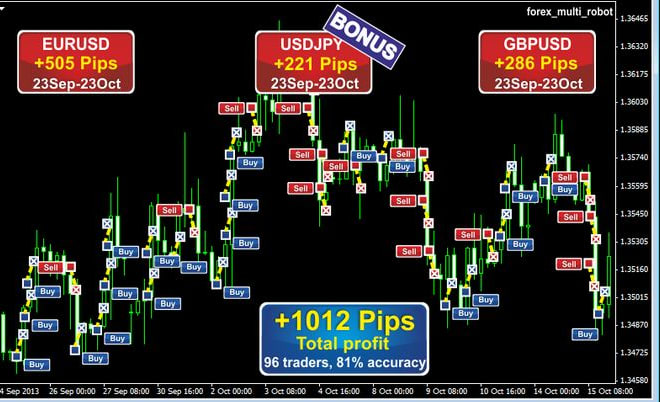

I will provide profitable forex trading bot, mt4 forex robot, forex ea robot

I will indicator traders dynamic index mt4 forex

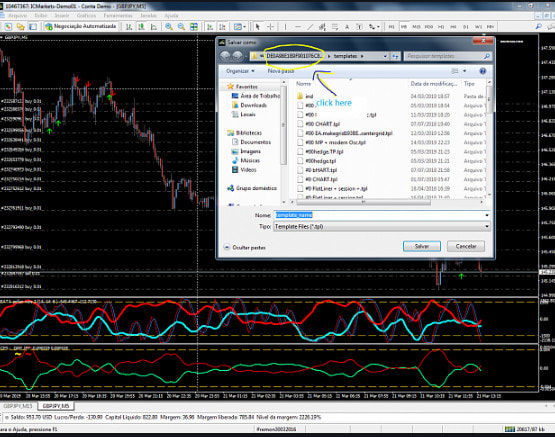

I will create mt4, mt5 indicator or expert advisor metatrader

I will do code for mt4 mt5 indicator or expert advisor for forex robot ea

I will code tradestation, ninjatrader, metatrader, tradingview,mt4,mt5 indicator

I will add license protection to your mt4 indicator or ea

I will add license protection to your mt4 indicator or ea

I will code a metatrader 4 mt4 indicator or expert advisor

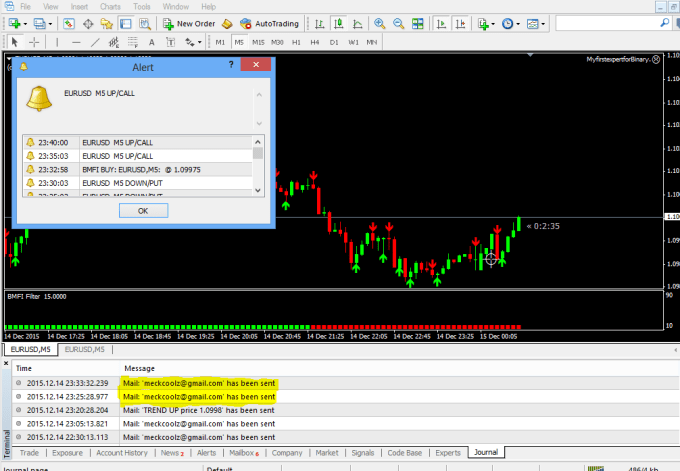

I will add email alert to your mt4 indicator

The email alert function is useful for trader's that do not want to be sitting and staring at the chart all day waiting for a signal to be generated.

I will add the email function to your existing custom metatrader4 indicator and also teach you the proper way to configure your mt4 terminal to send an e-mail notification.

All that is required from you to send the source code of the indicator you need the email alert added to and I will get the job done.

Order NOW!

I will create forex bot or indicator in mql4,mql5 or python ea

You can also order for

- Forex Robot

- Custom Indicator

- Expert Advisor

- Script