Trading robot software services

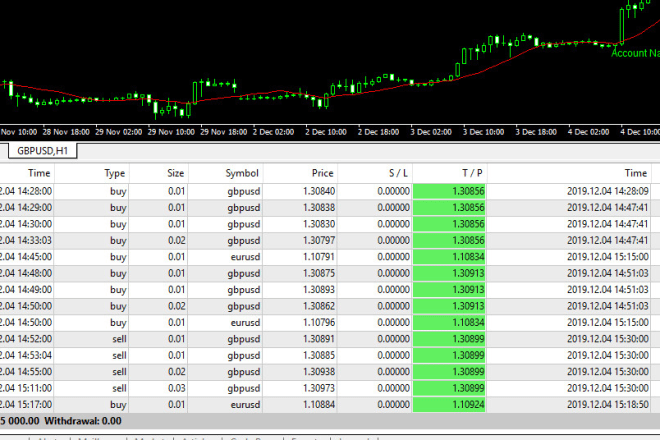

In recent years, trading robot software services have become increasingly popular among traders in the stock market. These services provide users with a platform to automatically trade stocks and other securities using algorithms. The purpose of this article is to provide an overview of trading robot software services and how they work. Trading robot software services use algorithms to automatically trade stocks and other securities. These services can be used by individuals or by institutions. Trading robot software services have become increasingly popular in recent years as they can provide a significant advantage to traders. There are a few different types of trading robot software services. The most common type is a market maker. Market makers provide liquidity to the markets by constantly buying and selling securities. This type of service is typically used by institutional traders. Another type of trading robot software service is a broker. Brokers provide a platform for individuals to trade stocks and other securities. This type of service is typically used by individual traders. Trading robot software services can provide a significant advantage to traders. These services can help traders make money in the stock market by automatically trading stocks and other securities.

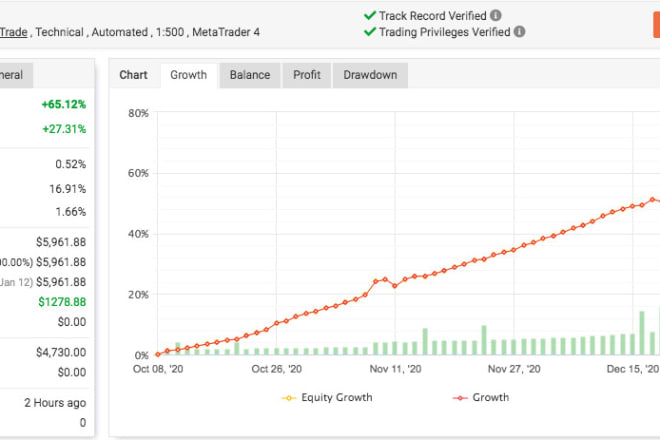

There are many different types of trading robot software services available on the market today. Some of the more popular ones include MetaTrader 4, TradeStation and NinjaTrader. These services allow users to trade automatically using pre-programmed trading strategies. Other popular services include eToro and Zulutrade.

In conclusion, trading robot software services can be a great way to trade automatically with little to no input from the trader. However, it is important to do your research and choose a reputable service provider who can offer a good track record and customer support.

Top services about Trading robot software

I will code a custom trading robot, ea for mt4 or mt5

I will give you profitable gold trading robot

I will give you high frequency professional trading robot

I will provide forex auto robot software,ea trading bot mt4

I will forex trading robot, profitable forex trading bot, mt4 ea

I will develop automated forex trading bot, mining bot, trading bot, crypto trading bot

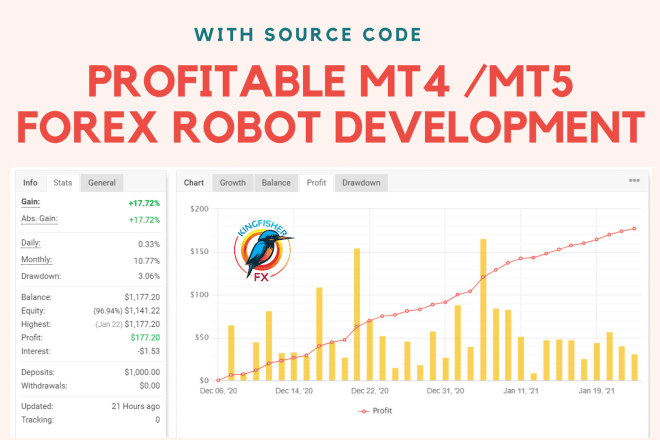

I will develop profitable mt4 mt5 forex ea robot expert advisor

I will provide accurate forex trading robot

I will forex trading, forex ea robot, forex bot, forex ea, forex robot

I will give to you my profitable forex trading robot, forex ea robot

I will offer high profitable forex robot, forex bot, forex trading bot, trading bot

I will give you a good ea scalping robotic for forex trading stock

I will create a trading robot expert advisor for metatrader 4

I will setup a no loss and high forex ea trading bot

I will develop bitcoin mining bot, gold trading bot, trading bot

I will give you the best automated trading robot