Trailing stop ea services

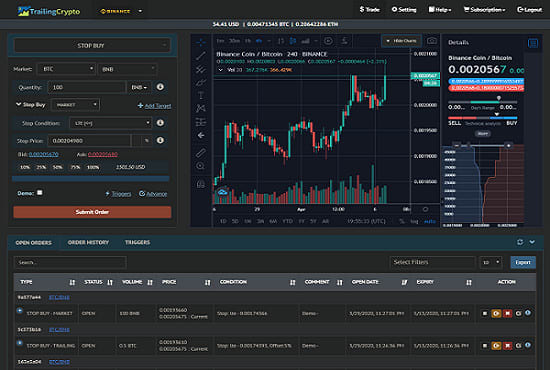

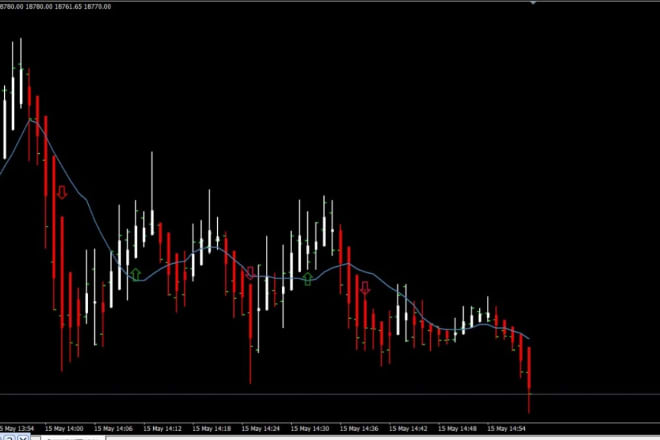

In today's fast-paced world, many investors are turning to trailing stop ea services to help them make the most of their money. A trailing stop ea is a type of software that helps investors keep track of their investments and make decisions about when to buy and sell. While there are many different types of trailing stop ea services available, they all share one common goal: to help investors make the most money possible.

A trailing stop is a type of stop loss order that is set at a certain percentage below the market price. For example, if you buy a stock at $100 and set a trailing stop of 10%, then your stop loss order will be set at $90. If the stock price falls to $90, your order will be executed and you will sell your shares.

There are many different trailing stop ea services available on the market, and it can be difficult to know which one to choose. However, by considering your needs and doing some research, you can find the perfect trailing stop ea service for your trading strategy.

Top services about Trailing stop ea

I will automate and errorless mql4 and mql5 indicators for metatrader forex robot ea

I will give auto sl tp ea for forex trading for mt4

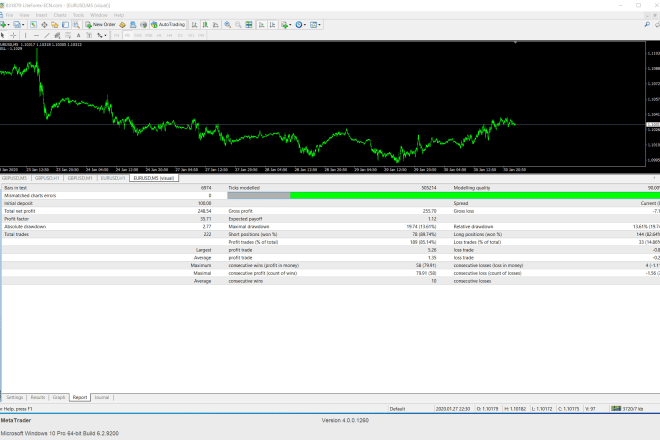

I will world best go profits accurate and cosistent ea with very low dd

I will do highly profitable mt4 ea with the forex ea metatrader 4

I will forex bot, forex ea, forex trading bot, crypto bot, mining bot, arbitrage bot

I will create ea for mt4

I will give you two forex trading robots

I will create indicator trading view, gunbot, cryptohopper, 3commas, crypto trading bot

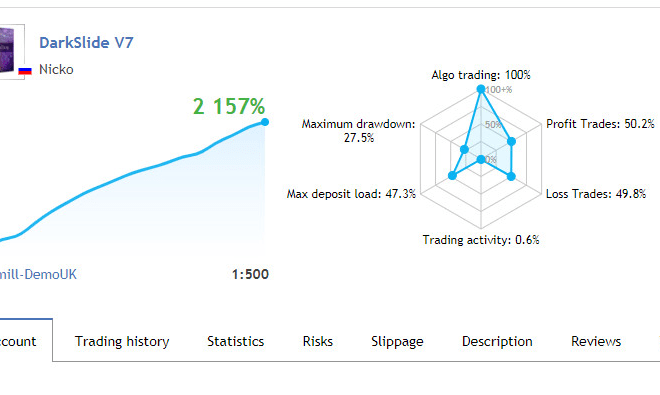

I will create a profitable trading bot, ea or indicator

I will create automated python trading bot for cryptocurrency on binance, coinbase pro

I will give mt4 programming service for mql4 for forex trading mt4

I will give guaranteed forex ea robot good

I will make any expert advisor and indicator in mt4