Trailing stop mt4 ea services

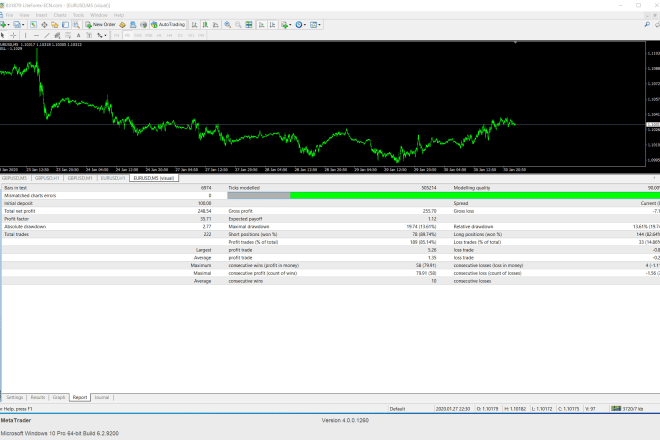

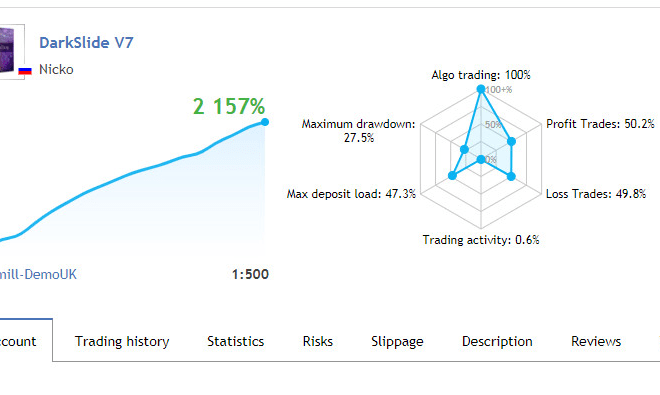

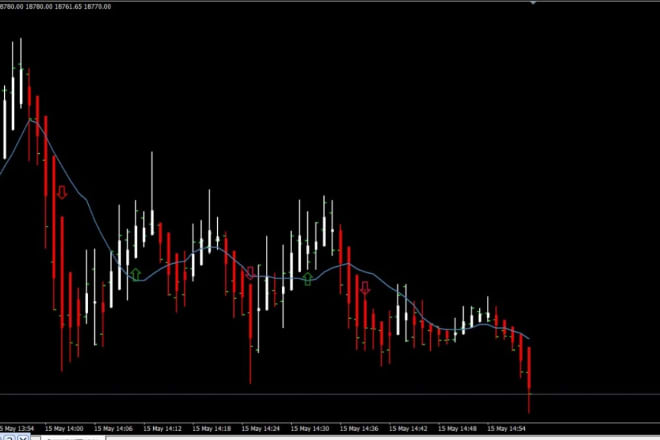

In recent years, the forex market has become more accessible to retail investors, and the use of Expert Advisors (EAs) has become more widespread. EAs are automated trading programs that can place and manage trades on behalf of the user. There are many different types of EAs available, and each has its own strengths and weaknesses. One type of EA that has become increasingly popular is the trailing stop EA. Trailing stop EAs are designed to protect profits and limit losses by automatically adjusting stop-loss levels as the market moves in favor of the trade. There are a number of different providers of trailing stop EAs, and it can be difficult to choose the right one. In this article, we will review some of the leading providers of trailing stop EAs and discuss the pros and cons of each.

Trailing stop orders are designed to protect gains by enabling a trade to remain open and continue to profit as long as the price is moving in the right direction. A trailing stop is a dynamic order that automatically adjusts to the changing price of the security. As the security's price changes, the trailing stop order moves with it, giving the security room to fluctuate.

Overall, trailing stop MT4 EA services can provide a helpful way to manage your trades and limit your losses. However, it is important to remember that these services are not infallible, and you should always do your own research to ensure that you are getting the best possible service for your needs.

Top services about Trailing stop mt4 ea

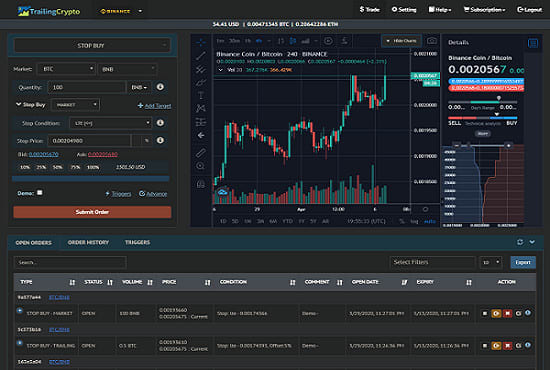

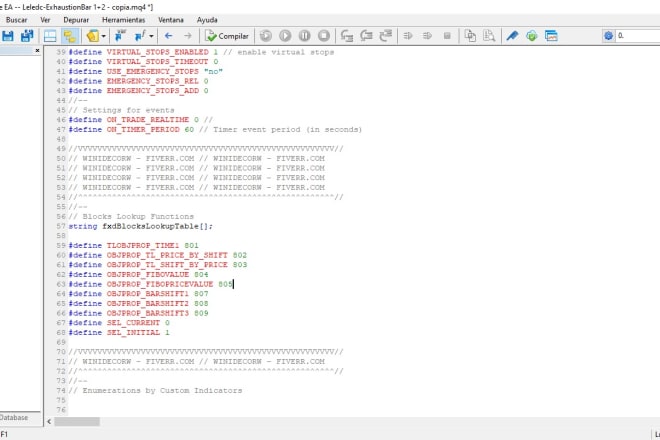

I will code mt4 mt5 forex robot expert advisor or indicator

I will give you an awesome mt4 metatrader 4 expert for advisor ea robot

I will create an expert advisor for mt4 or mt5 for you

I will code a metatrader mt4 indicator or expert advisor

I will create a profitable trading bot, ea or indicator

I will make forex ea and indicators development

I will code a metatrader mt4 indicator or expert advisor

I will create ea for mt4

I will give you two forex trading robots

I will give auto sl tp ea for forex trading for mt4

I will create indicator trading view, gunbot, cryptohopper, 3commas, crypto trading bot

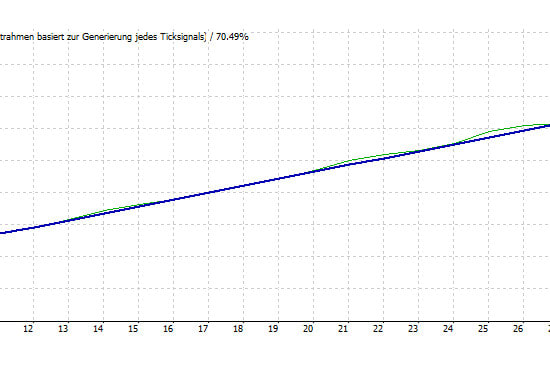

I will world best go profits accurate and cosistent ea with very low dd

I will create automated python trading bot for cryptocurrency on binance, coinbase pro

I will give mt4 programming service for mql4 for forex trading mt4

I will give guaranteed forex ea robot good

I will make any expert advisor and indicator in mt4