Triangular arbitrage binance services

In the world of cryptocurrency, there is always an opportunity for arbitrage. Triangular arbitrage is a type of trade that exploits the price differences of assets in different markets. When done correctly, triangular arbitrage can be a very profitable trade. Binance is one of the most popular cryptocurrency exchanges. They offer a variety of services, including triangular arbitrage. In this article, we will explain how Binance's triangular arbitrage works and how you can use it to make profits.

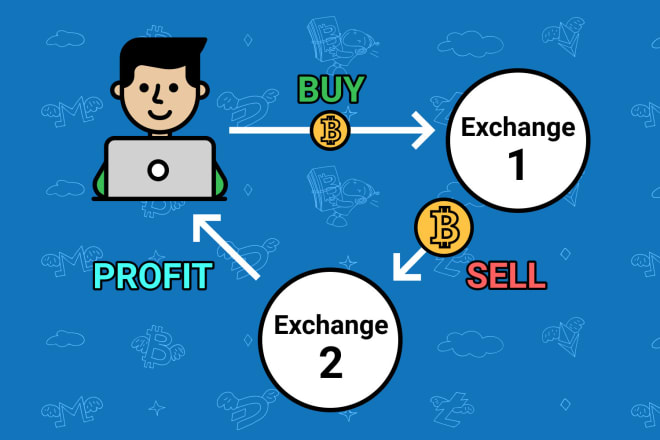

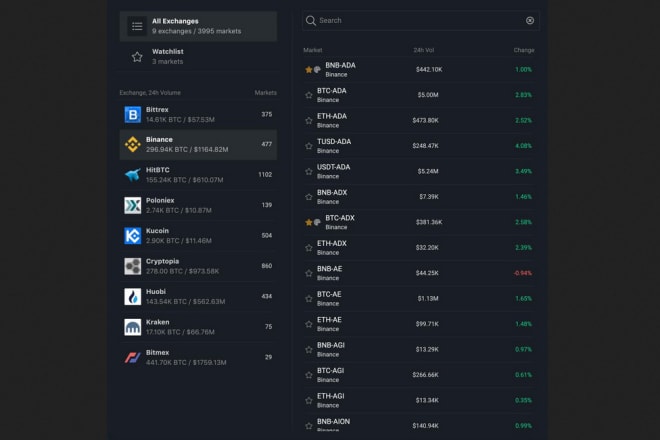

Binance is a digital asset exchange that provides a platform for trading various cryptocurrencies. As of January 2018, Binance was the largest cryptocurrency exchange in the world in terms of trading volume. Binance provides a variety of services including a triangular arbitrage service. This service allows users to take advantage of differences in prices between three different cryptocurrencies on Binance's platform. For example, if the price of Bitcoin is higher on Binance than on another exchange, and the price of Ethereum is higher on the other exchange than on Binance, a user could buy Bitcoin on Binance, trade it for Ethereum on the other exchange, and then trade the Ethereum back for Bitcoin on Binance, making a profit from the difference in prices.

The article discusses the advantages of using triangular arbitrage services on the Binance exchange. The triangular arbitrage strategy is a simple and effective way to make money in the cryptocurrency market. The article concludes that triangular arbitrage is a great way to make money on Binance, and that anyone interested in making money in the cryptocurrency market should consider using this strategy.

Top services about Triangular arbitrage binance

I will develop highly profitable cryptocurrency arbitrage trading bot

I will build crypto mining bot, crypto arbitrage trading, stock trading bot

I will build profitable crypto trading bot, arbitrage trading bot

I will forex trading bot, arbitrage trading bot, trading bot, forex ea trading bot

I will develop forex trading bot, arbitrage trading bot, forex

I will do forex trading bot, arbitrage, forex ea trading bot

I will build stock, tradingview, crypto, arbitrage trading bot

I will build making money with crypto arbitrage bot

I will forex trading bot, arbitrage trading bot, trading bot, forex ea automated bot

I will develop best forex trading bot, crypto trading bot

I will do forex trading bot, arbitrage trading bot, trading bot, forex ea trading bot

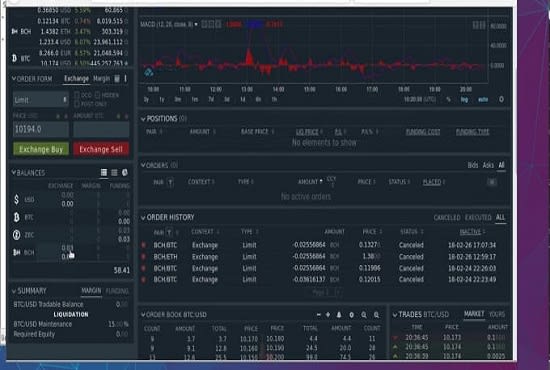

I will develop arbitrage,bitmex,binance,trading bot,bitcoin mining bot

I will provide you already made trading bot, bitcoin software, crypto forex binary bot

I will build crypto mining bot,cetx binance,crypto arbitrage trading,stock trading bot

I will crypto trading bot,forex ea bot,binance bot bitnex bot,binary bot,arbitrage bot