Us sales tax services

Sales tax is one of the most complex areas of tax law. There are literally thousands of sales tax rates in the United States, and they are constantly changing. Sales tax compliance is a burden for businesses of all sizes, but it is especially challenging for small businesses. The good news is that there are a number of sales tax services that can help businesses comply with the law. These services can help businesses file the correct return, calculate the correct tax, and remit the tax to the appropriate authorities. The best sales tax services will have a deep understanding of the law and will be up-to-date on the latest changes. They will also be able to help businesses manage their sales tax compliance on an ongoing basis. If you are a business owner, it is important to understand your sales tax obligations and to find a service that can help you meet them.

There is no federal sales tax in the United States, but there are sales taxes in some states. The sales tax rate varies by state, and some states have local sales taxes as well.

Overall, using a sales tax service can save you time and money by ensuring that you are correctly calculating and remitting your sales taxes. There are a number of different sales tax services available, so be sure to research and compare a few before choosing the one that is right for your business.

Top services about Us sales tax

I will file sales tax return for all US states

I will do US sales tax filings

I will help you get homedepot tax exempt all states the legal way

I will file your US sales tax returns

I will do book keeping, US sales tax registrations and US sales tax filings

I will get US tax returns 1040,1065,1120 preped and efiled by a US cpa

I will register llc and setup company in USA

I will give you a Sales Mini Course

Sales 2.0 refers to the integration of new technologies, sales models, processes, and mindsets resulting in a more efficient and effective sales team.

In our Sales 2.0 mini-course you will learn:

- What is Sales 2.0?

- Sales 2.0 Objectives

- Why Sales 2.0?

- Strategy

- Processes

- Resources

This is a video training course which outlines everything you need to have a Sales 2.0 sales system.

I will create sales playbooks, proposals, training, and processes

I will shopify sales funnel in webinar sales funnel in clickfunnel

I will boost your overall sales strategy

Sales strategy or sales consulting for your product or service is very important today. Sales today is not the same as it was yesterday, let alone years ago.

The sales game changes at quick speed. Partner with proven sales experts today that will deliver a winning sales strategy for your niche.

Crafting an effective sales strategy is essential for success. Most consider the sales strategy as an afterthought. However, sales focus must really be considered as the most crucial factor.

Without an effective sales strategy, you make success harder to obtain. Don't follow the crowd by just winging it, team up with proven experts that will deliver actual results.

It's not enough to have the best product in your niche, you need a winning sales strategy that differentiates from your competition.

Get a customized sales strategy from enterprising students working in combination with seasoned sales professionals. You can't beat that winning combo!

For $50, you get a basic outline of the best sales strategy for your niche.

Please see the gig extras

I will develop a highly converting internet marketing sales letter

You Want Quick Delivery!

I will deliver both!

A Great, Highly Converting sales letter or sales page can make or break your online marketing.

All the traffic in the world to a bad sales letter earns you nothing. Just a few visitors to an AWESOME sales letter is BANK!!!

I create Highly Converting sales letters and sales pages that give you More Customers and More Profit. Feel free to contact me about Custom Offers, those are my favorite!

Please note that the sales letter is in MS Word. It is content only, I don't do all the fancy html stuff or graphics. Just the most compelling and highly converting sales copy you will find on the fiverr!

I guarantee my work!! If you aren't madly in love with the sales letter, give me some feedback and I'll rewrite it until you love it!! See my many happy customers!

I will get you gym membership sales follow up templates

If you're commission based this will get you more sales and if you're salary you'll impress your boss and it'll translate into more dough for you.

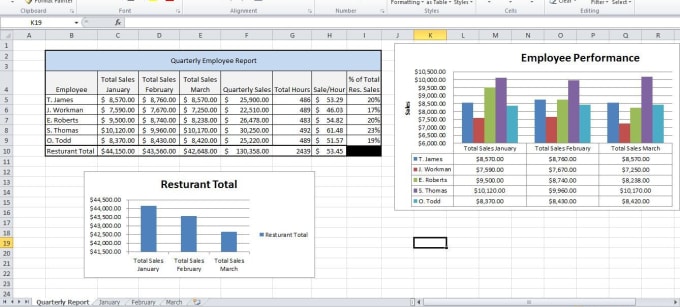

I will create a dashboard for tracking sales

• number of daily sales

• number of weekly sales

• performance of sales people

• progress in sales target

• predicting companies sales

If you want some thing else, lets Chat !!!

I will prepare analytical reports of sale purchase production etc

1. Monthly Sales Report (Qty & Amount)

2. Product wise Sales Report (Qty & Amount)

3. Customer Sales Report (Qty & Amount)

4. Area Wise Sales Report (Qty & Amount)

5. Sales Price Trend (Chart)

6. Salesman Sales Report

7. Product vs. Customer Sales Report

8. Product vs. Area wise Sales Report

9. Customer vs. Area Sales Report (Qty)

10. Other Customized Reports

I will provide you with surefire sales letter that sells your stuff

Get my professionally written SALES copy and enjoy all of your NEW leads and sales ...no matter what you sell!

ORDER NOW!