Virtual bank account paypal services

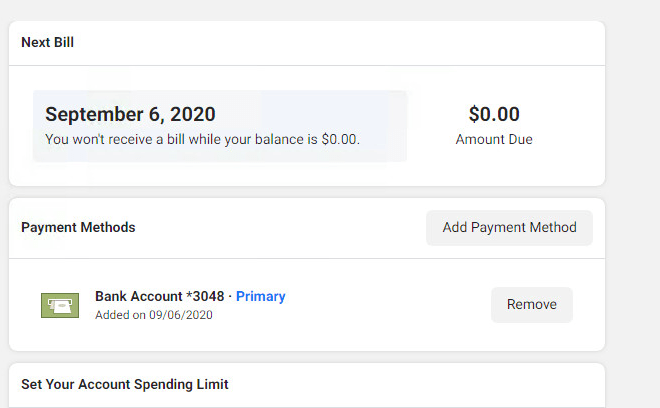

In today's world, more and more people are conducting their financial transactions online. This trend has led to the emergence of virtual bank accounts, which allow users to conduct transactions without having a physical bank account. PayPal is one of the most popular providers of virtual bank account services. PayPal allows users to send and receive money without revealing their personal financial information. PayPal also offers a variety of other features, such as the ability to set up recurring payments and to receive payments from other PayPal users.

A virtual bank account is an account that is not associated with a physical bank. Instead, it is an account that is held by an online service, such as PayPal. Virtual bank accounts can be used to send and receive payments, and to store funds.

Overall, using a virtual bank account with PayPal is a great way to manage your finances. You can easily keep track of your spending and income, and you can transfer money between your accounts with ease. Plus, you can use your virtual account to shop online, pay bills, and more.

Top services about Virtual bank account paypal

I will develop cryptocurrency wallet app and exchange platforms

I will be your virtual and trusted accountant with professional qualifications

I will registered company in UK

I will assist in bookkeeping using quickbooks online, xero, wave

I will work as your virtual assistant for 2 hours

I will do professional bookkeeping and data entry in quickbooks

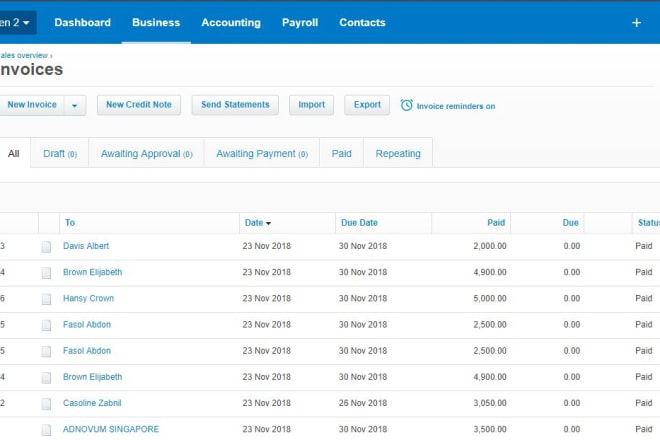

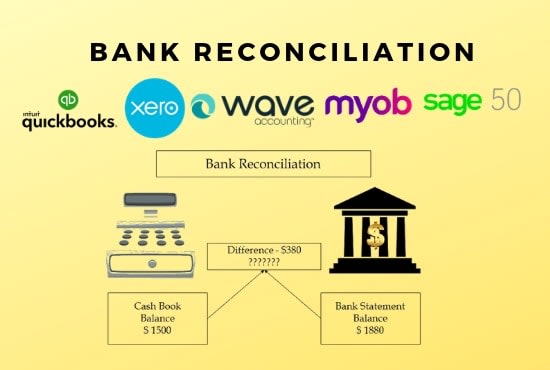

I will reconcile your paypal, bank cards, bank statements

I will integrate paypal, paypal express, securepay in wordpress

I will do reconciliation from paystub, paypal, zelle, quickbooks bank statement

I will handle your business in a professional way

I will help you receive payment via mpesa and paypal

I will create gojek clone apps

I will skyrocket gofundme, indiegogo, kickstarter crowdfunding campaign promotion

I will develop a bank app,cash app,loan app like paypal, payooner

I will develop money transfer app, cash app, wallet app,bank app, payment app