Virtual cfo ppt services

In today's business world, the role of the CFO is more important than ever. But with the demands of the job, it can be difficult for CFOs to find the time to do everything that's expected of them. That's where virtual CFO services come in. Virtual CFOs can provide the same services as an in-house CFO, but without the full-time commitment. This can be a great solution for businesses that can't afford to hire a full-time CFO, or for CFOs who want to outsource some of their work. There are a few things to keep in mind when considering virtual CFO services. First, make sure you find a reputable provider. There are a lot of fly-by-night operations out there, so it's important to do your research. Second, be clear about what services you need. Virtual CFOs can provide a wide range of services, from financial planning and analysis to bookkeeping and taxes. Make sure you know what you need before you start shopping around. Finally, don't be afraid to negotiate. Virtual CFO services can be expensive, so it's important to make sure you're getting a good value for your money. If you're looking for a way to free up your time and get the financial help you need, virtual CFO services may be the answer. Just make sure you do your homework and find a reputable provider.

A virtual CFO is a finance executive who provides strategic and financial guidance to businesses on a contract basis. They work with businesses to develop financial plans, manage cash flow, and reduce costs. Virtual CFOs also help businesses to secure financing and make investment decisions.

There are many benefits to using a virtual CFO, including saving money on costs associated with hiring a full-time CFO, having more flexibility and control over your finances, and gaining access to a wider range of financial expertise. If you are considering using virtual CFO services, be sure to research different providers to find one that best suits your needs.

Top services about Virtual cfo ppt

I will do virtual staging, virtual furniture

- Virtual staging for empty homes

- Virtual furniture replacement

- Virtual room enhancement

I will be your administrative personal virtual assistant

I will provide virtual staging service professionally

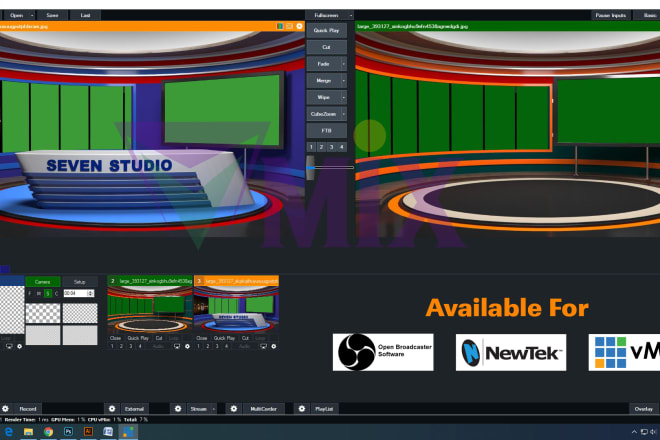

I will do 4k virtual set,and 3d model of virtual studio

I will be your dedicated virtual assistant

I will be your virtual assistant with prompt service

I will build fully custom virtual tour

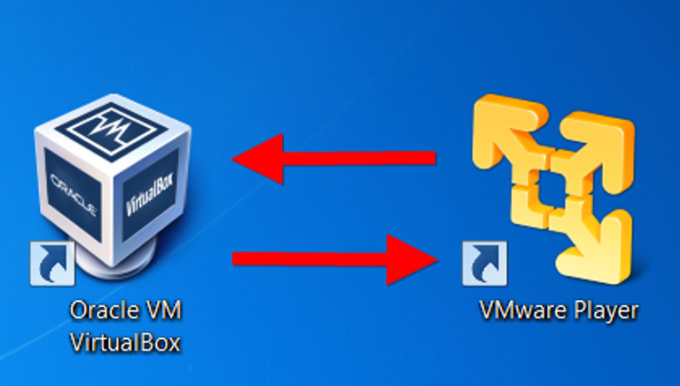

I will install virtual machine on virtual box, vmware, amazon ec2

1 VM = 1 GIG

I will work as a virtual assistant, research, data entry and mining