Withdraw balance services

In recent years, many banks and credit card companies have started offering balance withdrawal services. This service allows customers to withdraw cash from their account without having to go through a teller or an ATM. This can be a convenient way to get cash when you need it, but it's important to understand the fees associated with this service before you use it. In this article, we'll discuss the fees associated with balance withdrawal services and how to avoid them.

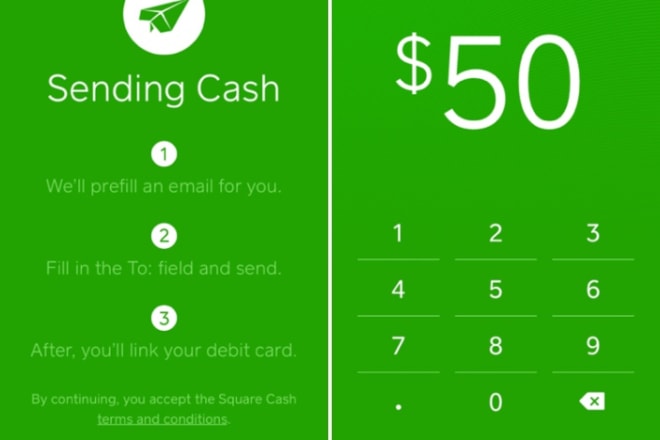

There are many ways to withdraw money from a balance service. The most common way is to use an ATM or debit card. Other ways include using a check, using a credit card, or using a PayPal account.

In conclusion, balance withdrawal services can be a great way to access your money when you need it, but it is important to be aware of the fees associated with these services. Be sure to shop around and compare rates before choosing a balance withdrawal service to ensure you are getting the best deal possible.

Top services about Withdraw balance

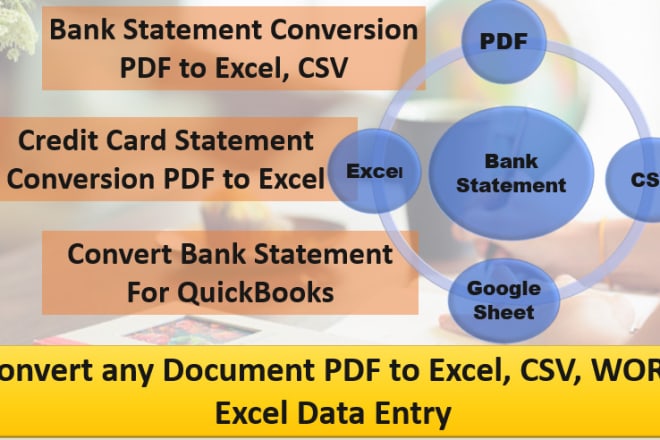

I will convert statements from PDF to excel

I will prepare bank reconciliation statement and bookkeeping

I will develop a complete multi vendor ecommerce website in PHP

I will prepare final statement for debit card and credit card

I will do high earning trading bot, forex trading bot

I will do bank statement or credit card reconciliation with quickbooks

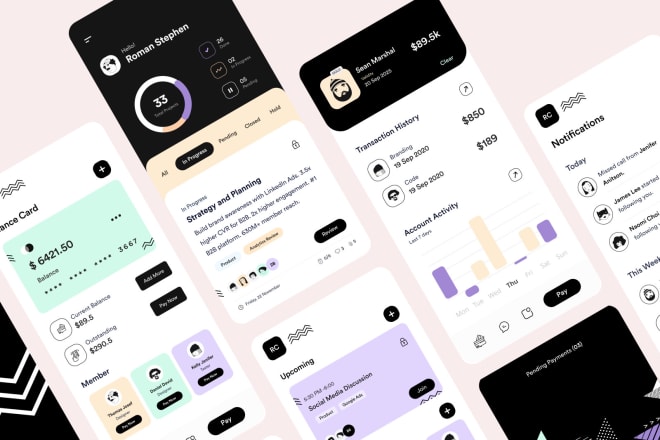

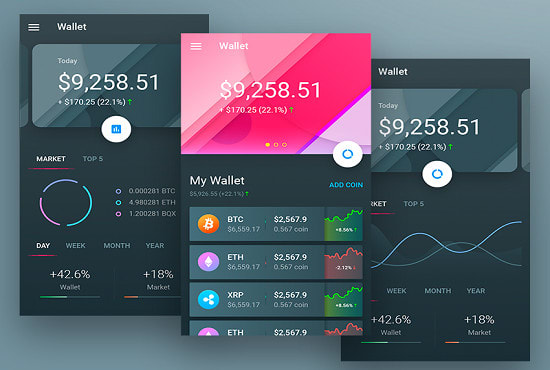

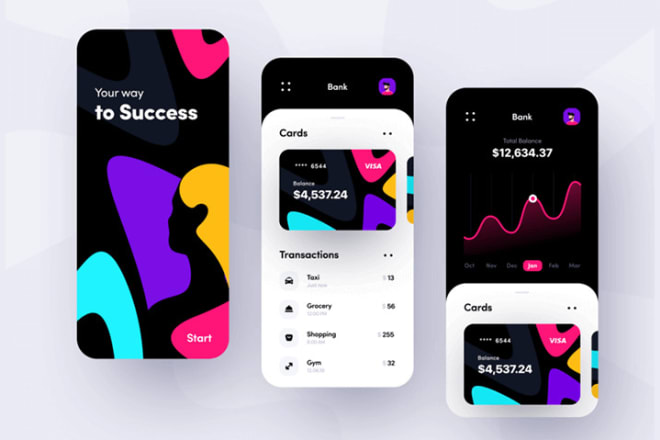

I will build crypto wallet, wallet app, cash app and bank app

I will convert bank statement PDF to excel, CSV, google sheet

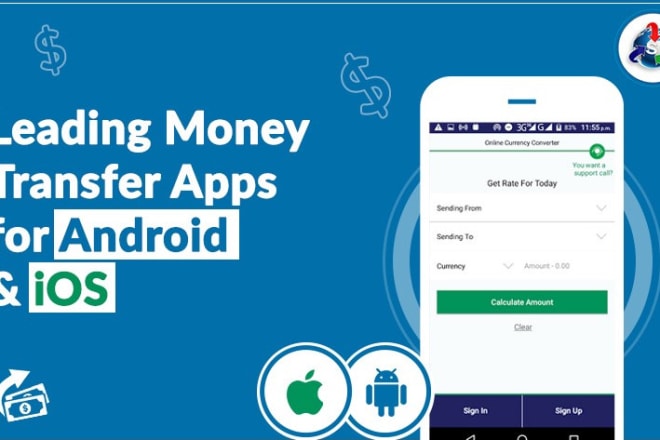

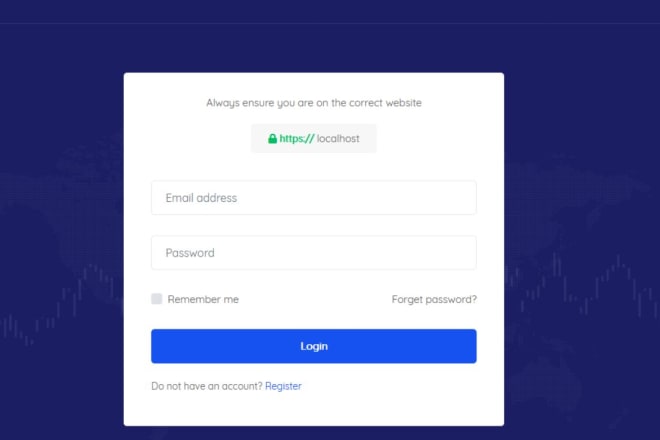

I will develop money transfer app, cash app, wallet app,bank app, payment app

I will build cash app, money transfer app, bank app, loan app

I will develop cash app, money transfer app, bank app, loan app

I will create cash app, money transfer app, bank app, loan app

I will build transaction cash app, wallet app, loan app, bank app

I will build a cash app, wallet app, payment app, bank app for you

I will develop cash app, loan app, bank app, transfer, payment app

I will build cash app, wallet app, payment app, bank app, loan app for you

I will build you a site like paypal