Withdraw from paypal services

If you're looking to withdraw from PayPal services, there are a few things you need to know. First, you'll need to have a balance in your PayPal account. If you don't have a balance, you can't withdraw any funds. Second, you'll need to choose a withdrawal method. There are two withdrawal methods available: bank transfer and check. Bank transfer is the quickest and easiest way to withdraw funds from your PayPal account. Check is a bit slower, but it's still a fairly easy process. Finally, you'll need to provide some basic information, such as your name, address, and date of birth. Once you have all of that information, you can begin the withdrawal process.

In order to withdraw from PayPal services, you will need to contact PayPal directly and request to have your account closed. Once your account is closed, you will no longer be able to use PayPal to send or receive payments.

In conclusion, if you are considering withdrawing from PayPal services, there are a few things you should keep in mind. First, make sure you have a backup plan for your payments. Second, remember that PayPal may keep your account information on file, so you may need to contact them to have it removed. Finally, keep in mind that withdrawing from PayPal could affect your credit score.

Top services about Withdraw from paypal

I will develop directory website,classified and multi vendor ecommerce marketplace site

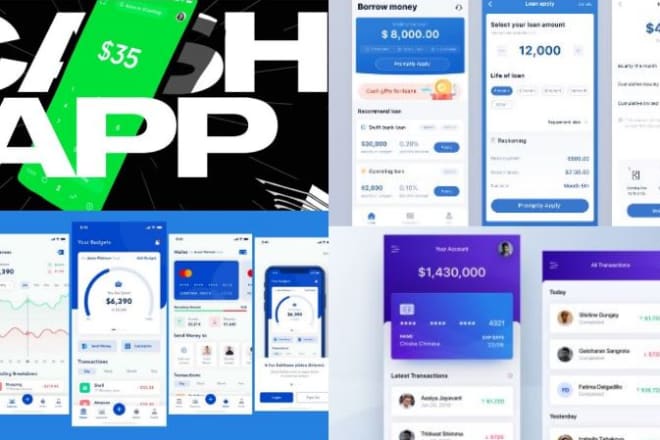

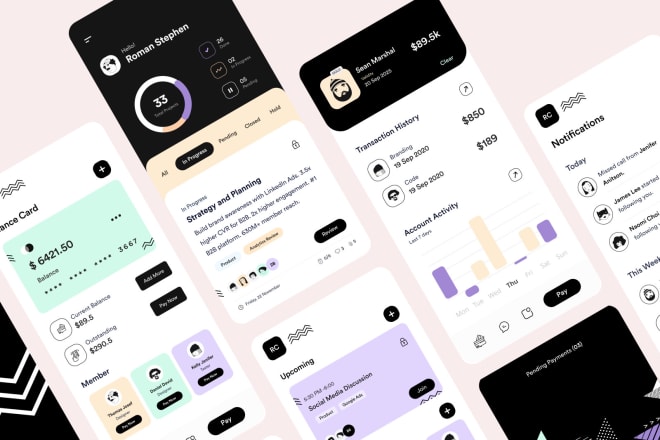

I will build cash app,bank app,loan app,payment app,transfer app

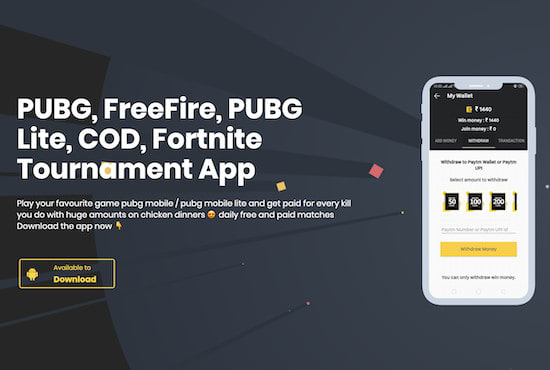

I will setup tournament app like battlegame

I will build cash app,bank app,loan app,payment app,online money transfer app

I will develop hotel payment wallet app for you

I will build you a site like paypal

I will design and develop MLM software and website

I will develop money transfer app, cash app, wallet app,bank app, payment app

I will provide u bank to remove paypal limits and withdraw funds

I will provide USA bank to remove paypal send withdraw limits

I will develop cash app, money transfer app, bank app, loan app

I will create cash app, money transfer app, bank app, loan app

I will build transaction cash app, wallet app, loan app, bank app

I will integrate paypal with your woocommerce

I will do paypal integration and solve paypal payment issues