Withdraw money services

In the United States, there are two main types of withdrawal methods for taking out money from a financial institution: through an ATM or through a teller. Each has its own benefits and drawbacks, so it's important to understand the difference before deciding which is right for you. ATMs, or Automated Teller Machines, are machines that dispense cash and accept deposits without the need for a teller. They're usually located inside a bank or credit union, but can also be found in other locations like grocery stores or gas stations. The main benefit of using an ATM is that it's convenient and available 24/7. However, there are some drawbacks. For example, you may be charged a fee for using an out-of-network ATM, and there's always the risk of your card getting lost or stolen. Tellers, on the other hand, are bank employees who handle transactions like withdrawals and deposits. The main benefit of using a teller is that you can talk to someone if you have any questions or problems. However, tellers are only available during business hours, so if you need to withdraw money outside of those hours, you'll need to use an ATM.

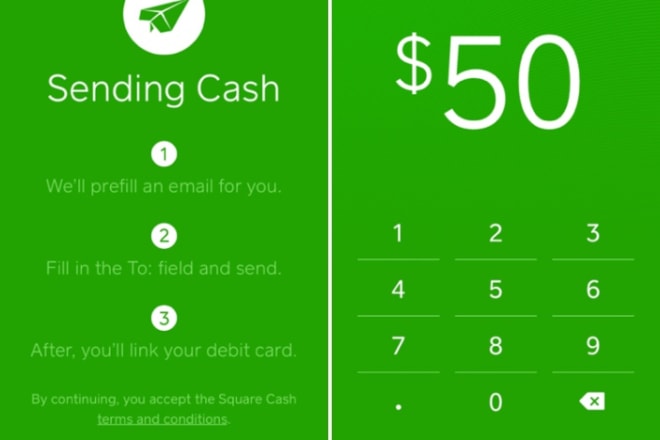

There are many ways to withdraw money from services. The most common way is to use an ATM, which is a machine that dispenses cash. Other ways include using a teller at a bank, or using a service such as PayPal.

The article concludes that the best way to withdraw money from services is to use an ATM or a debit card.

Top services about Withdraw money

I will deposite withdraw website real money

I will develop money transfer app, cash app, wallet app,bank app, payment app

I will build cash app, money transfer app, bank app, loan app

I will create cash app, money transfer app, bank app, loan app

I will develop cash app, money transfer app, bank app, loan app

I will build transaction cash app, wallet app, loan app, bank app

I will build a cash app, wallet app, payment app, bank app for you

I will develop cash app, loan app, bank app, transfer, payment app

I will build cash app, wallet app, payment app, bank app, loan app for you