Withdrawal methods services

There are many ways to withdraw money from a bank account. The most common are through an ATM, by writing a check, or by making a withdrawal at a bank teller window. There are also other methods, such as by phone or online. ATMs are the most convenient way to withdraw money, as they are available 24 hours a day, 7 days a week. They can be found in most public places, such as grocery stores, gas stations, and malls. To use an ATM, one must have a bank card and know their PIN number. Writing a check is another way to withdraw money from a bank account. To do this, the account holder must fill out a withdrawal slip and write the check out to themselves. They then take the check to a bank teller, who will give them the cash. Making a withdrawal at a bank teller window is similar to writing a check, but the account holder does not need a withdrawal slip. They simply tell the teller how much money they would like to withdraw and the teller gives them the cash. There are also other methods of withdrawing money from a bank account, such as by phone or online. These methods are typically used by people who do not have a bank card or who do not know their PIN number.

There are a few different ways to withdraw money from services, the most common being through a bank or credit card. Other methods include using an online service such as PayPal, or through a check.

The most important thing to remember when choosing a withdrawal method is to pick one that is safe and reliable. There are many different withdrawal methods available, so be sure to do your research before making a decision. Withdrawal methods include PayPal, wire transfer, check, and debit card.

Top services about Withdrawal methods

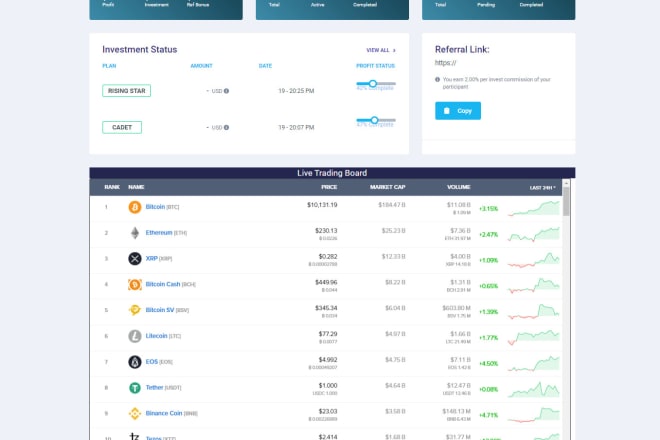

I will develop an investment website and platform with reviews

I will tell you all the ways to earn money online without hard work

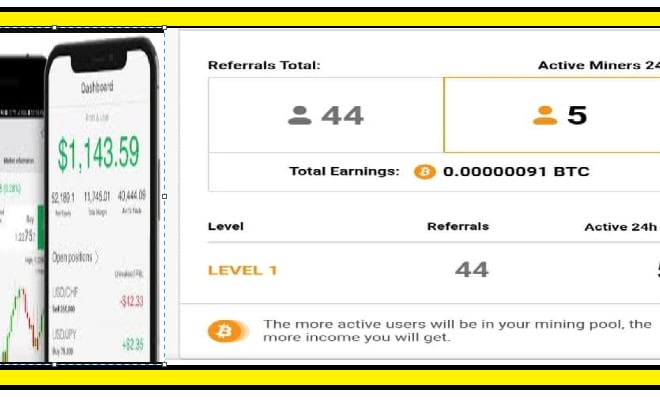

I will develop a bitcoin mining bot with easy withdrawal

I will build a standard forex ea trading bot with auto withdrawal

I will create a pay per click PTC website for you

I will develop a daily profitable no withdrawal fee mining bot, mining software

I will show you how to make money online in 48 hours

I Will teach you step by step how to make $150 in 48 hours from scratch and $21,500 in 30 days.

I will show you 5 different money making methods ranging from internet marketing to selling products online.

Any of these 5 methods can make you plenty of money.

This is a method that 99% of you will probably never even heard of.

Method 1: $150 in 48 hours.

This is an unbelievably easy strategy to earn money via

paypal the same day completing really simple offers!

(NOT PTC, Click For Pennies, or Signing up to Our Affiliate Offers, NO NO NO)

Perfect for newbies and anyone just needing quick cash.

Method 2: Physical Product Riches.

Method 3: Youtube Marketing

Method 4: Profiting With Services

Method 5: Providing a Solution

( I invite you to discover the rest )

Any of These 5 Methods Alone Can Make YOU Easy Money!

However, we know that not everyone has the same level of experience online,

that's why we've included 5 different methods of making money.

So that there's something for everybody.

Some methods can make money as fast as 24 hours!

- Oh, and I almost forgot..

I will build a freelancing marketplace website like freelancing

I will do spiritual readings, predictions and white magic