Withdrawing money services

Many people rely on cash machines (ATMs) to get cash when they need it. ATMs are convenient because they are usually available 24 hours a day, 7 days a week. However, some people have had problems with ATMs. For example, they may have been charged hidden fees, or their card may have been “eaten” by the machine. In this article, we will look at some of the problems with ATMs and how to avoid them.

There are a few ways to withdraw money from services, the most popular being through an ATM or by using a debit card. There are also a few other methods, such as through a check, money order, or by wire transfer. When using an ATM, you will need to have your card and PIN number. For a debit card, you will need to have your card and the amount of money you would like to withdraw.

As of July 1st, 2018, financial institutions will no longer be able to offer withdrawal services to non-account holders. This change comes as a result of new regulations from the Financial Consumer Agency of Canada (FCAC). The FCAC is concerned about the high fees that non-account holders are charged for these services, and wants to protect consumers from being overcharged. While this change may be inconvenient for some, it is important to remember that there are many other ways to access cash. For example, most retailers offer cash back services, and there are also many ATMs located around the city. With a little planning, everyone can still access the cash they need without having to pay high fees.

Top services about Withdrawing money

I will deposite withdraw website real money

I will develop cash app, bank, loan and money transfer app with web

I will build crypto mining bot, crypto arbitrage trading, stock trading bot

I will create a premium crypto game app, wallet game app

I will develop a crypto game mobile app, crypto game website, game development

I will develop a crypto game website, crypto game mobile app, game development

I will send you powerful money reiki healing

I will provide bestseller ebook affiliate marketing leader and you can resell free

I will cast a powerful money spell to make you very rich

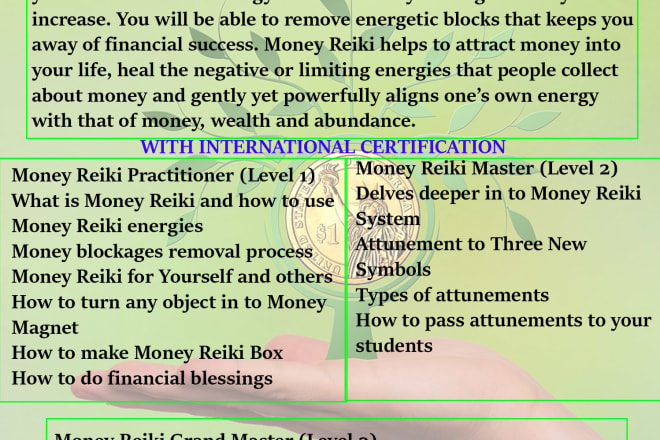

I will complete money reiki ecourse with attunement and certificate