Forex risk management plan services

When it comes to Forex trading, risk management is key. Without a proper risk management plan in place, your Forex trading can quickly become a losing proposition. There are a number of Forex risk management plan services available, and choosing the right one can mean the difference between success and failure in the Forex market. In this article, we'll take a look at some of the things you should look for in a Forex risk management plan service.

There is no one-size-fits-all risk management plan for forex traders, but there are some commonalities among successful plans. A good forex risk management plan should take into account the trader's risk tolerance, account size, and trading goals. It should also include a plan for how to deal with losing streaks and drawdowns.

When it comes to forex risk management plan services, there are a lot of different options out there. It can be difficult to know which one is right for you, but it is important to do your research and find a service that fits your needs. A good forex risk management plan service will help you to make informed decisions about your trades, and will also help to protect your capital.

Top services about Forex risk management plan

I will help you develop a trading strategy that will suit your personality

I will increase your Profits with Forex Strategies

I will provide trading plan in video guide

I will do cost and management accounting work

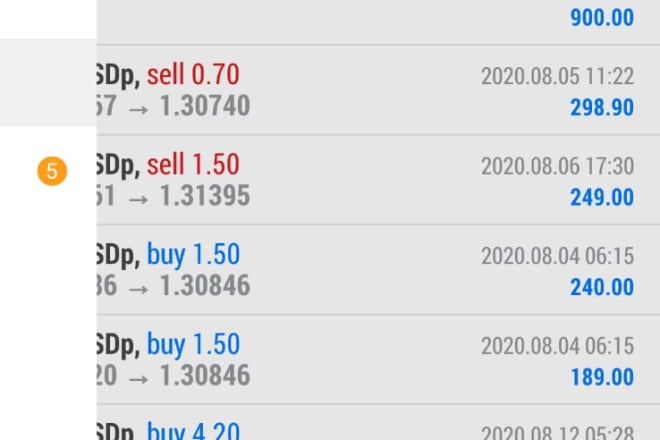

I will trading with profit and low risk

I will manage your fx account and make you daily profit with tight risk management plan

I will give you risk management plan for forex

I will give you top forex trading strategy

I will do the best forex account management service

I will grant you higly guaranteed profitable forex trading ea robot

I will help in performing all activities related to project management

I will do forex account management service

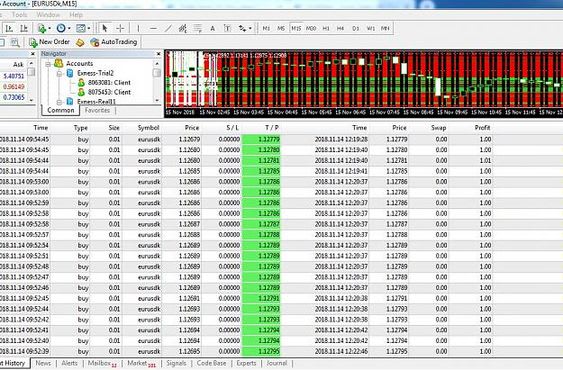

I will high profitable ea forex robots trading metatrader

I will be your one on one profitable forex mentor

I will give you a 85 accuracy indicators for forex

I will provide a forex account growth plan to grow 50 dollars to 50k

New to Forex Trading? This Seed Strategy is a tool that helps you to discover the power of trading in the 6.6 Trillion dollar marketplace. In order to become a profitable trader, it is important to have an educational plan and a good trading strategy and account management plan

Basic

- The Basic Gig offers a 60 day strategy for you. shows you how you can systematically grow your trading account from as little as $50 to 10K in as few as 60 days using proper risk management. You can use whatever starting balance you like and the tool will customize a plan for you.

Standard

- The Standard Gig offers a 90 day plan for you. Based on $50 starting balance your 90 day plan could grow to over $1,000,000.00

- PLUS to help you catch pips I will connect you to a FREE FOREX SIGNAL CLUB.

- You will also receive an interactive 90 day profit journal where you can track your daily progress. (Fast Start Video Training - NOT INCLUDED WITH STANDARD)

Premium

- The Premium Gig offers the 90 day plan & everything that the standard gig offers PLUS it includes a "SEED STRATEGY FAST START TRAINING VIDEO"