Visor taxes services

In the United States, the federal government taxes many different types of business entities, including sole proprietorships, partnerships, corporations, and limited liability companies. One of the key tax considerations for any business entity is how it will be taxed on its income. The tax rate that a business entity pays on its income can have a significant impact on its overall profitability. The federal government taxes business entities on their income at different rates. The tax rate that a business entity pays on its income can have a significant impact on its overall profitability. Sole proprietorships, partnerships, and corporations are taxed differently than limited liability companies. Limited liability companies are taxed as pass-through entities. This means that the income of the limited liability company is taxed at the individual tax rates of the owners. The individual tax rates can be as high as 39.6 percent. Sole proprietorships, partnerships, and corporations are taxed at the corporate tax rate of 21 percent. The corporate tax rate is a flat tax rate. This means that all businesses that are taxed as corporations pay the same tax rate on their income. The tax rate that a business entity pays on its income can have a significant impact on its overall profitability. This is why it is important for business owners to understand the different tax rates that apply to their business entity.

There is not much to know about visor taxes services. They are a company that provides tax services to businesses and individuals. They are based in the United States and have been in business since 2001. They offer a variety of services, including tax preparation, tax planning, and tax resolution.

In conclusion, it is clear that the government is committed to providing quality services to its citizens. However, it is also clear that the government is not immune to criticism. In particular, the government's decision to impose taxes on services has been met with criticism from some quarters. Nonetheless, it is important to remember that the government is elected by the people and, as such, is accountable to them.

Top services about Visor taxes

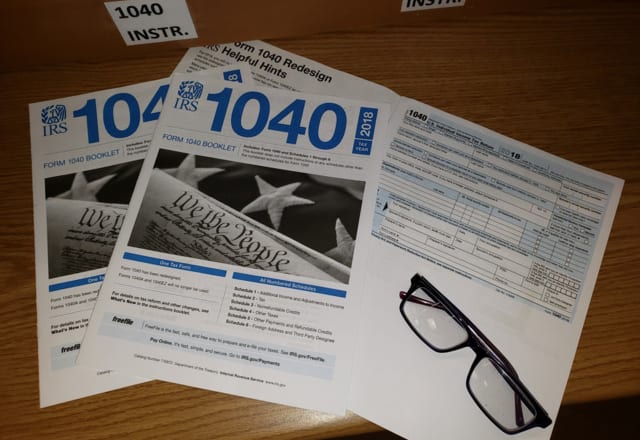

I will minimize your US tax filings 1040 1065 1120 returns

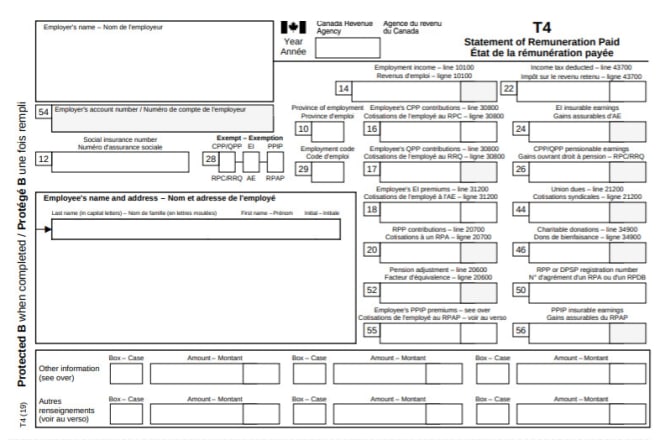

I will do your payroll taxes and prepare t4 slips

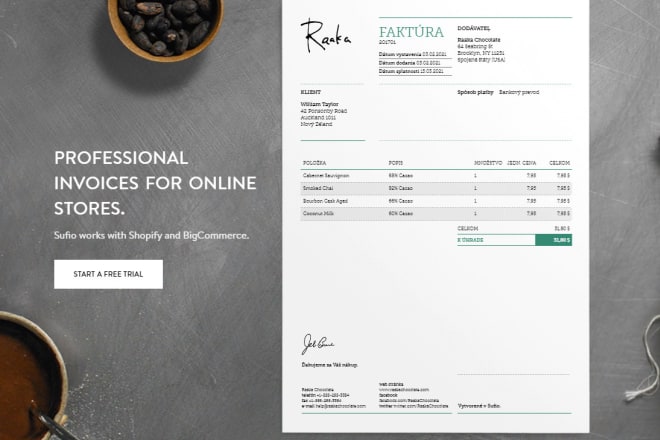

I will set up taxes in your shopify store and provide tax advice

I will provide us cpa services for usa tax filings for individuals, llcs, c and s corp

I will prepare your USA personal and business income tax returns

I will be your trusted CPA and tax advisor

I will do USA property taxes search for you

I will do taxes for freelancers, internet services and cryptocurrency operations in arg

I will send 1600 PLR Articles on Forex, Trading, Taxes and Stocks

Also as a $5 Extra we provide 55-60 High Quality STOCK IMAGES (free to use for commercial purpose) on Forex, Trading and Stocks to accompany this Pack !

This PLR pack contains articles on the following -

- Forex

- Currency Trading

- Investing

- Taxes

- Stocks

Here are few sample Topics -

- 7 Reasons To Start Trading On The Forex Currency Market

- Finding Spectacular Gains From Forex And Shares

- A Cooling Real Estate Market and Investing in Preforeclosures

- An Overview Of Forex Investing Strategies

Each Article is approx 300~1000 words long .You are free to modify, edit and use these articles as per your requirements .Bundled with loads of quality information this Pack will help create valuable content for your website, blogs , social media etc.

All Articles have High Keyword Density and are SEO optimized .

Do check out my Extras for some great offers . Feel free to ask me any questions I am here 24*7 , will immediately resolve queries . Look forward to working with you soon .

ORDER NOW ! Express 24hr Delivery service !

I will be your bookkeeping assistant

I am expert and qualified Chartered Accountant , having 9 years of bookkeeping, financial services, administration and consultancy work experience. I have expert level skills for filing annual returns, sales taxes, payroll taxes, withholding, UI (CA) and SDI (CA. USA).

I can :

> Prepare your sales/ purchase reports (As per required period)

> I can guide you to excel the receivables, solution of payable and capital budgeting

> Prepare Financial Reports

> Payroll Management for your business / businesses and all companies (Wages plans etc)

> Prepare your business Cash flow statement

> Consult in investment

> Provide you perfect NPV plans etc.