Hmrc rt01 services

The HMRC RT01 services is a free online service that helps you to complete your Self Assessment tax return. The service is available to any UK resident who is self-employed, including those who are sole traders, partners in a business, or a director of a company. The service is also available to those who are self-employed and have a UK income from other sources, such as renting out property. The service is easy to use and you can complete your return in just a few minutes. You will need to provide your basic personal details, such as your name and address, and your National Insurance number. You will also need to provide details of your self-employment income and any other income you have received. The service will then calculate your tax bill and send you a payment request. If you are a self-employed individual, the HMRC RT01 services is an essential tool to help you meet your tax obligations. The service is quick and easy to use, and will save you time and money.

The HMRC RT01 services is a set of tools and services that can help businesses with their tax affairs. It includes online filing, payment and registration services. The HMRC RT01 services can help businesses save time and money on their tax affairs.

The HMRC RT01 services is a great way for businesses to keep track of their taxes. It is a simple and efficient way to ensure that businesses are up to date with their tax information. This service is reliable and easy to use, and it is a great resource for businesses of all sizes.

Top services about Hmrc rt01

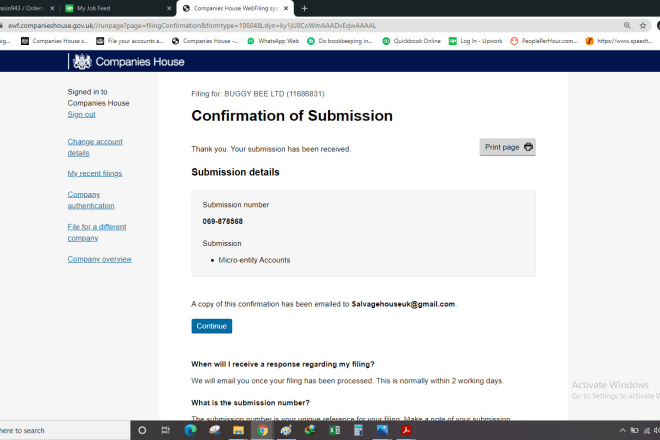

I will file UK accounts with companies house, vat filing with hmrc

I will prepare UK company accounts, file to companies house, hmrc

I will prepare UK accounts and file tax returns with hmrc

I will prepare UK annual accounts and corporation tax return

I will complete your self assessment tax return

I will prepare and file UK company year end accounts to companies house and hmrc

I will do UK bookkeeping, vat return in quickbooks, xero, sage

I will prepare and file UK company year end accounts to companies house and hmrc

I will do UK tax consulting, vat returns and hmrc filling