Dormant accounts hmrc services

If you have a dormant account with HMRC – that is, you haven’t paid any tax on it for a while – you may be able to get some help with your tax affairs. HMRC’s Dormant Accounts team can help you get your affairs in order and make sure you’re up to date with your tax.

If you have a dormant account with HMRC, you may be able to claim certain tax benefits. For example, if you have a dormant account with HMRC, you may be able to claim certain tax benefits.

The number of people using HMRC services has been increasing over the last few years. However, there are still a significant number of people who have dormant accounts with HMRC. This is a problem because it means that people are not using the services that they are paying for. It is important for HMRC to address this issue so that people can get the most out of their services.

Top services about Dormant accounts hmrc

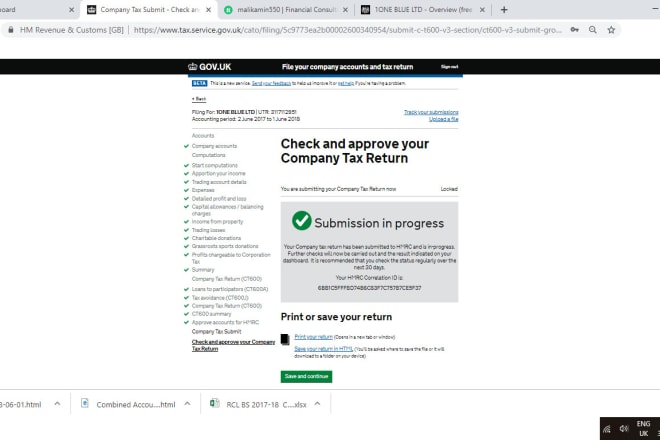

I will prepare UK company accounts and corporation tax return

I will do UK tax consulting, vat returns and hmrc filling

I will file UK company accounts tax return companies house hmrc

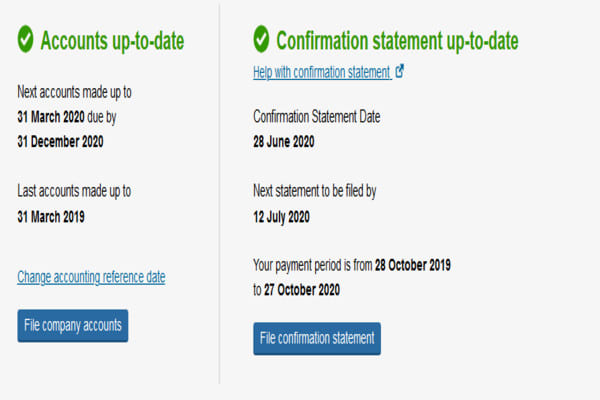

I will submit your dormant UK limited company accounts

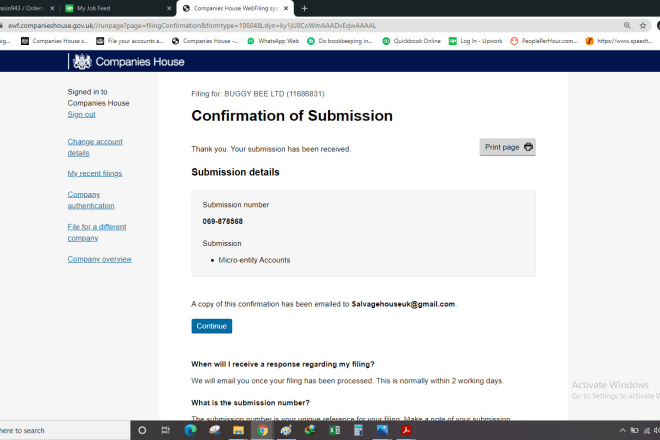

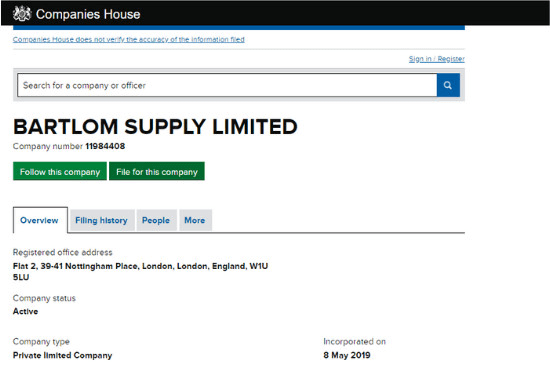

I will submit company dormant account on companies house

I will file UK company accounts tax return with companies house or hmrc

I will file UK company accounts and vat return with companies house or hmrc,

I will submit a dormant company account to hmrc and companies house

I will uk company accounts ct600 corporation tax return hmrc

I will file UK accounts with companies house, vat filing with hmrc

I will prepare and file UK company year end accounts to companies house and hmrc

I will prepare and file UK company year end accounts to companies house and hmrc

I will prepare UK annual accounts and corporation tax return

I will prepare UK company accounts, file to companies house, hmrc

I will prepare UK accounts and file tax returns with hmrc

I will file UK tax return, UK accounts to hmrc and companies house

I will prepare and file accounts based on UK tax requirement

I can prepare Small & medium company accounts And tax reports. If you are in a hurry to file your accounts to avoid the late filing penalty from HM revenue i can help you out by filing dormant accounts. Also if your company transaction are low i can prepare your accounts in an hour to file your accounts.

Tax adjustments can be done if you wish to avoid the high tax.