File company accounts services

There are many benefits to outsourcing your company's accounting and bookkeeping services. Perhaps the most obvious benefit is that it can save your company money. When you outsource your accounting services, you don't have to pay the salaries and benefits of in-house staff. You also don't have to pay for the office space, equipment, and supplies that would be necessary to house an accounting department. Another benefit of outsourcing your accounting needs is that it frees up your time to focus on running your business. If you're spending all of your time on bookkeeping and accounting, you're not able to focus on other aspects of your business that may need your attention. When you outsource your accounting, you can hand off those responsibilities to someone else, freeing up your time to focus on other areas of your business. There are many reputable companies that provide accounting and bookkeeping services, so you can be sure to find one that meets your specific needs. Doing your research to find a reputable and affordable accounting firm is an important first step in outsourcing your company's accounting needs.

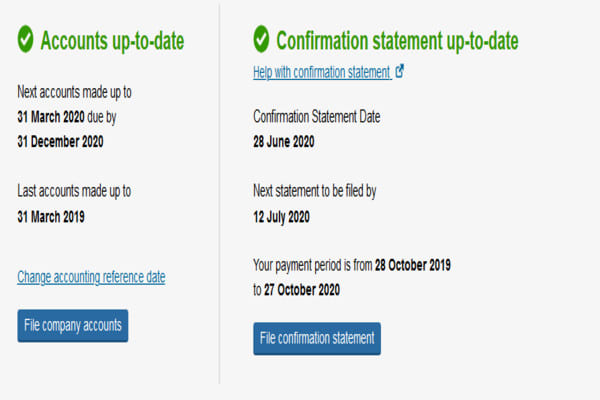

There are many file company accounts services available to businesses. These services can help businesses keep track of their finances and make sure that their accounts are up to date. They can also help businesses file their taxes and stay compliant with government regulations.

Overall, using a file company to manage your business accounts can be a great way to save time and money. They can provide a wide range of services, from bookkeeping and tax preparation to financial planning and investment advice. They can also help you keep track of your expenses and income, so you can make informed decisions about your business finances. However, it is important to research different file companies before selecting one, as not all companies are created equal. Be sure to read reviews and compare pricing before making your final decision.

Top services about File company accounts

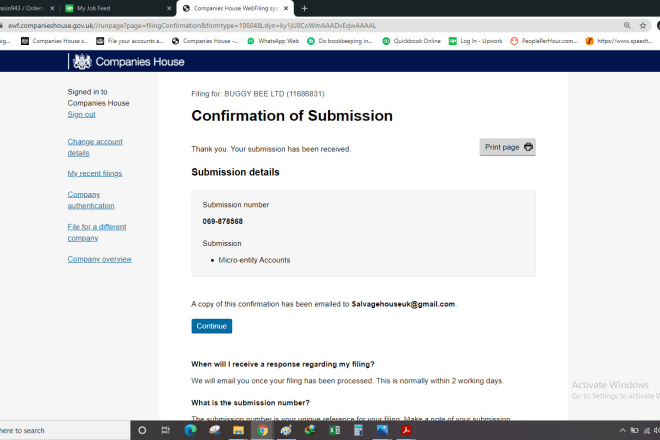

I will prepare and file UK company year end accounts to companies house and hmrc

I will prepare UK annual accounts and corporation tax return

I will prepare UK company accounts and corporation tax return

I will prepare and file your UK tax returns and company accounts

I will prepare UK company accounts and corporation tax return

I will produce and file UK company accounts and tax return

I will file your UK company accounts and tax return

I will prepare company accounts and file to companies house

I will prepare and file accounts based on UK tax requirement

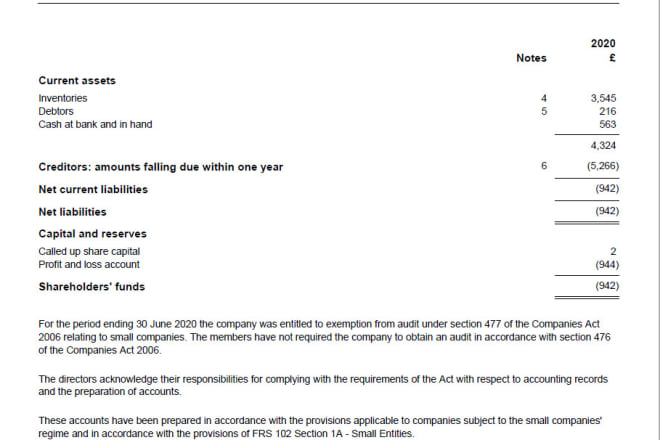

I can prepare Small & medium company accounts And tax reports. If you are in a hurry to file your accounts to avoid the late filing penalty from HM revenue i can help you out by filing dormant accounts. Also if your company transaction are low i can prepare your accounts in an hour to file your accounts.

Tax adjustments can be done if you wish to avoid the high tax.

I will prepare and file UK company year end accounts to companies house and hmrc

I will prepare and file UK company accounts and corporation tax rtn

I will prepare UK company accounts and corporation tax return

I will uk company accounts ct600 corporation tax return hmrc

I will file UK tax return, UK accounts to hmrc and companies house