Filing accounts with hmrc services

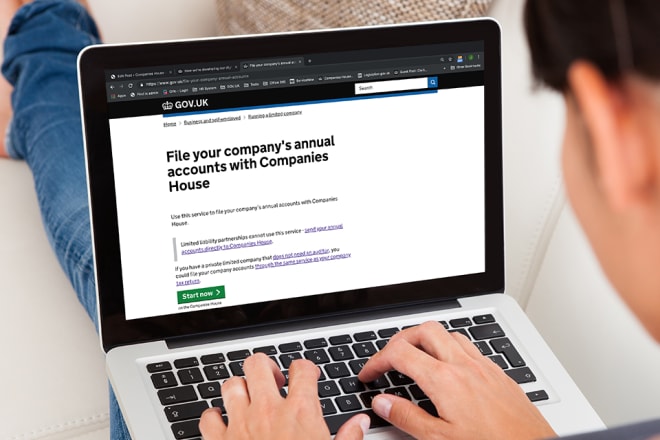

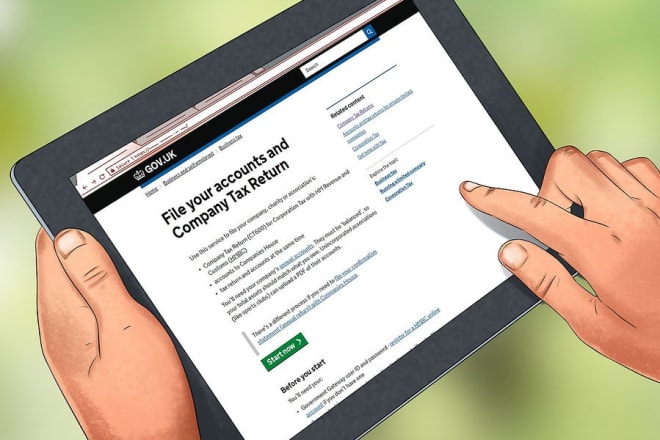

If you're a business owner, you need to file your company's accounts with HMRC Services. This includes your corporation tax return and any other associated forms. If you don't file your accounts on time, you could face late filing penalties.

There are a few things you should know when filing your accounts with HMRC services. First, make sure that you have all of the necessary information and documentation ready. This includes your company's financial statements, your tax return, and any other relevant paperwork. Next, you will need to file your return online or through the mail. Finally, you will need to pay any taxes due.

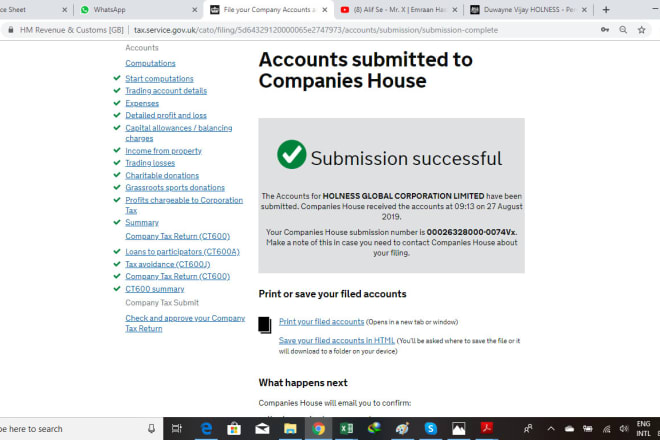

Overall, it is very straightforward to file your accounts with HMRC services. The process is simple and the website is easy to use. The only thing to be aware of is the deadlines. Make sure you file your accounts on time to avoid any penalties.

Top services about Filing accounts with hmrc

I will prepare UK company accounts and corporation tax return

I will prepare UK company accounts and corporation tax return

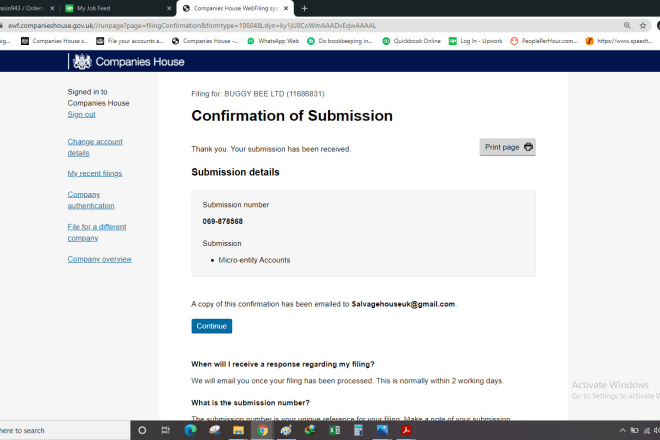

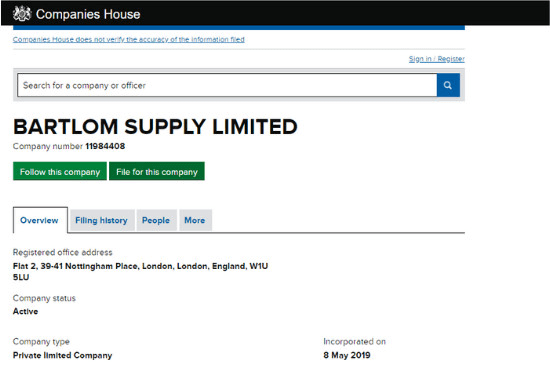

I will prepare UK company accounts and file it to companies house

I will file UK accounts with companies house, vat registration and filing with hmrc

I will prepare UK company accounts and corporation tax return

I will produce and file UK company accounts and tax return

I will file your UK company accounts and tax return

I will file UK accounts with companies house, vat filing with hmrc

I will prepare UK annual accounts and corporation tax return

I will file UK tax return, UK accounts to hmrc and companies house

I will do UK self assessment, company accounts, corporation tax, vat

I will prepare and file UK company year end accounts to companies house and hmrc

I will prepare and file UK company year end accounts to companies house and hmrc

I will prepare UK accounts and file tax returns with hmrc

I will prepare UK company accounts, file to companies house, hmrc