Who can submit company accounts services

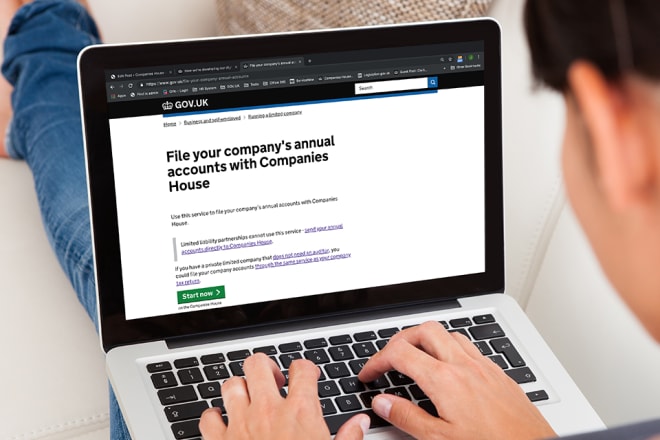

The Companies Act 2006 requires all companies to file accounts with Companies House every year. The service is free for small companies. However, for larger companies there is a charge. The service is open to any company registered in England and Wales.

There is no one definitive answer to this question, as it can vary depending on the company and the specific services being offered. However, in general, most companies that offer company accounts services will allow any registered business to submit their accounts for processing. This typically includes businesses of all sizes, from sole proprietorships to large corporations. Some companies may have specific requirements or preferences in terms of the types of businesses they work with, but in general, most will be open to working with any registered business.

If you are a company owner, you are responsible for submitting your company's accounts to the relevant authorities. This is a legal requirement, and failure to do so can result in serious consequences. There are a number of different service providers who can help you with this process, so it is important to choose one that is reputable and has experience in dealing with the relevant authorities.

Top services about Who can submit company accounts

I will prepare UK company accounts and corporation tax return

I will do tax returns vat registration and submission company accounts

I will incorporate a UK company and submit tax vat, annual accounts

I will prepare UK company accounts and corporation tax return submit it to hmrc

I will prepare,submit UK company accounts and company tax return

I will file your UK company accounts and tax return

I will prepare UK company accounts and corporation tax return submit it to hmrc

I will prepare and file UK company year end accounts to companies house and hmrc

I will prepare and file UK company year end accounts to companies house and hmrc

I will prepare and file UK company accounts and corporation tax rtn

I will submit year end accounts to companies house

I will prepare UK company accounts and corporation tax return

I have vast experience in accountancy field and I had served 500+ UK clients.

I am experienced Accountant and provide all sort of accountancy services including Tax Return, Annual Accounts and Self Assessment within UK.

I have great knowledge of UK company rules and accounting standards and recent updates in standards like FRS 105 and 102

Why me?

- Well experienced

- Guaranteed Satisfaction

- Confidential and Trustworthy.

- 100% satisfaction grantee.

Feel free to leave a message. Thank you!

I will submit your dormant UK limited company accounts

I will prepare and submit UK year end accounts and tax returns

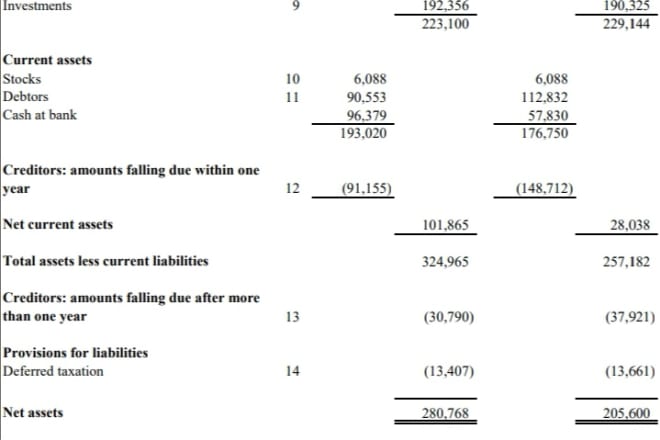

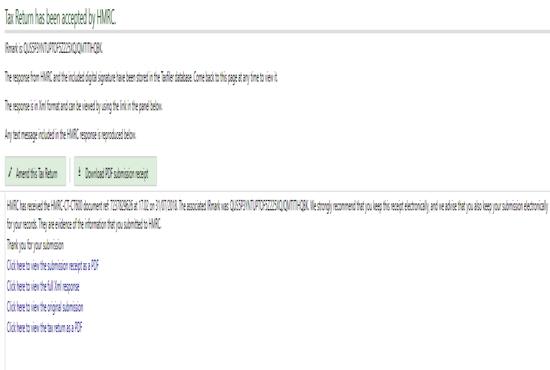

I will prepare your Company Annual Statutory Accounts to FRS 105 standard and an IXBRL file for submission to Companies House. I will also prepare your Corporation tax returns and submit it online to HMRC.

You will receive PDF of your full Accounts as well as the Filleted Accounts as filed at Companies House as well as a PDF copy of your tax return and any documents submitted with it.

You will need your trial balance in excel format so I can import it into my filing software, if you don't have your trial balance in excel format but have a hard copy I can enter the Trial Balance data manually but there would be an additional charge.

I will also need your Companies House Online filing Code, if you don't have one I can apply to Companies House for it on your behalf at a small additional cost.

Finally I will need your Government Gateway ID for your company so I can file your Corporation Tax online for you, if you don't have one I can set one up for you for an additional fee.