How long to file company accounts services

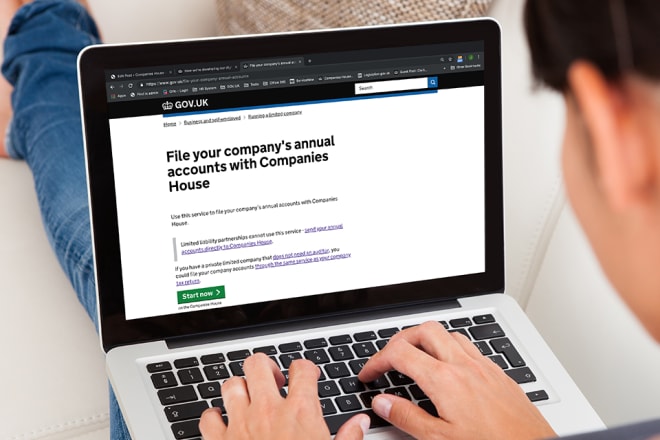

If you're thinking about using a company accounts service to manage your finances, you're probably wondering how long the process will take. The answer depends on a few factors, including the size of your company and the complexity of your financial situation. In general, however, you can expect the entire process to take about two weeks.

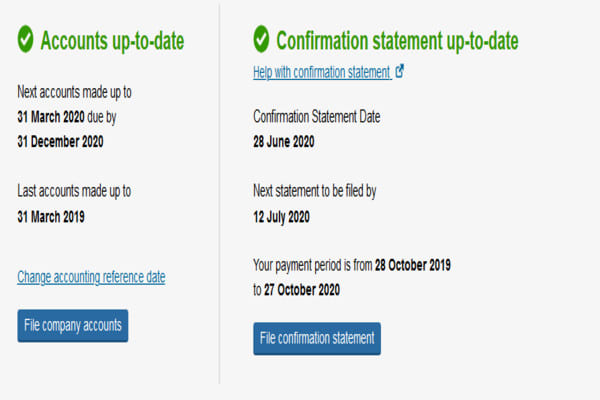

There is no definitive answer to this question as it depends on the size and complexity of the company's accounts, as well as the preference of the company's management. However, most accountants would recommend that company accounts be filed on an annual basis.

The article concludes by giving advice on how to file company accounts services. It is important to ensure that all the information is accurate and up to date, as this can help to avoid any penalties or fines. The author also recommends using an accountant to help with this process.

Top services about How long to file company accounts

I will prepare and file UK company accounts and corporation tax rtn

I will guide how to file income tax return to become filer pakistan

I will calculate your vat return, corporation tax, self assessment

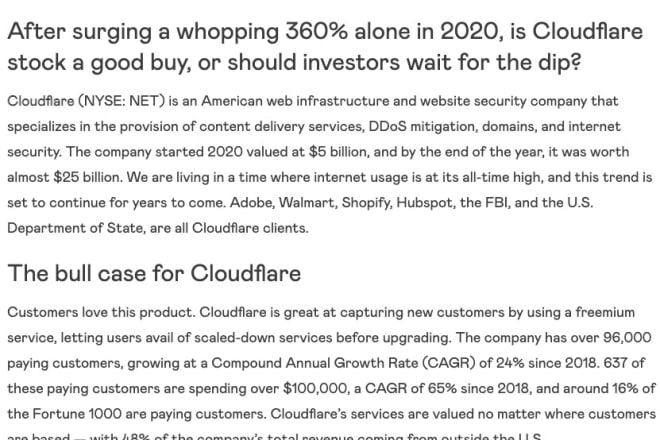

I will teach and mentor long term investing

I will file and register llc company in USA

I will prepare USA individual and corporate tax returns

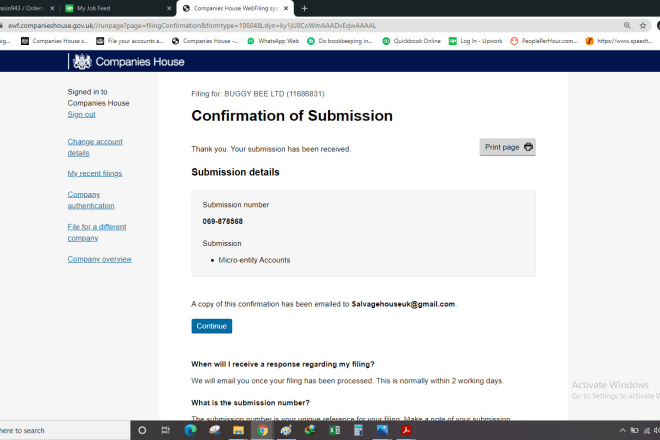

I will submit year end accounts to companies house

I will prepare and file your UK company accounts

I will prepare and file accounts based on UK tax requirement

I can prepare Small & medium company accounts And tax reports. If you are in a hurry to file your accounts to avoid the late filing penalty from HM revenue i can help you out by filing dormant accounts. Also if your company transaction are low i can prepare your accounts in an hour to file your accounts.

Tax adjustments can be done if you wish to avoid the high tax.

I will prepare and file UK company year end accounts to companies house and hmrc

I will prepare and file UK company year end accounts to companies house and hmrc

I will prepare UK company accounts and corporation tax return

I will uk company accounts ct600 corporation tax return hmrc

I will file UK tax return, UK accounts to hmrc and companies house

I will file UK accounts with companies house, vat filing with hmrc

I will do tax returns for your company or self assessments UK only