Submit accounts to companies house services

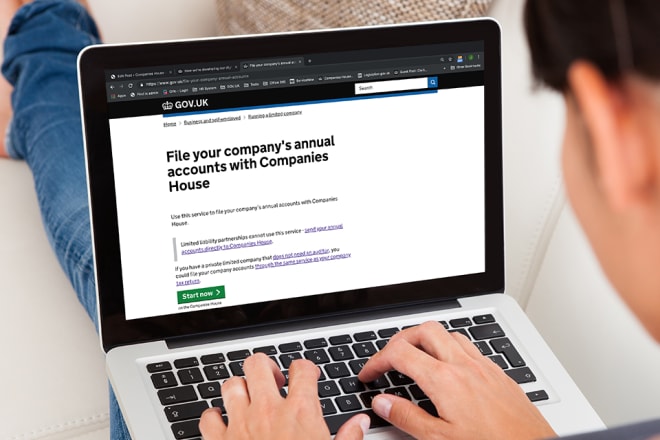

If you are a company director, you must submit your company's accounts to Companies House. This is a legal requirement. You must do this even if your company is not trading. There are different rules for different types of company. You must make sure you submit the right accounts for your company. If you do not submit your accounts, you could be fined and you may also be disqualified from being a company director.

In the United Kingdom, companies house is the registrar of companies and is a subsidiary of the Department for Business, Innovation and Skills. All limited companies are required to submit their accounts to Companies House each year.

It is important to submit accounts to Companies House Services in order to maintain a good credit rating and to avoid any legal penalties. This process can be done online, and it is important to keep accurate records in order to avoid any difficulties.

Top services about Submit accounts to companies house

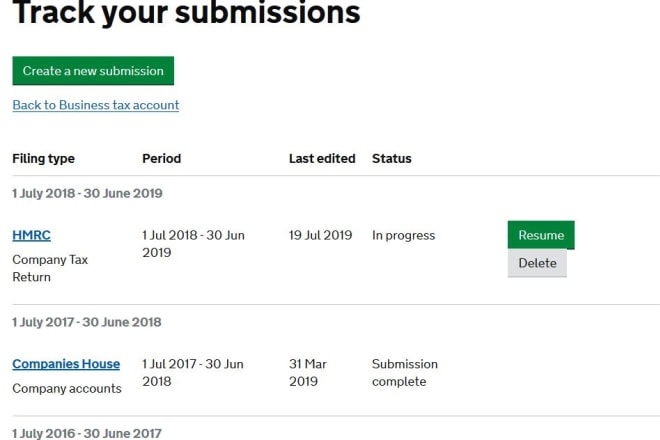

I will prepare and file UK company year end accounts to companies house and hmrc

I will do your company accounts file them to companies house

I will file UK tax return, UK accounts to hmrc and companies house

I will submit year end accounts to companies house

I will prepare and file UK company year end accounts to companies house and hmrc

I will prepare and submit your accounts and ct600 to hmrc and companies house

I will prepare UK company accounts and corporation tax return submit it to hmrc

I will prepare and submit UK year end accounts and tax returns

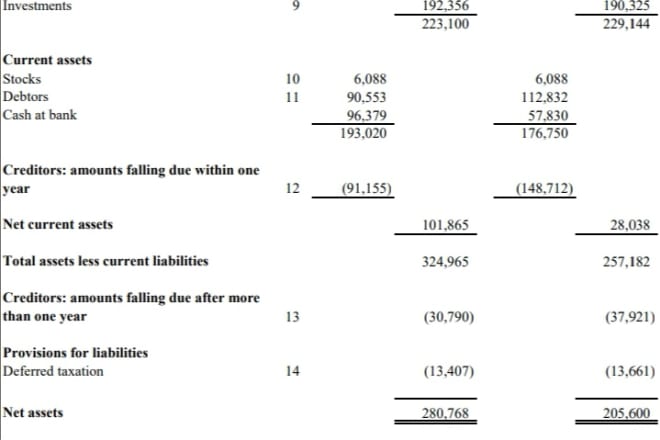

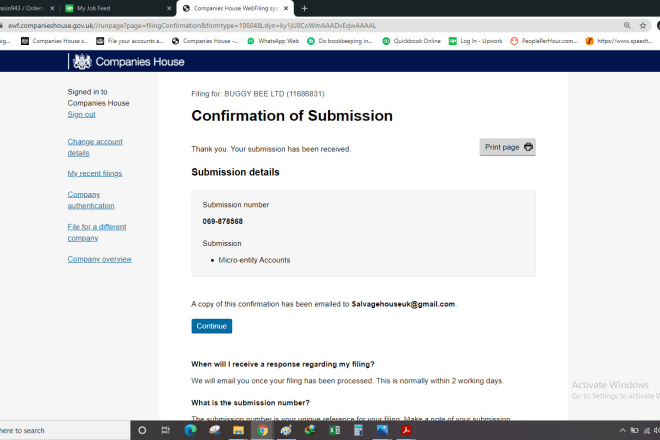

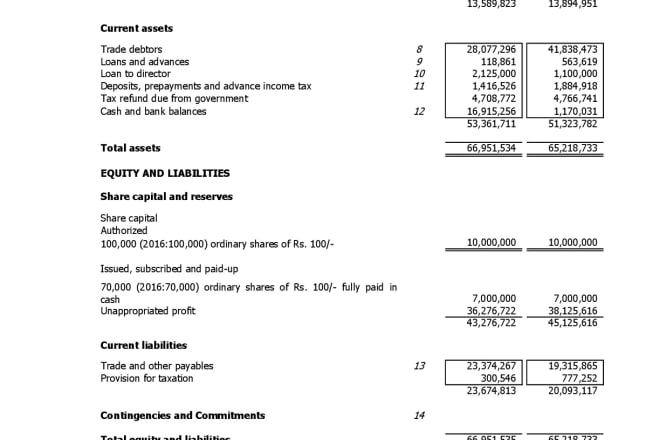

I will prepare your Company Annual Statutory Accounts to FRS 105 standard and an IXBRL file for submission to Companies House. I will also prepare your Corporation tax returns and submit it online to HMRC.

You will receive PDF of your full Accounts as well as the Filleted Accounts as filed at Companies House as well as a PDF copy of your tax return and any documents submitted with it.

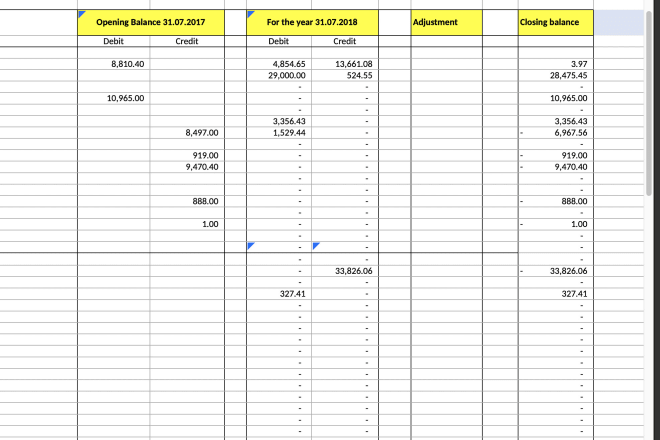

You will need your trial balance in excel format so I can import it into my filing software, if you don't have your trial balance in excel format but have a hard copy I can enter the Trial Balance data manually but there would be an additional charge.

I will also need your Companies House Online filing Code, if you don't have one I can apply to Companies House for it on your behalf at a small additional cost.

Finally I will need your Government Gateway ID for your company so I can file your Corporation Tax online for you, if you don't have one I can set one up for you for an additional fee.

I will file UK accounts with companies house, vat filing with hmrc

I will prepare UK annual accounts and corporation tax return

I will prepare financial statement, accounts in companies house format