Filing company accounts with hmrc services

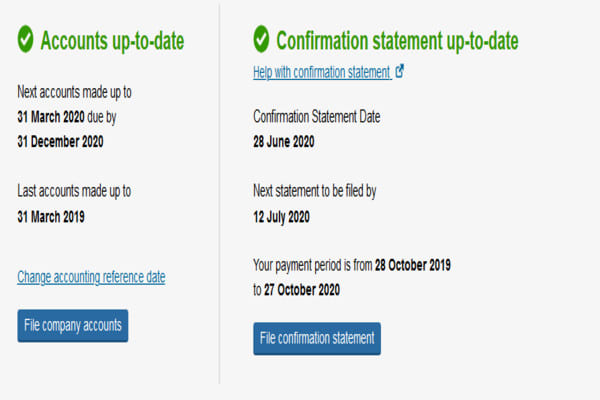

When it comes to filing company accounts with HMRC, there are a few things you need to keep in mind. First and foremost, you need to make sure that all of your paperwork is in order. This means that you need to have all of your financial information organized and ready to go. Additionally, you need to make sure that you are filing your company accounts on time. If you are late in filing your company accounts, you may be subject to penalties from HMRC. Finally, you need to make sure that you are accurate in your filing. If you make any mistakes in your filing, HMRC may come after you for back taxes.

Filing company accounts with HMRC Services is a process that all businesses in the United Kingdom must go through in order to stay compliant with the law. This process involves submitting annual financial statements and other required documentation to HMRC, which is the government agency responsible for collecting taxes. businesses must ensure that their records are up to date and accurate in order to avoid any penalties or interest charges.

Overall, it is positive that filing company accounts with HMRC services is a relatively straightforward process. However, it is worth noting that there are a few potential pitfalls that could trip up businesses if they are not careful. For example, businesses need to be aware of the deadlines for filing their accounts, and they also need to make sure that all the information they provide is accurate. Nonetheless, as long as businesses are aware of these potential issues, they should be able to file their company accounts without any major problems.

Top services about Filing company accounts with hmrc

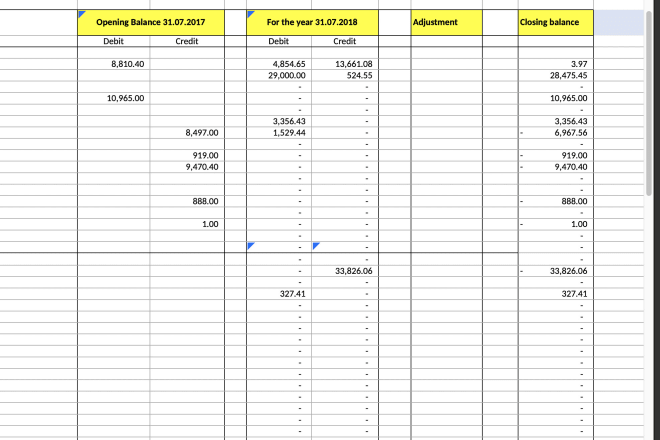

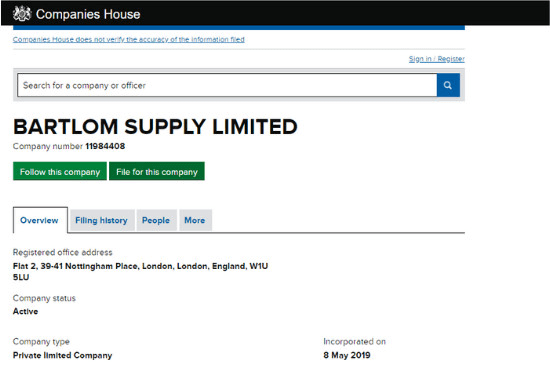

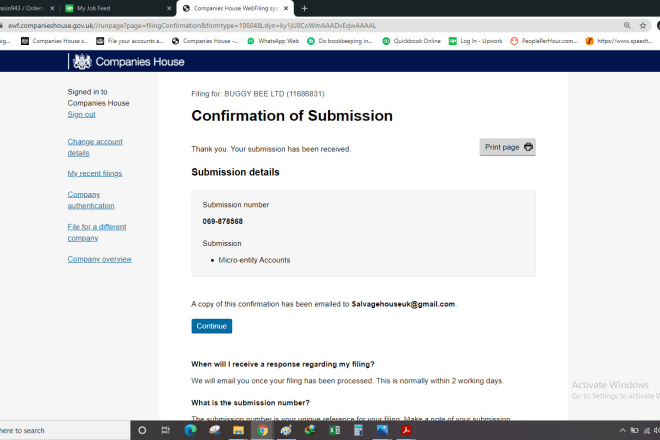

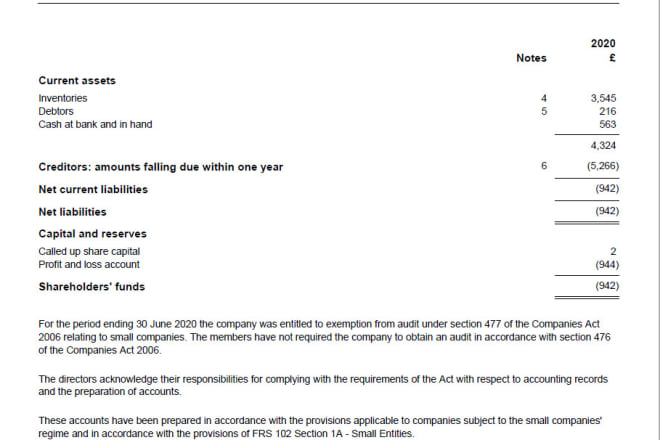

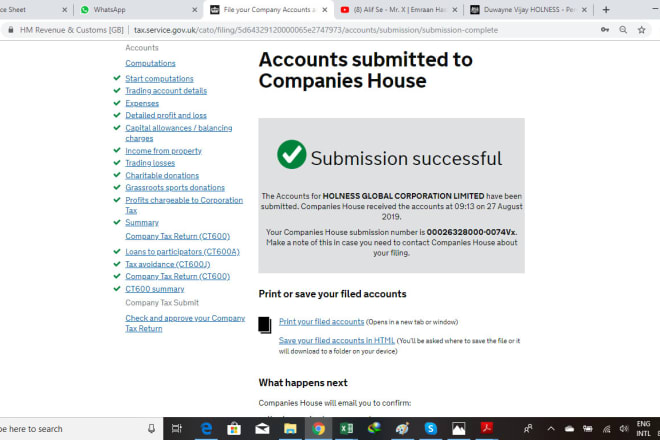

I will prepare UK company accounts, file to companies house, hmrc

I will file UK accounts with companies house, vat filing with hmrc

I will prepare UK annual accounts and corporation tax return

I will prepare UK company accounts and corporation tax return

I will prepare UK company accounts and corporation tax return

I will file UK accounts with companies house, vat registration and filing with hmrc

I will file UK company accounts tax return with companies house or hmrc

I will prepare company accounts and file to companies house

I will file UK tax return, UK accounts to hmrc and companies house

I will prepare and file UK company year end accounts to companies house and hmrc

I will prepare and file UK company year end accounts to companies house and hmrc

I will do UK self assessment, company accounts, corporation tax, vat

I will uk company accounts ct600 corporation tax return hmrc

I will prepare and file UK company accounts and corporation tax rtn